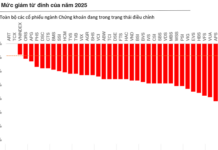

During a bull market, it’s important to prepare for significant downturns.

Greed

The Fear and Greed Index provides a comprehensive measure of market sentiment in the cryptocurrency market, ranging from 0 to 100.

A low score indicates excessive selling pressure, while a high score indicates the market’s potential for correction. Extreme fear can present buying opportunities as investors become overly concerned, while extreme greed can signal a market top.

Currently, the Bitcoin sentiment is at “Extreme Greed.”

Whale Movements

The next important thing is to monitor the behavior of large holders or “whales” in the cryptocurrency market as they can influence prices and engage in manipulative activities.

In addition, staying updated on the ongoing technological developments and potential vulnerabilities in the blockchain network is necessary.

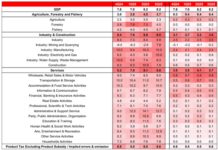

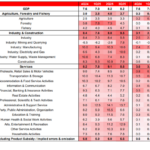

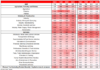

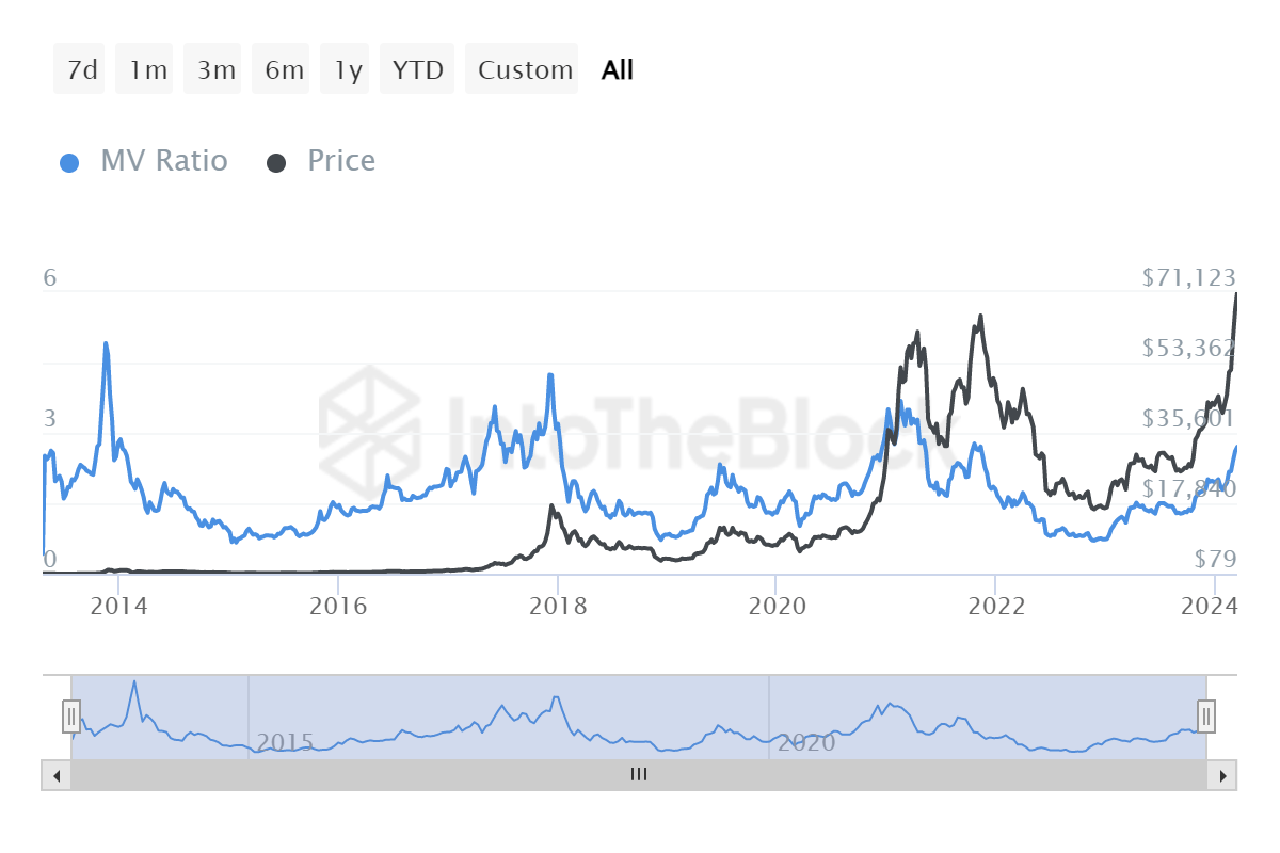

The MV Ratio provides valuable insights into the potential price volatility of Bitcoin. This metric calculates the average price at which Bitcoin is acquired by different wallet types on the blockchain, such as whales holding 10 to 100 BTC.

