The information about the implementation of the KRX system and the prospects of upgrading the Vietnamese stock market in 2024-2025 have helped the stock market recover strongly from the beginning of the year until now.

In its latest updated report, VnDirect believes that stock prices will rise as the actual results of the monetary easing policy permeate the economy. In that context, stocks with positive business results that bring good and sustainable profits will attract more investor attention. Growth momentum is investors’ expectation of better business results; and success in capital mobilization.

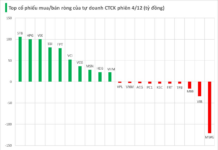

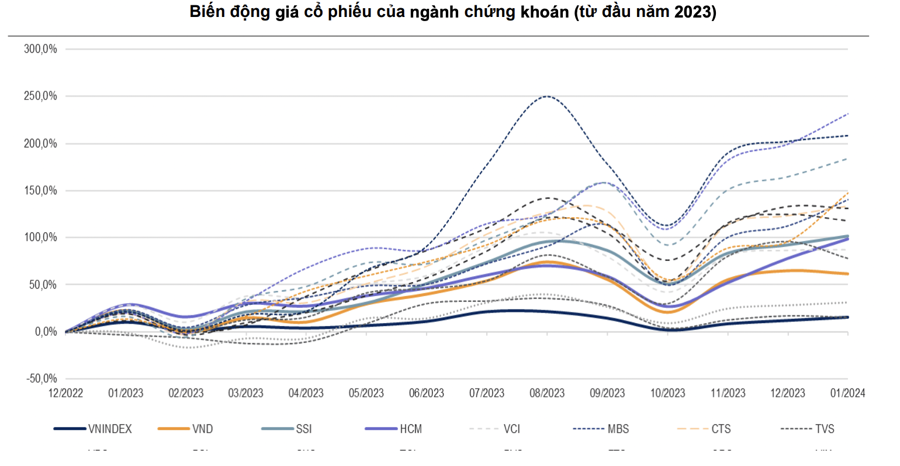

In the context of a sluggish economy, low deposit interest rates and a frozen real estate market, money is flowing into the stock market. The securities industry has outperformed the market index, with many securities stocks growing by more than 50%.

Notably, the first strong increase came from medium and small-cap stocks such as VIX, BSI, FTS, with growth rates of 208.7%, 231.5% and 183.9% respectively as of Q1/2024 compared to the beginning of 2023. This reflects investors’ short-term speculative readiness as the stock market is in an accumulation phase.

VnDirect expects large-cap stocks in the industry with positive business results to have better opportunities in 2024 due to better-than-expected business results; better price prospects than medium and small-cap stocks as their stock prices have not increased much last year.

The long-term valuation of the securities industry is no longer cheap, but it is still suitable for the short and medium term. Long-term prospects have been reflected in stock prices. The government is determined to turn the stock market into a long-term capital mobilization channel for businesses, reducing pressure on the banking system.

In the context of improved incomes of the people, securities are seen as an investment channel alongside the traditional real estate market. Further technological developments will contribute to increasing the number of people accessing this investment channel.

It is more attractive to foreign investors due to higher returns than other industries, with no restrictions on FOL rates.

The motivations for short and medium-term strategies: The loose monetary policy is maintained, and the possibility that the State Bank of Vietnam will lower the benchmark interest rate. Prospects for upgrading to emerging markets by FTSE, attracting capital from foreign investors. When the KRX system is operational, market liquidity will increase.

Credit growth is increasing, with expectations that capital flows will flow into asset markets as the real economy has not yet fully absorbed it; Foreign capital returns after net selling in 2023.

Regarding investment strategies, investors should maintain a short and medium-term perspective with stocks in this industry, as long-term prospects have been reflected in the price increase of the entire industry’s stocks. Therefore, there will be differentiation among stocks, and potential stocks are those with reasonable valuations, expected positive business results, and are favored by foreign investors.

Speaking more about the securities investment channel, according to VnDirect, the securities channel continues to maintain its appeal in the context of low deposit interest rates.

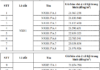

The earnings yield on price (E/P) of the Vn-Index has slightly increased to 7.1% despite the Vn-Index increasing by 7.6% in February 2024 as companies on the market continue to update their business results for Q4/2023 with strong profit recovery.

The average 12-month deposit interest rate of NHTM in February 2024 decreased slightly to 4.75% (-0.03 percentage points compared to the previous month), widening the gap between the market’s E/P and deposit interest rates. The high difference between the earnings yield on price (E/P) of the Vn-Index and the deposit interest rate indicates that the attractiveness of the securities channel is still maintained compared to the savings deposit channel.

VnDirect believes that banks will continue to maintain low deposit and lending interest rates in the first half of 2024 to support the economic recovery.