In the beginning of 2024, the banking stock wave brought a fresh breeze to the market. However, in the first trading week of March 2024, signs of weakness started to show, causing VN-Index to stall at a 18-month high with multiple fluctuations.

Although the money flow followed an impressive trend, investors still have concerns about the strength of banking stocks. Therefore, evaluating the technical aspects of all listed or registered stocks on the three markets helps ease some of the hidden fears.

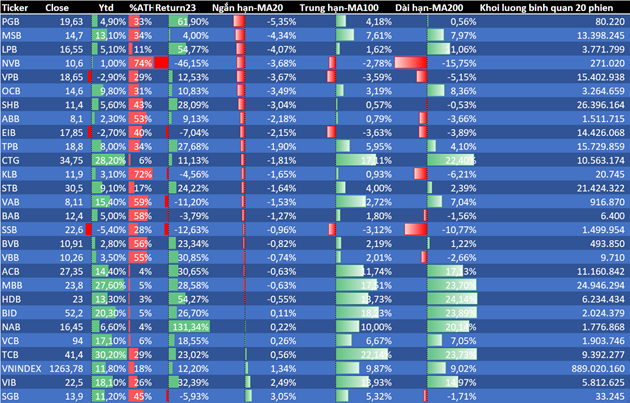

Specifically, after the Friday trading session (March 15th), the banking group had only 6 out of 27 stocks that maintained a short-term uptrend (price surpassing the 20-day moving average – MA20). This is almost the opposite of the movement in January 2024, when all 27 stocks exhibited a short-term uptrend.

However, it is worth noting that no stock can continuously increase in a long uptrend. In fact, the banking wave started from November to December of 2023 until March 2024, with many stocks continuously setting price records like BID, ACB, HDB, MBB, VCB, NAB.

Only 6 out of 27 bank stocks maintain a short-term uptrend (until the end of March 15th).

|

Although some achievements have been lost, all 6 aforementioned stocks are still fluctuating around MA20 with a range of less than 1% while maintaining a medium and long-term uptrend.

In addition, the term “correction” in financial investment refers to the price decrease of a stock or security from its recent peak by at least 10%. Therefore, none of the 6 aforementioned banking stocks have entered a correction phase yet.

Of course, this scenario can still happen to the mentioned stocks, but it is unlikely to result in a deep and simultaneous decline. Some other stocks in the same industry like VPB, SSB, NVB instead of creating a clear uptrend in the banking wave, are still consolidating, which brings a sense of frustration to investors.

In the latest report assessing the banking industry, Mirae Asset Vietnam Securities (MAS) expects a better growth prospect for the industry in 2024 compared to 2023.

Firstly, the rapid disbursement in the last month of 2023 and the expected sustainable credit growth in 2024 will lay a solid foundation for net interest income (NII) recovery.

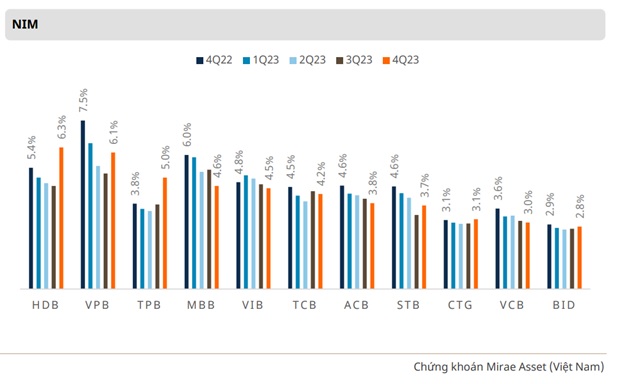

Moreover, the expected NIM (Net Interest Margin) bottoming out and rebounding also act as a catalyst for NII growth. In addition, non-interest income will also recover better thanks to a more optimistic economic outlook, with areas such as service income from domestic transactions and export activities, cross-selling insurance services experiencing more positive growth due to a low base in 2023 with negative growth mostly recorded at most banks, and the digital transformation process will reduce the correlation between revenue and expenses.

In the short term, the stock price movement will depend more on the money flow rather than fundamental factors. There will not be many short-term investment opportunities for this industry, especially for “passive” investors with a short holding period. Therefore, short-term trading will be more suitable for professional investors combined with market outlook analysis.

On the contrary, for long-term investment strategies, MAS still recognizes investment opportunities in stocks with factors such as reasonable valuation, stable asset quality, and growth potential, such as CTG, TCB, MBB and ACB.

Quân Mai