The MV Ratio is seen by many as a more reliable measure to evaluate the “true” value of cryptocurrencies.

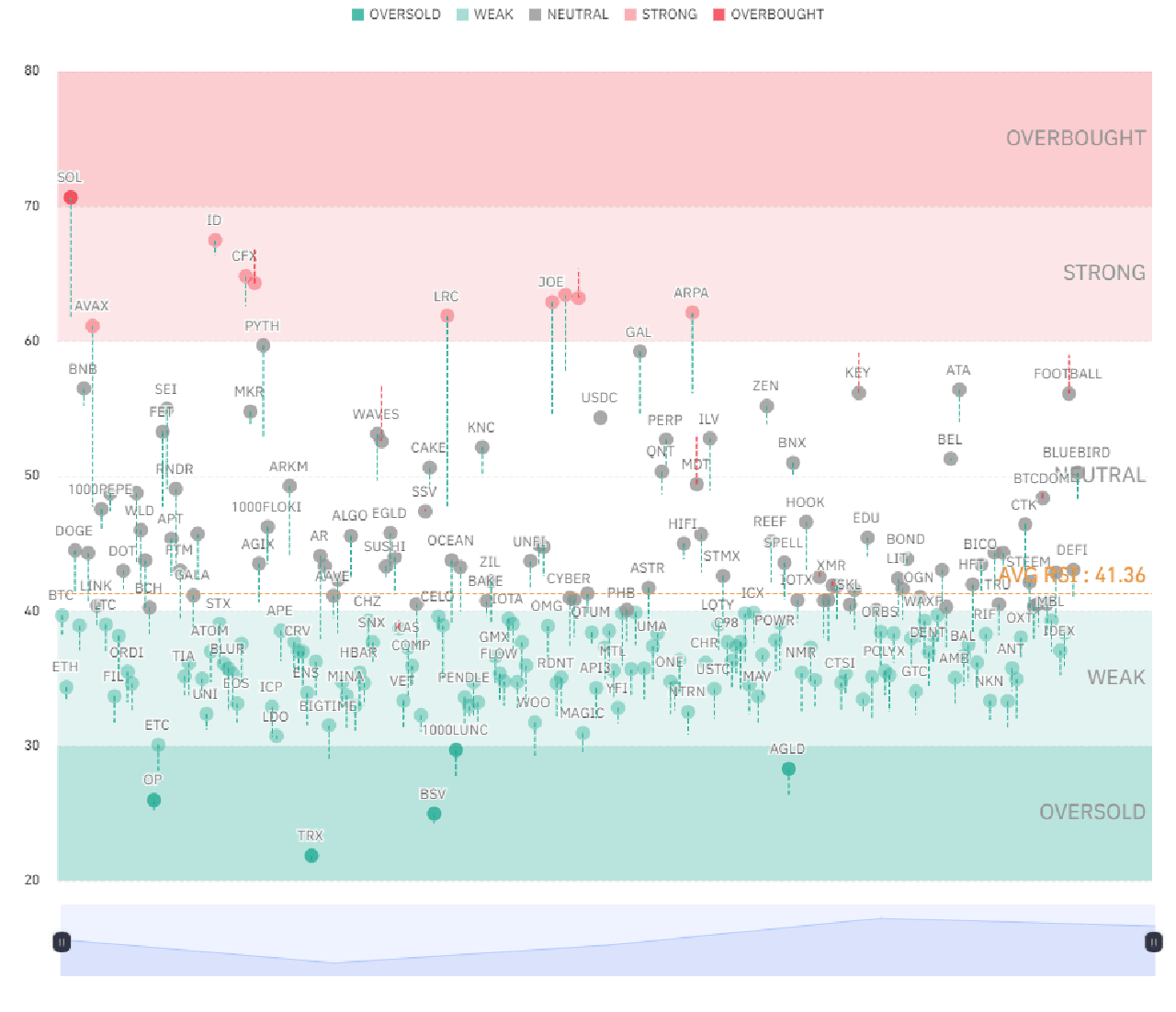

RSI

A higher RSI value usually indicates stronger buying pressure and a strong uptrend. However, when the RSI value becomes excessively high in the cryptocurrency market, it can signal overbought conditions and hint at an upcoming sell-off.

