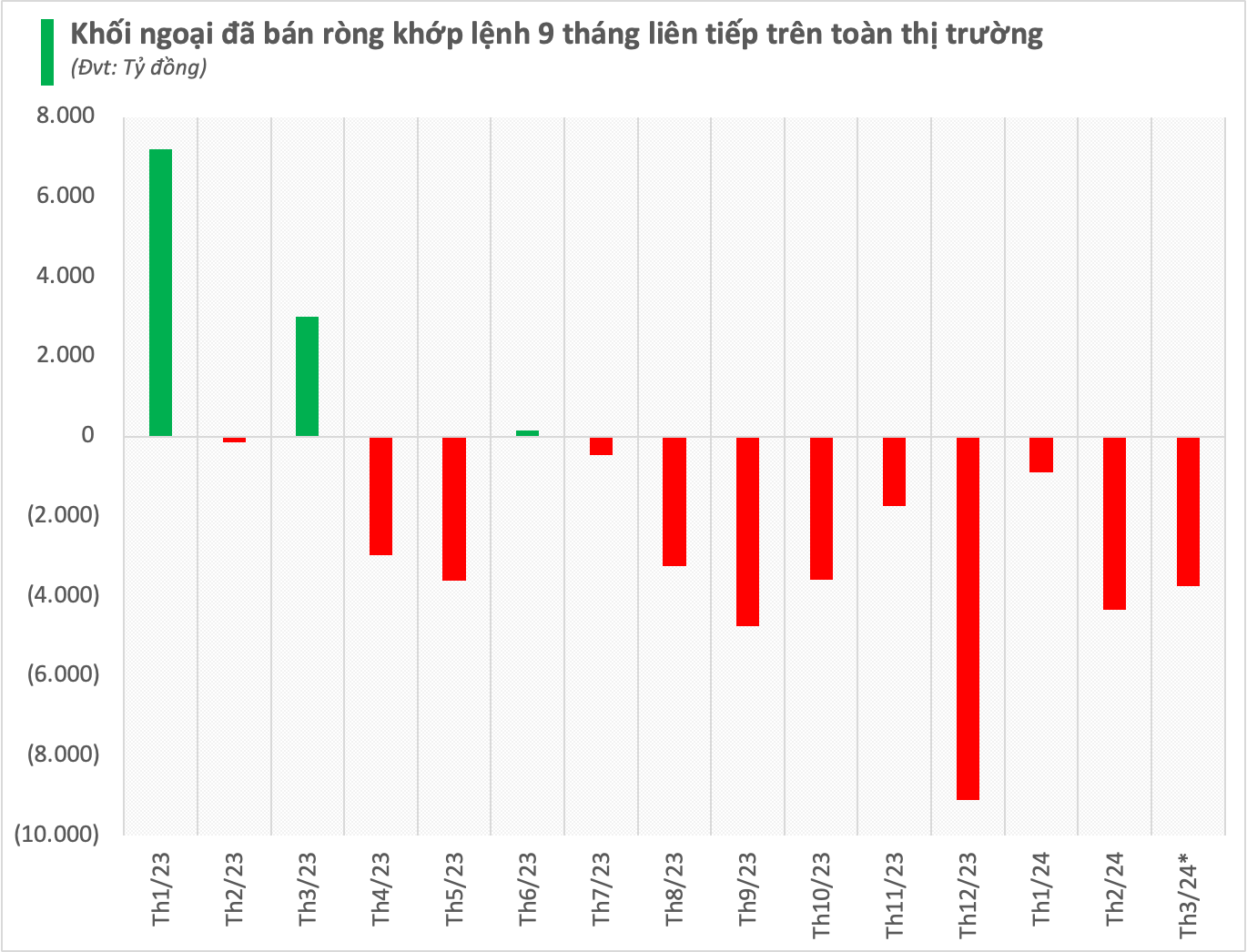

Foreign investors are still aggressively net selling on the Vietnam stock market, with the value even reaching trillions of dong per session over the past week. Accumulated since the beginning of 2024 until now, the net selling value of foreign investors reached 4,755 billion.

