On March 18th, Vinamilk Joint Stock Company (Vinamilk – symbol VNM) will finalize the list of shareholders attending the Annual General Meeting (AGM) in 2024 and make an interim dividend payment for the 3rd quarter of 2023. This year, Vinamilk plans to hold the AGM on April 25th via online meeting like previous years. The specific meeting details will be updated and sent to shareholders according to legal regulations.

Regarding dividends, Vinamilk will make an interim payment of 9% for shareholders (1 share will receive 900 dong). The expected dividend payment date is April 26th. With nearly 2.09 billion shares in circulation, Vinamilk will have to spend about 1,881 billion dong to pay dividends this time.

Of which, the State Capital Investment and Trading Corporation (SCIC) is the largest shareholder holding 36% of the capital, and will receive 677 billion dong. F&N Group of Thai billionaire Charoen Sirivadhanabhakdi will “pocket” 384 billion dong thanks to holding 20.4% of the capital. The remaining foreign major shareholder is Platinum Victory Pte. Ptd with 10.62% of the capital, also receiving nearly 200 billion dong.

Previously, Vinamilk has implemented 2 interim dividend payments for 2023, including the 1st payment with a 15% ratio paid in early October 2023 and the 2nd payment with a 5% ratio just paid on February 28th, 2024. Therefore, including the upcoming dividend payment, the total dividend ratio that the company distributes is 29%, equivalent to a total amount of over 6,000 billion dong.

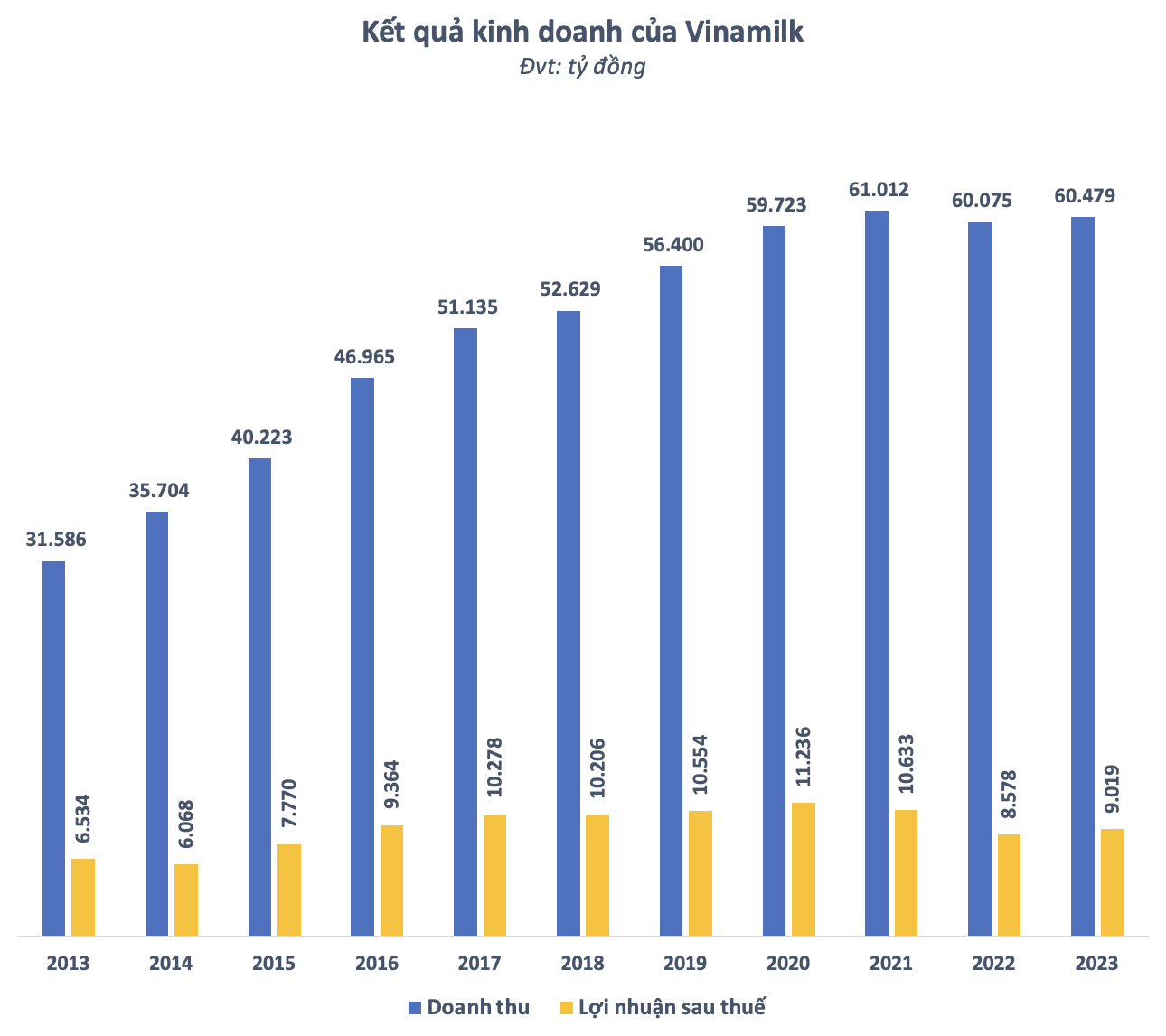

Regarding the business results in the 4th quarter of 2023, Vinamilk’s gross profit margin improved significantly from 38.8% in the same period of 2022 to over 42.5%. After-tax profit reached 2,351 billion dong, an increase of 24% compared to the 4th quarter of 2022, thereby recording the 3rd consecutive quarterly growth compared to the same period last year. Accumulated net profit for the year reached 9,019 billion dong, an increase of 5% compared to 2022, ending 2 consecutive years of decline.

On the market, VNM shares are currently trading at around 70,000 dong/share, a slight increase of nearly 4% compared to the beginning of the year. Vinamilk’s market capitalization is approximately 146,300 billion dong, ranking 10th on the list of the most valuable companies on the stock exchange.