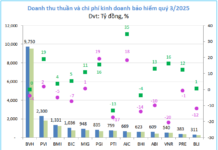

In the report about Masan Group Joint Stock Company by BVSC Securities, experts expect MSN’s profits in 2024 to rebound strongly. BVSC forecasts consolidated net revenue of 90,417 billion VND (+15.5% YoY) and minority shareholders’ after-tax profit of 1,651 billion VND, nearly quadrupling the low base in 2023.

Growth momentum for Masan comes from the pillar of The CrownX with stable growth from Masan Consumer Holdings while WinCommerce continues to improve operational efficiency, aiming for the first year of positive operating profit. Other segments including Masan MeatLife and Masan Hi-Tech Materials narrowed losses, reducing the overall profit burden for the Group. At the same time, interest costs decreased thanks to low interest rates. Exchange rate risks of USD loans were fully hedged through futures contracts and derivatives.

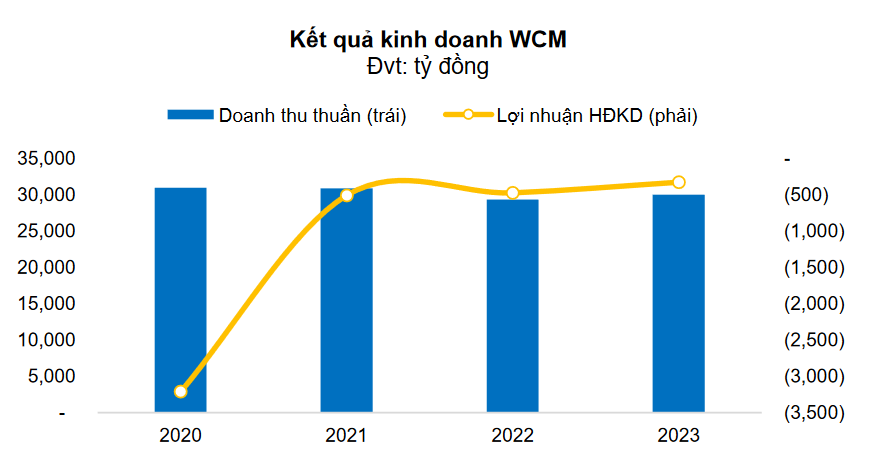

In the past year, WinCommerce recorded net revenue of 30,054 billion VND (+2.3% YoY) and operating loss of 324 billion VND, a decrease of nearly 150 billion VND compared to the previous year.

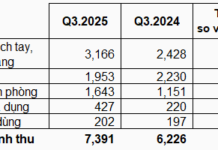

According to BVSC, WinCommerce (WCM) will strive to expand and maintain positive EBITDA at the same time. WinCommerce opened an additional 312 mini supermarket stores (WMP) and 2 supermarkets (WMT) in 2023. Although this result is much lower than the plan to open more than 1,200 points at the beginning of the year, it still reflects the company’s efforts to balance between two goals: expanding presence and improving the operational efficiency of the retail chain in the context of consumer confidence being bleak.

WinCommerce focuses on transforming stores according to different models to fit the operating areas. By the end of 2023, out of a total of 3,500 WMP stores, there were 424 WiN stores, 1,887 WinMart+ stores for urban areas, and 1,190 WinMart+ stores for rural areas. In addition, the company also had 131 standard WinMart supermarkets and 1 premium WinMart supermarket in Phu My Hung – District 7 (opened from mid-2023).

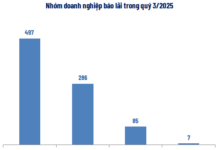

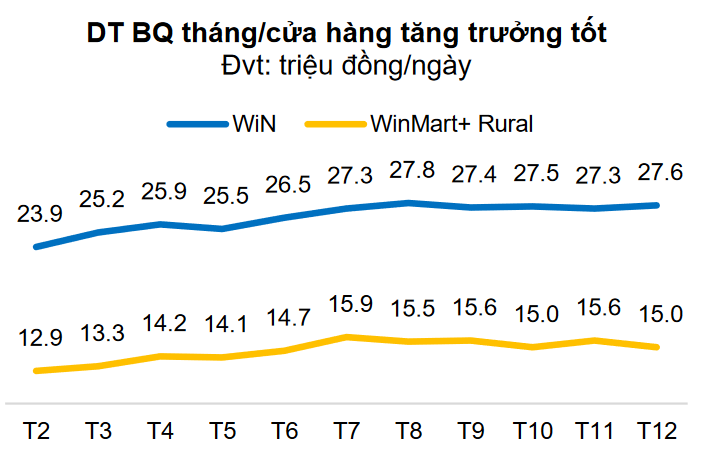

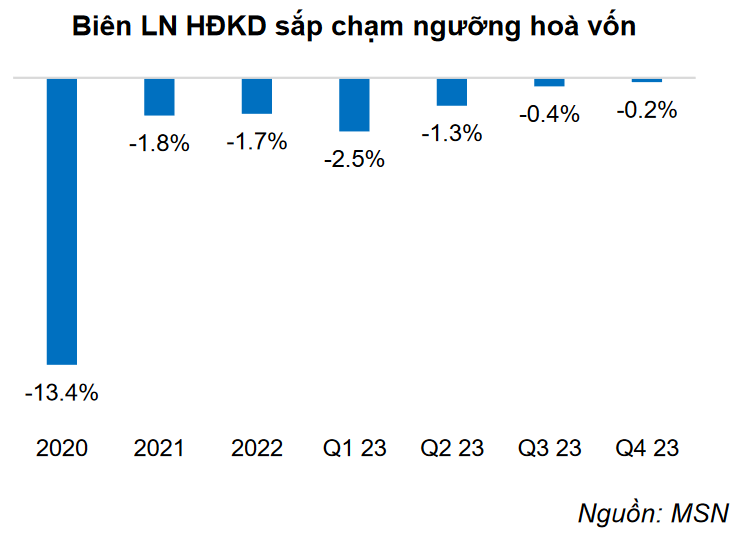

The operational efficiency of the chain has been greatly improved, with the operating margin improving from -2.5% in Q1 to -0.2% in Q4 2023. The main driver is the increase in gross margin from 22.1% to 25.5% and a 11% reduction in transportation costs for ambient products and a 11% reduction for fresh products, thanks to optimizing the flow of goods through Supra – a subsidiary providing logistics solutions for the WinCommerce system established since Q1 2022. In addition, the average daily revenue of the stores also grew well, typical examples are WiN increasing from 23.9 million VND to 26.3 million VND and WinMart+ in rural areas increasing from 12.9 million VND to 15 million VND.

At the end of the trading session on March 7, MSN’s stock closed at 80,800 VND/share, up 5.07%. If calculated over the past 3 weeks, MSN’s stock price has increased by more than 24%.