In accordance with the Resolution of the Annual General Meeting of Shareholders 2024 published on March 14, CTCP Green Port Vip (UPCoM: VGR) will pay a total dividend of nearly 443 billion VND for the year 2023, equivalent to 70% of the charter capital, which is 7,000 VND per share. The dividend will be paid from the undistributed after-tax profit as of December 31, 2023, which is nearly 567 billion VND. This will also be the highest dividend rate in recent years for the Company.

|

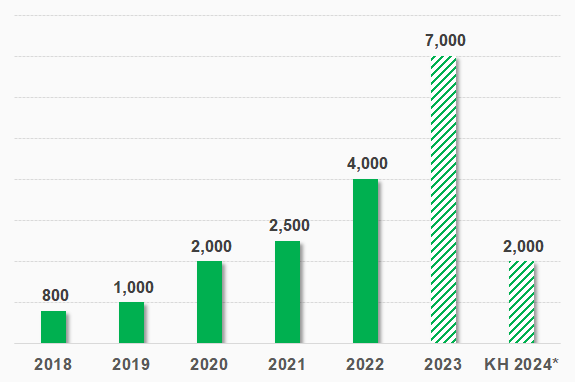

Dividend in cash in recent years of VGR

Unit: VND/share

*Minimum cash dividend plan for 2024: 20% of charter capital

Source: VietstockFinance

|

It is worth mentioning that this dividend amount is higher than the expected amount of 253 billion VND, equivalent to 40% of the charter capital, presented in the documents of the General Meeting of Shareholders announced in February.

With the above-mentioned changes, Container Vietnam Corporation (HOSE: VSC) is expected to benefit the most as it is the parent company directly owning 74.35% of VGR’s capital, estimated to receive over 329 billion VND from this dividend payout.

Prior to this, VGR had already made a provisional dividend payment of 10% on June 14, 2023. Therefore, in the coming period, VGR shareholders will still receive a dividend payment with a rate of up to 60%.

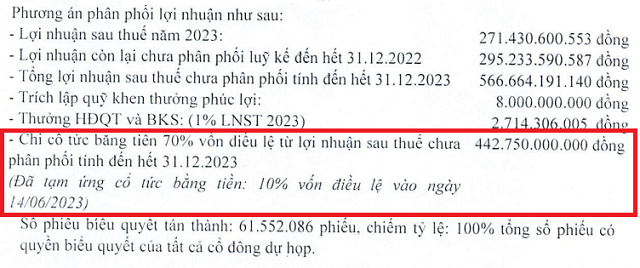

As part of the profit distribution plan for 2023, VGR will allocate 8 billion VND for reward and welfare fund, and more than 2.7 billion VND for the reward of the Board of Directors and the Supervisory Board (1% of the after-tax profit for 2023).

|

Distribution plan for 2023 profit of VGR

Source: Resolution of the Annual General Meeting of Shareholders 2024 of VGR

|

For the year 2024, VGR sets a revenue target of 774 billion VND and a pre-tax profit of 240 billion VND, a decrease of 14% and 22% respectively compared to the performance in 2023. If the plan is achieved, the 2024 revenue of VGR will be the lowest in the past 4 years since 2021. In terms of dividend, the General Meeting of Shareholders approves a minimum dividend rate of 20% of the charter capital.

Huy Khai