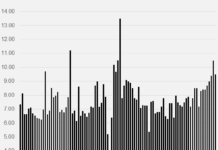

There was significant volatility in the Vietnam stock market in the early trading session of the week. Selling pressure from large-cap stocks caused the index to lose over 40 points towards the end of the morning session. The sentiment stabilized in the afternoon session, allowing the VN-Index to stage a remarkable recovery and close the session on 18th of March with a decrease of 20.22 points (-1.6%) to 1,243 points.

Foreign trading activities exerted significant pressure as they were net sellers with a total value of approximately 902 billion VND across the entire market.

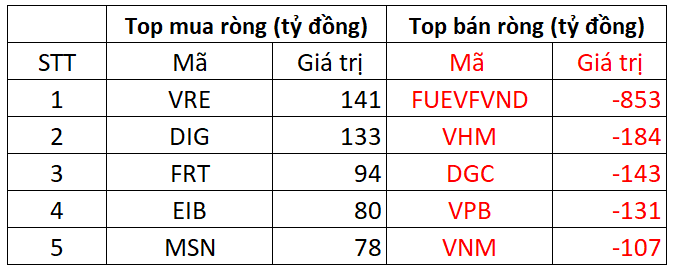

On HOSE, foreign investors were net sellers with an approximate value of 947 billion VND.

In terms of buying activities, the focus was on VRE and DIG stocks, with a value of 141 billion VND and 133 billion VND respectively during the session. These two stocks experienced significant price increases. In addition, FRT and EIB were net buyers with 94 billion VND and 80 billion VND respectively on HOSE.

On the other hand, FUEVFVND experienced the most selling pressure from foreign investors with a value of 853 billion VND (mostly through negotiated deals). VHM and DGC were the next two stocks that were sold with values of 184 billion VND and 143 billion VND each.

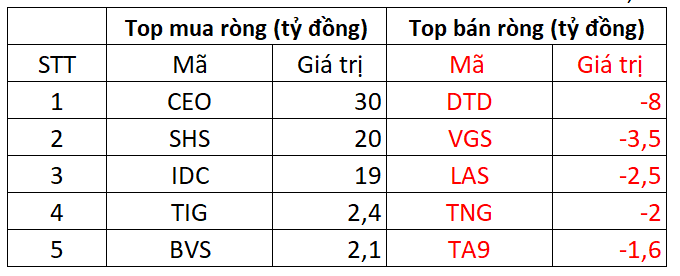

On HNX, foreign investors were net buyers with an approximate value of 57 billion VND.

In terms of buying activities, CEO was the stock with the highest net buying value of 30 billion VND. SHS followed as the next highest net buyer on HNX with 20 billion VND. In addition, foreign investors also net bought IDC, TIG, BVS stocks with relatively smaller values.

On the other hand, DTD experienced selling pressure from foreign investors with a value of 8 billion VND. VGS followed with a sell-off of approximately 3 billion VND.

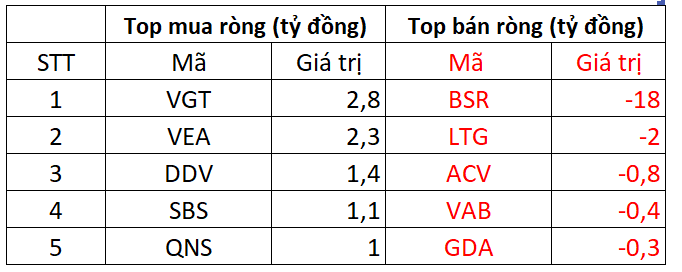

On UPCOM, foreign investors were net sellers with an approximate value of 12 billion VND.

In terms of buying activities, VGT stock was net bought by foreign investors with a value of 2.8 billion VND. After that, VEA and DDV were also net bought with a value of a few billion VND each.

On the other hand, BSR suffered a net selling pressure of approximately 18 billion VND today. In addition, foreign investors also net sold LTG, ACV, VAB, and other stocks.