After a long rally to surpass the highest price of the year, the VN-Index experienced significant volatility during the trading week of 4-8/3, with especially heavy trading volume in the final session. Increased selling pressure towards the end of the session, combined with investor caution, caused the index to sharply correct. Compared to the previous week, the VN-Index decreased by 10.93 points (-0.87%) to 1,247.35 points.

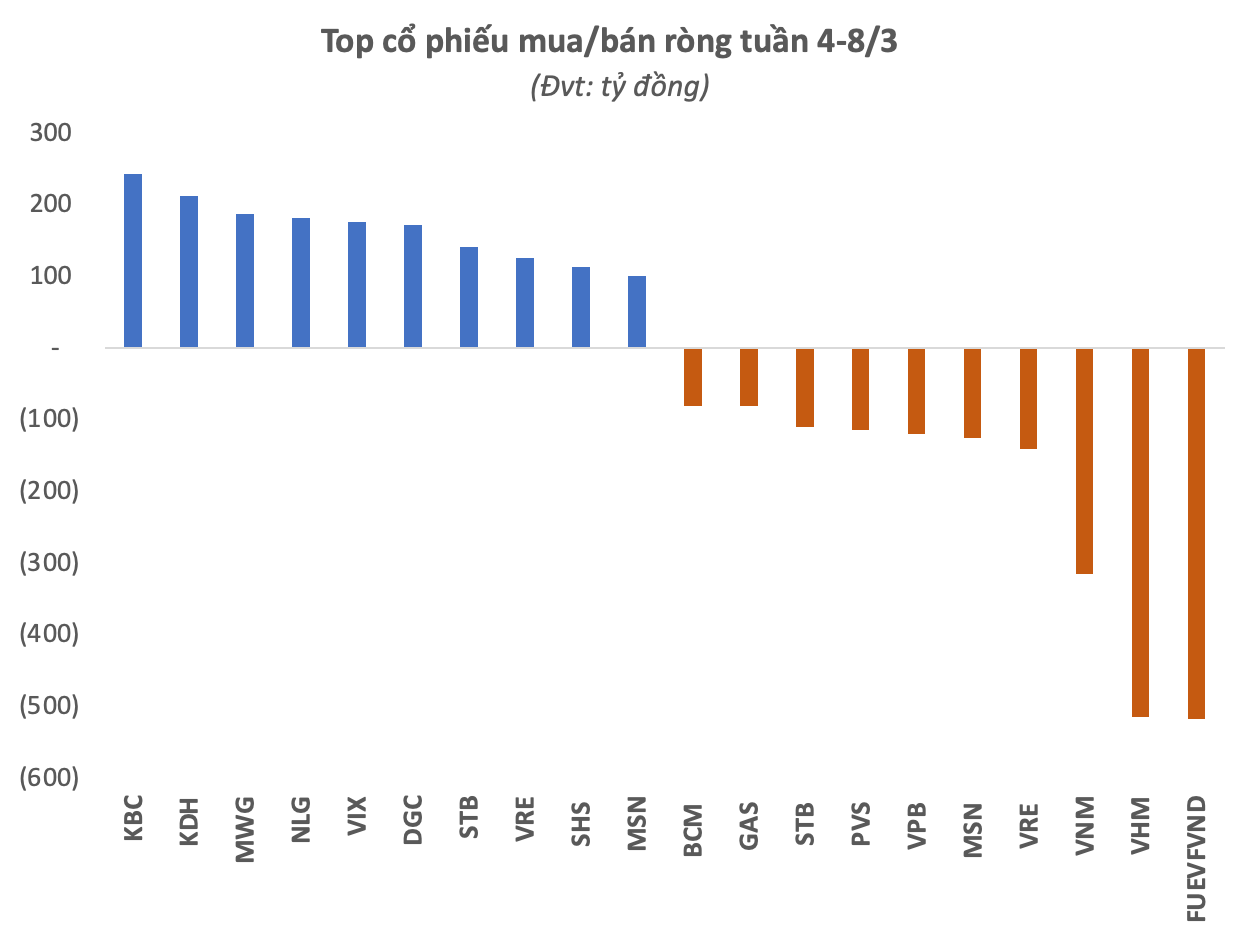

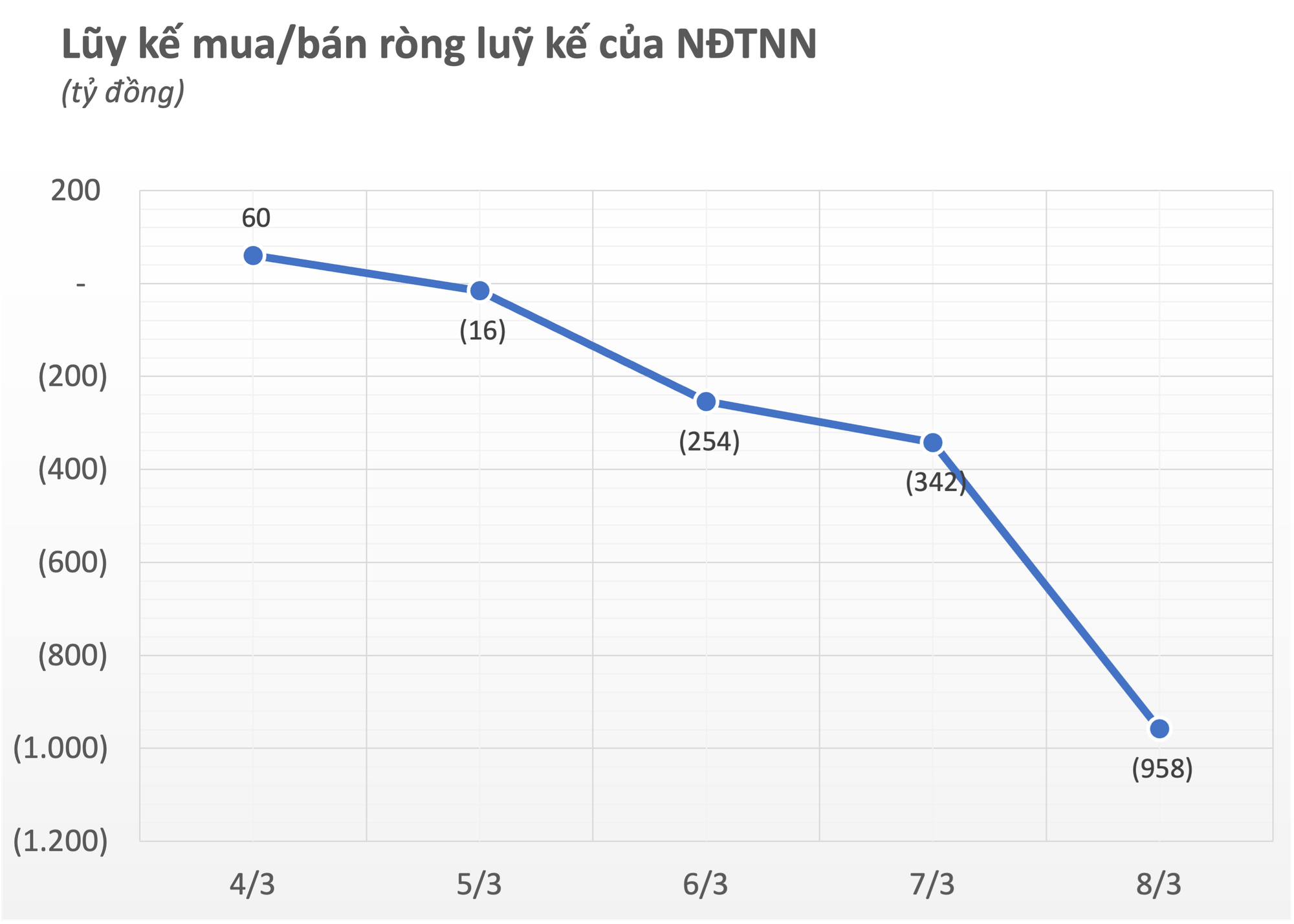

The trading volume increased significantly, with the value of transactions on the HoSE exchange increasing by about 16% compared to the previous week. Additionally, foreign investors also increased their trading activities, although they were net sellers. The total net selling value for the week amounted to 958 billion VND, with net selling 1,034 billion VND in matching trades and net buying 76 billion VND in negotiated deals.

Looking at each exchange individually, foreign investors were net sellers of 975 billion VND on the HoSE, net buyers of 37 billion VND on the HNX, and net sellers of 20 billion VND on the UPCoM.

Breaking it down by stock, the net selling highlight was the Diamond fund certificate FUEVFVND managed by Dragon Capital with a net selling value of nearly 517 billion VND. Following that, there were also two stocks with net selling of half a billion VND each: VHM with 515 billion VND and VNM with 315 billion VND. The list of net selling also included VCB and SAB, which were net sold for 141 billion VND and 125 billion VND, respectively; the oil and gas stock PVD was also net sold by foreign investors for over 119 billion VND, followed by VPB with net selling of 114 billion VND. The list of net selling by foreign investors in the past week also included HPG, TPB, VIC,…