Regarding this incident, sharing with the media, Eximbank representative said that this is a long-standing overdue debt of nearly 11 years, Eximbank has notified and directly worked with the customer many times, however, the customer still does not have a plan to handle the debt.

As of now, Eximbank also confirms that they have not received any payment from the customer. According to the representative, the interest and fee calculation method is in accordance with the agreement between Eximbank and the customer in the card opening file on March 15, 2013, with the customer’s full signature (fee regulations, interest are clearly defined in the fee schedule for issuance and use of cards, publicly posted on the Eximbank website).

At the end of last year, in the financial market, Eximbank was also a prominent name when the bank “cleared” the debt for Hoang Anh Gia Lai Group (HAGL, stock code HAG).

Specifically, on December 13, 2023, HAGL announced unusual information about the settlement of the loan from Eximbank. In which, Gia Lai Livestock Joint Stock Company – a subsidiary of HAGL – has fully paid the amount of 750 billion dong (including the entire principal debt of over 586 billion dong and a part of accrued interest of over 163 billion dong) to Eximbank.

The above mentioned amount of money that HAGL paid to the bank to settle the loan for credit contracts dated September 23, 2014, and August 15, 2014, according to the reduction of interest announcement on October 20, 2023, from the Debt Management and Asset Exploitation Company Limited (Eximbank AMC).

HAGL said that the total amount of interest exempted by Eximbank is 1,424.8 billion dong, including a part of interest in due, the entire overdue interest, and late payment interest.

With this “debt clearance” from Eximbank, HAGL recorded financial expenses, specifically in the reduced borrowing interest item of over 1,400 billion dong. Accordingly, in 2023, HAGL recorded a sharp increase in interest to 1,817 billion dong.

Returning to the credit card incident, according to Tuoi Tre Online, the State Bank Inspectorate of Vietnam in Quang Ninh branch has requested Eximbank in Quang Ninh branch to report the debt case “credit debt from 8.5 million to over 8.8 billion dong after nearly 11 years”.

Eximbank also said that they are continuing to work and coordinate with customers to have a plan to support customers in handling their debts.

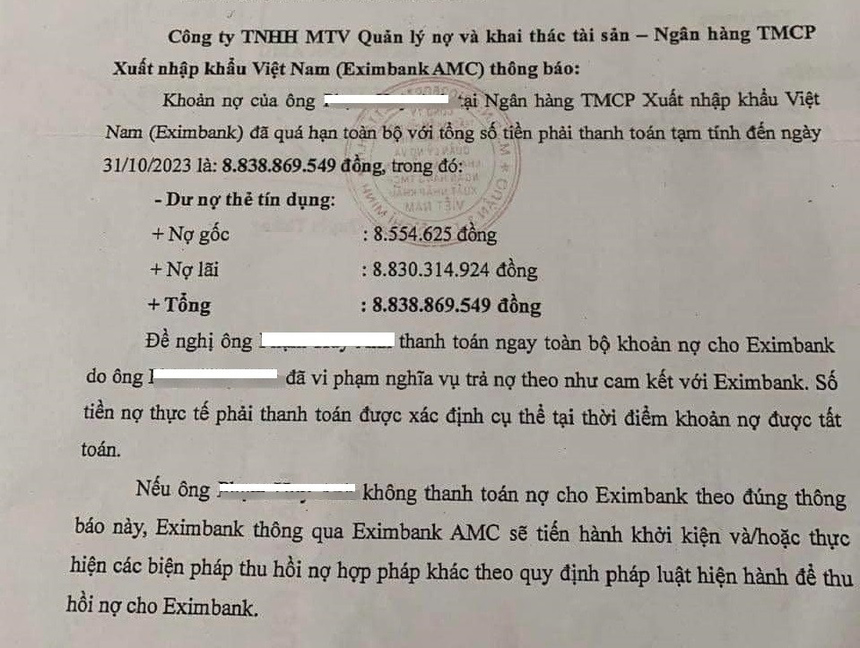

Earlier, on social media, there appeared a “Overdue Debt Reminder Letter sent by Eximbank AMC to customers”, notifying customer named P.H.A in Quang Ninh about a debt worth over 8.83 billion dong, while the principal debt is only about 8.55 million dong.

It is known that the customer P.H.A opened a Master Card at Eximbank in Quang Ninh branch on March 23, 2013, with a credit limit of 10 million dong. There were 2 payment transactions on April 23, 2013, and July 26, 2013. Since September 14, 2013, the above mentioned credit card debt has turned into bad debt, overdue time has been nearly 11 years.

When the credit card loan was classified as bad debt, Eximbank proceeded to recover Mr. P.H.A’s debt:

On September 16, 2013: Eximbank Quang Ninh branch sent a written notice to the customer regarding the violation of repayment obligations.

On December 12, 2017, the customer filed a complaint letter about not receiving notification of violation of payment obligations.

On December 23, 2017, Eximbank Quang Ninh branch replied in writing about the payment obligations, and also requested Mr. P.H.A to have a plan to repay the debt to the bank.

On August 19, 2021, Eximbank AMC has directly worked and resolved the debt for Mr. P.H.A

On May 10, 2022, Eximbank AMC continued to have a meeting with Mr. P.H.A to discuss and find solutions to support the customer in handling the debt.

On November 8, 2023, Eximbank AMC sent Letter No. 2155/2023 to Mr. P.H.A to notify the obligations to be paid, and to coordinate with the bank to process the mentioned debt.