Buyers in the weekend session focused mainly on large-cap stocks that have seen significant gains recently. Domestic money flow continues to show interest in the market, focusing on mid and small-cap stocks. Due to the strong fluctuations in the past sessions, VN-Index closed at 1,247.4 points, equivalent to a 0.9% decrease from the previous week.

This week, BID (-3.4%), VCB (-2.3%), VHM (-3.2%) were the major large-cap stocks that dragged down the market. On the other hand, the recovery momentum of the index was led by MSN (+11.4%), BCM (+9.0%), and GAS (+2.5%), helping to curb the selling pressure in the market. In addition, mid-cap stocks also shone in the market this week with some strong price increases.

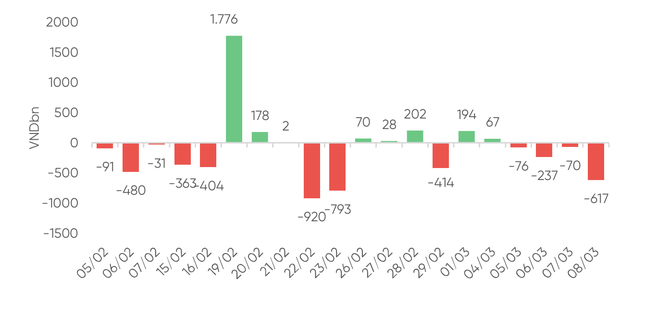

Foreign investors returned to net selling, mainly on HoSE with a value of 981.4 billion dong (according to VPBankS statistics).

Liquidity continues to improve with trading value on the three exchanges reaching 30,187 billion dong/session (an increase of 15.9% compared to the previous week). This week, foreign investors returned to net selling on all three exchanges, mainly on HoSE with a value of 981.4 billion dong.

In the next trading week, Mr. Dinh Quang Hinh – an expert from VNDirect Securities – recommends investors to carefully observe the buying power zone at the support level of 1,230 points (+/-10 points). If this zone is maintained, the market’s uptrend will be preserved and capital can flow to stocks that have accumulated for some time such as steel, securities, real estate, and some mid-cap stocks.

In fact, the uptrend of the market has not been broken. In addition, concerns about exchange rates and liquidity in the interbank market have eased. It is worth noting that after surpassing the 24,700 dong/USD level, the interbank USD/VND exchange rate gradually declined to the 24,650 dong range in the weekend session. Therefore, market sentiment may soon stabilize.

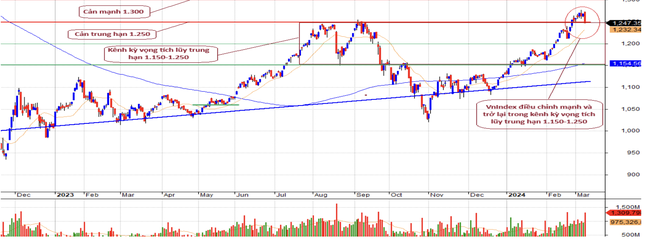

From a short-term perspective, the analysis team from Saigon – Hanoi Securities (SHS) believes that the sharp market correction in the weekend session will challenge the next short-term uptrend. The short-term uptrend may not be over yet if the VN-Index quickly recovers and surpasses the resistance level of 1,250 points in the coming sessions.

SHS believes that the short-term uptrend may not be over yet, if the VN-Index quickly recovers and surpasses the resistance level of 1,250 points in the coming sessions.

In this scenario, the VN-Index still has the possibility of further upward momentum towards the strong resistance level of 1,300 points. However, SHS does not highly evaluate the possibility of a strong uptrend formation for the VN-Index. After the end of the enthusiasm, the VN-Index may adjust back within the range of 1,150 – 1,250 points due to the accumulation platform for the uptrend not being reliable enough.

From a medium-term perspective, SHS believes that the VN-Index is in a strong uptrend, however, the uptrend has not been formed on a long and reliable accumulation base. Therefore, the possibility of the VN-Index adjusting back and moving within the accumulation range of 1,150 – 1,250 points is likely to occur.

The analysis team of TPS Securities expresses a neutral stance, the market will struggle to determine the balance zone. According to TPS, the correction of the index after the long-lasting uptrend from the beginning of the year is considered healthy for the market’s growth in the medium and long term. The support zone of the index is currently located at 1,240 – 1,250 points. If the support zone is broken, the index may inertially decline and trade sideways for a few sessions to determine the balance point.