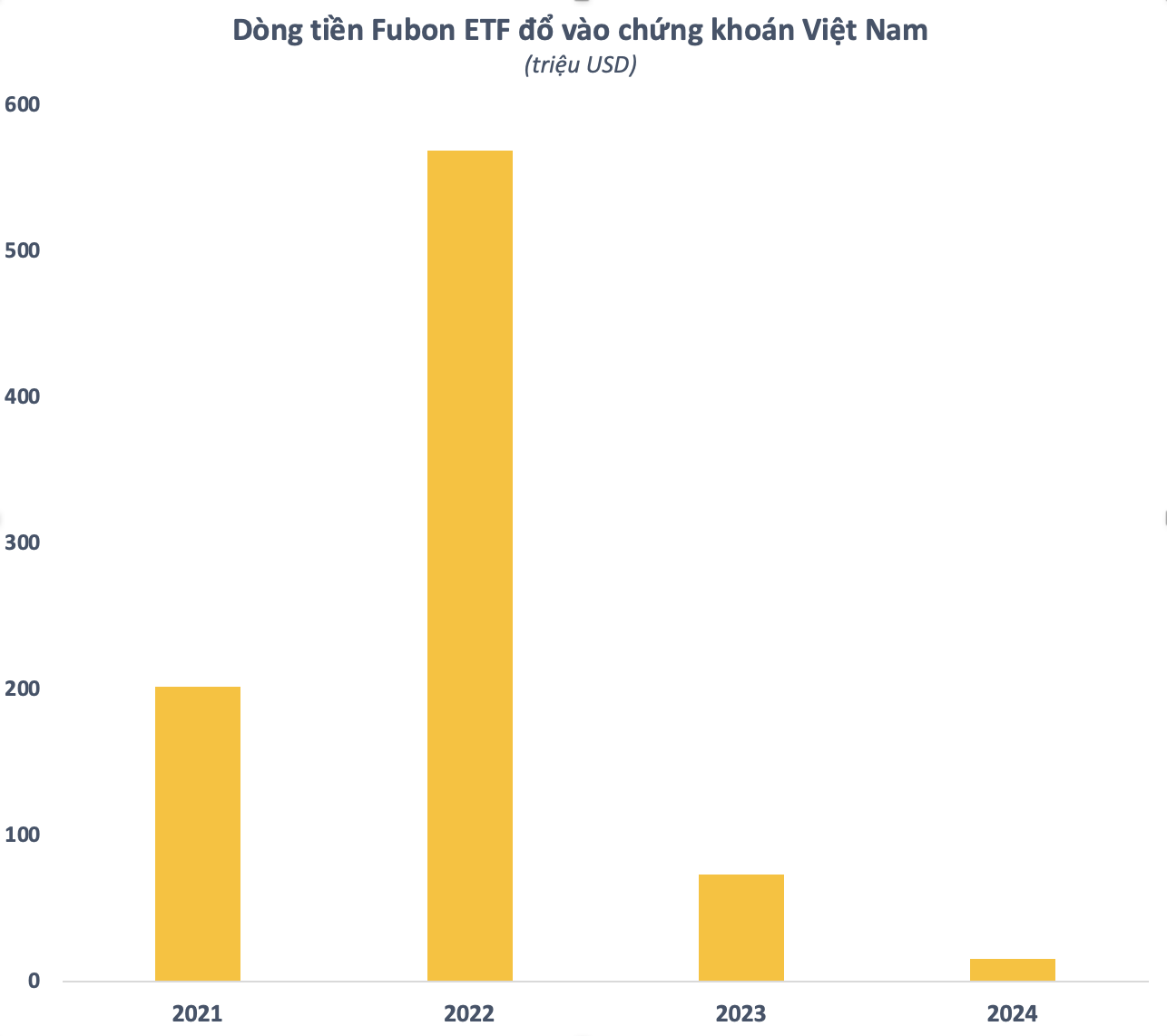

Despite the net selling wave from foreign investors, Fubon ETF continues to attract capital to invest in Vietnamese stocks, which is a notable phenomenon. Since the beginning of 2024, the fund has attracted a net inflow of $15.5 million (~390 billion VND) while foreign investors have sold a total of nearly 10,000 billion VND through the matching order channel on the Vietnamese stock market.

Fubon ETF started pouring capital into the Vietnamese stock market since March 2021 and immediately attracted strong inflows. In its first year alone, the fund attracted a net inflow of over $200 million (including the initial public offering). In 2022, the ETF from Taiwan continued to be the “magnet” attracting the most foreign capital into the market with a cumulative cash flow value of up to $570 million.

The year 2023 witnessed a somewhat “declining” performance of Fubon ETF. In fact, the fund experienced a strong capital outflow in the third quarter of last year. However, the accumulated cash flow value into this ETF still reached over $73 million throughout the year, ranking it among the top in the market. Thus, Fubon ETF has attracted a total net inflow of $860 million to invest in Vietnamese stocks.