It is worth noting that the 9,000 billion threshold has been officially surpassed if only considering trading on the order matching channel. This is also the 9th consecutive month that foreign capital has been “dumping” on the stock of Vietnamese stocks.

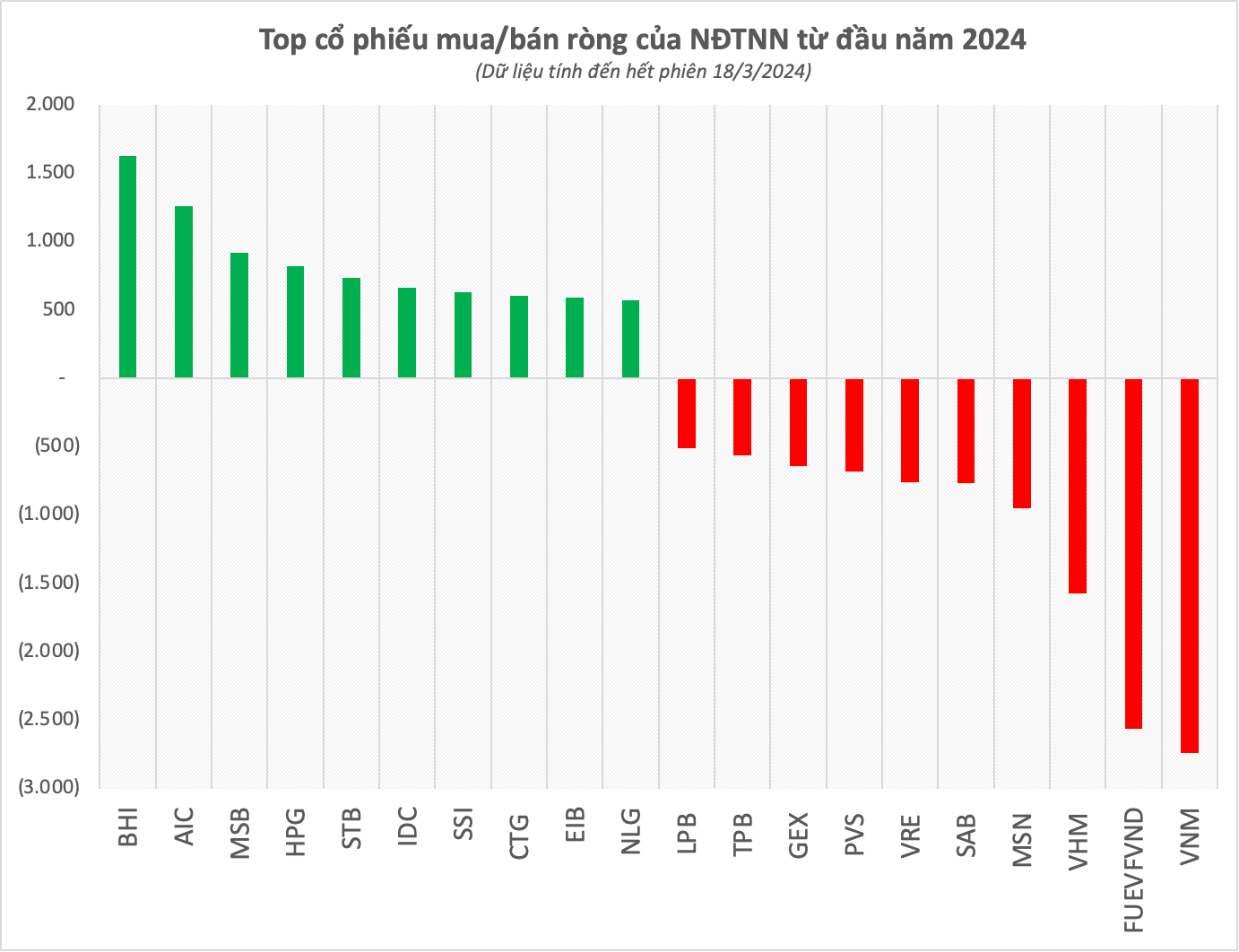

There are up to 2 stocks that have been net sold on both 2,500 billion in just less than 3 months of the year, which are VNM and FUEVFVND with a value of 2,737 billion and 2,559 billion dong respectively. While most of VNM shares were net sold on the order matching, the Diamond fund certificates of Dragon Capital were net sold on both channels.