When the average RSI value exceeds 70 and enters the “overbought” zone (marked in red), the likelihood of a market correction increases. It’s important to note that the market can still remain in an overbought state for an extended period, with prices continuing to rise.

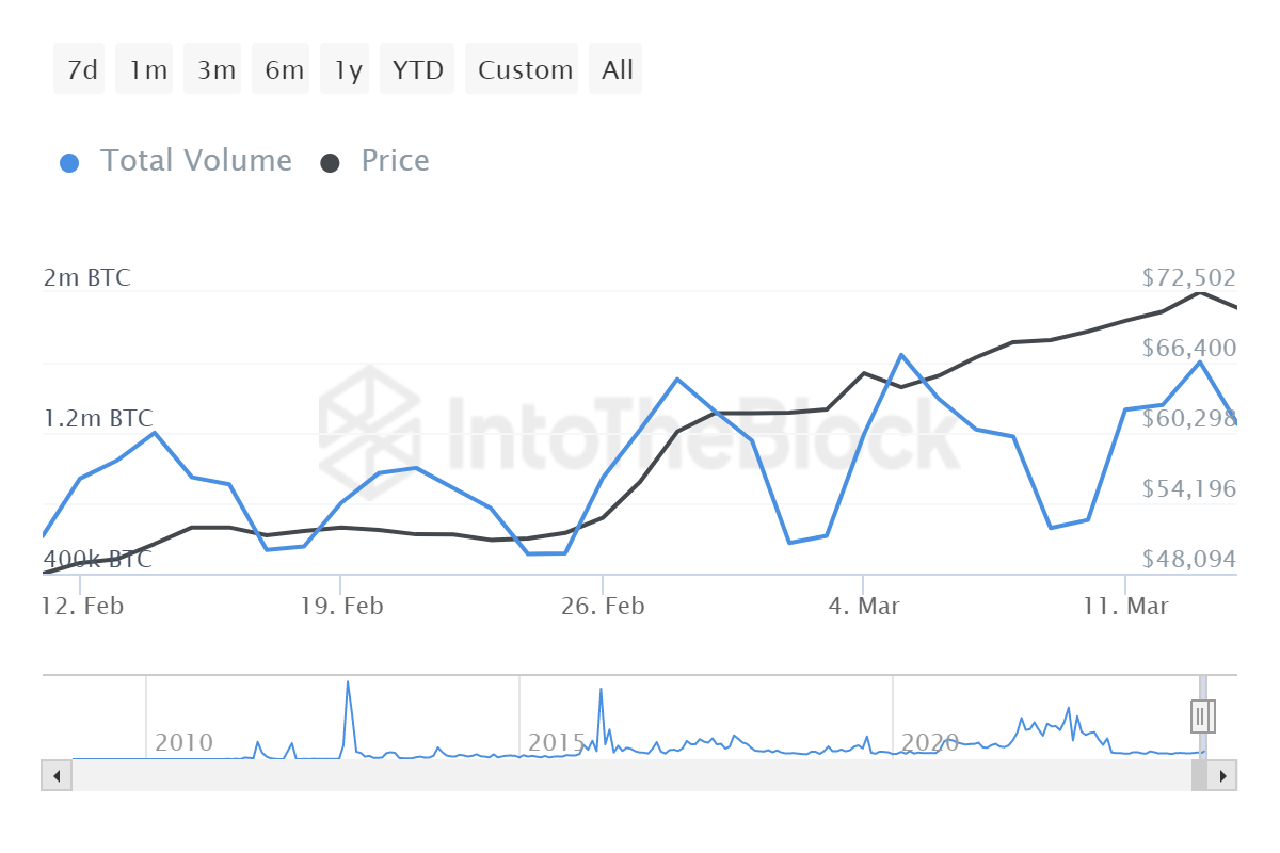

Low Trading Volume

A sudden decline in trading volume and liquidity plays as another red flag in the market.

This decline can signal a loss of investor confidence and a general downturn in market activity.

With reduced liquidity, the market becomes more susceptible to price fluctuations and the potential for market crashes.

Therefore, monitoring trading volume and liquidity levels can provide valuable insights into the health and stability of the market.

Regulatory Measures

In 2022, the cryptocurrency market faced increasing regulations in major countries like China and the United States, leading to stricter regulations.

This trend contributed to the onset of the “Crypto Winter.” For instance, exchanges such as Bittrex were forced to halt operations.