Bluechips also recorded strong net selling including VHM (-1,569 billion), MSN (946 billion), SAB (-766 billion dong), VRE (-757 billion dong), … Most of the selling volume was executed via order matching.

On the contrary, the two stocks that were bought the most from the beginning of the year were from the UPCoM market and through agreement, including BHI with 1,638 billion and AIC with 1,263 billion dong. In addition, MSB, HPG, STB were also net bought hundreds of billion dong for each stock.

The net selling trend of foreign investors has dominated the stock market for the past few years, as in 2023, foreign investors net sold nearly 23,000 billion dong. Some opinions suggest that foreign capital only locally net sold due to portfolio restructuring moves, which did not have a major impact on the overall market. However, it must be said that although accounting for only over 10% of the trading volume, the buying and selling moves of foreign investors still somewhat affect the psychology and decisions of domestic investors.

According to evaluations, net selling by foreign investors may originate from the difference in interest rate environment, monetary policy, exchange rate, the restructuring activities of foreign funds or some time-sensitive factors. Part of the net selling pressure also comes from the trend of capital withdrawal from some large ETFs. A typical example is the pair of DCVFM VNDiamond ETF (FUEVFVND) and DCVFM VN30 ETF (E1VFVN30) of Dragon Capital, which have withdrawn over 2,000 billion dong since the beginning of the year, including the contribution of Thai investors selling. Or the longest-standing foreign ETF in the Vietnam stock market, FTSE Vietnam ETF, has also been significantly withdrawn in recent months, with a net withdrawal value of nearly 23 million USD (560 billion dong) in just under 1 month, corresponding to hundreds of billions of dong of Vietnamese stocks sold.

In addition, after the market’s breakout, VN-Index is approaching the price peak in 18 months, with a P/E ratio of nearly 15 times – significantly higher than the bottom price in the fourth quarter of the previous year. The market valuation is no longer so attractive, somewhat hindering foreign capital flow. The upgrading of the market is still at the expectation stage, while the current context is difficult to expect investment capital into frontier markets like the Vietnam stock market.

Especially, one of the fundamental factors that makes foreign money refuse to buy Vietnamese stocks comes from the difference in proportion among industry groups on the exchange when market capitalization is concentrated in the finance and real estate groups. Meanwhile, attractive sectors for foreign investors such as manufacturing, industry, technology, health care, … do not have many stocks on the stock market and the proportion is also very limited.

However, the internal of the Vietnamese economy is considered optimistic, the bright spots of Vietnam show economic growth and stable political and social environment, opening up positive prospects for the Vietnam stock market. According to Mr. Nguyen Anh Khoa – Head of Analysis and Research Department of Agriseco Securities, the forecast of the time when foreign capital stops selling does not bring much meaning when the stock market has continued to record a strong development since the end of 2023, even though foreign investors have been strongly net selling with a large scale.

In the near term, widely spreading information is the market’s upgrade story. At the conference to implement the stock market tasks for 2024, Prime Minister Pham Minh Chinh directed ministries and sectors to vigorously promote solutions for Vietnam to upgrade from frontier to emerging market by 2025.

According to calculations by the World Bank, if upgraded to an emerging market, the Vietnam stock market can attract 25 billion USD in indirect investment capital from international investors poured in until 2030.

Along with the upgrade, the new KRX system being tested also brings many expectations for investors. The system will partially meet the demand for large-scale transactions, increase derivative products, thereby supporting the upgrading process; providing peace of mind for foreign investors and individuals when trading, avoiding the situation of order congestion as in the past. This will affect the liquidity of the market, the liquidity of stocks with large market capitalization when foreign investment funds trade more.