It is worth noting that Fubon ETF continues to attract capital to invest in Vietnamese stocks despite the unsatisfactory results. The fund started off relatively smoothly, but then quickly lost all its achievements, even incurring heavy losses in 2022. Despite the strong recovery periods in 2023, it was still not enough to bring this ETF “ashore”. As of now, the investment performance of Fubon ETF since its inception is still negative, with a decrease of nearly 16%.

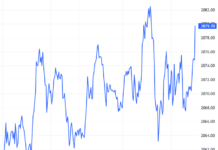

NAV/ccq fluctuations of Fubon ETF since its inception

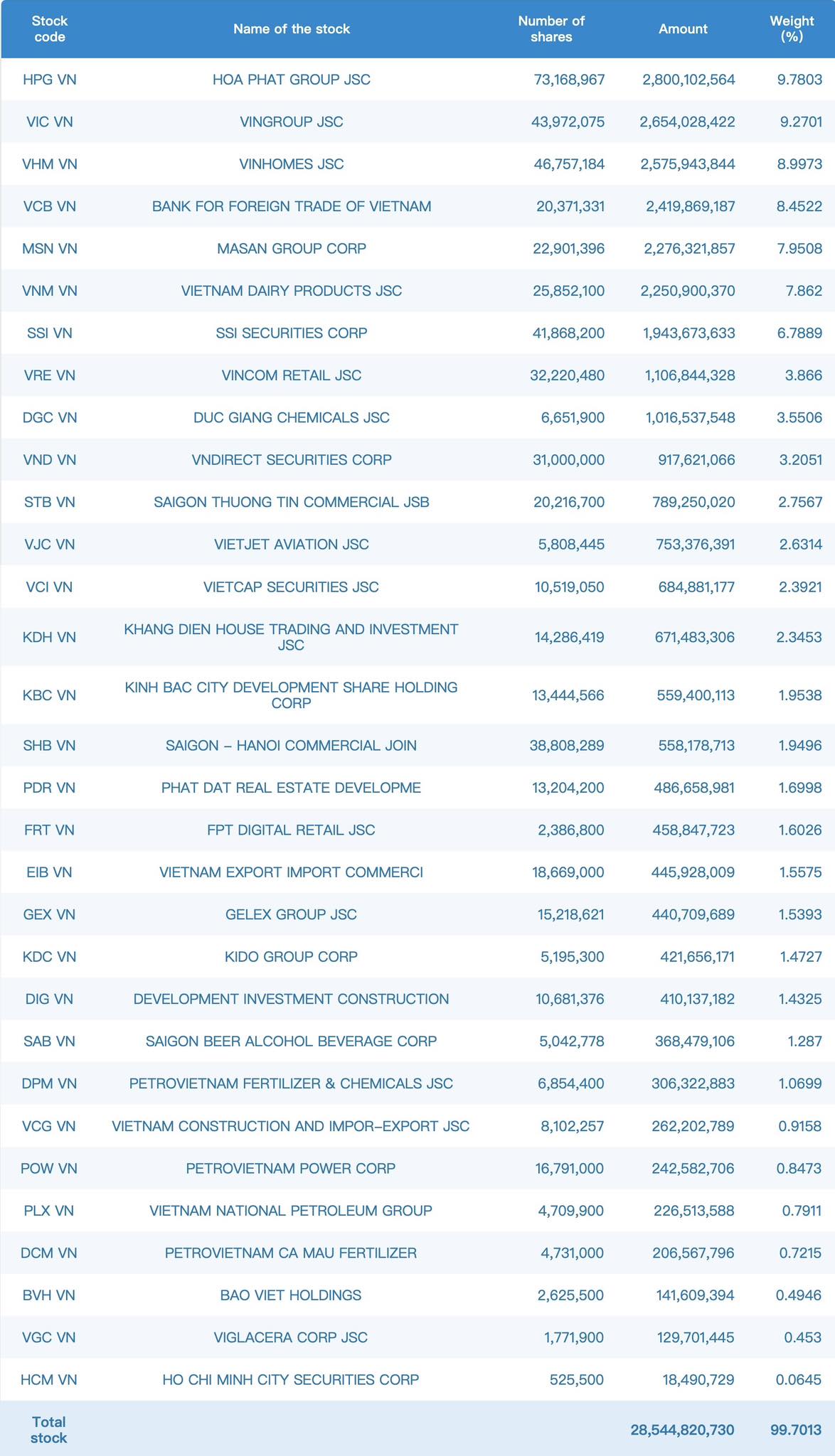

Fubon ETF is currently the largest portfolio converted fund in the Vietnamese stock market with a net asset value (NAV) of approximately $888 million (~22,000 billion VND) as of March 19, 2024. The fund invests in Vietnamese stocks according to the FTSE Vietnam 30 Index, which includes the 30 largest capitalized stocks on HoSE (subject to foreign room conditions).

At the time of its launch, Yang Yining, Director of Fubon FTSE Vietnam ETF, stated that the selected stocks must have a “high performance” in terms of financials, such as return on equity (ROE) and higher dividend ratios than companies listed on the exchange, thereby helping the index have more growth potential and higher competitiveness than the VN-Index.

However, in reality, the VN-Index is at a higher price level than when Fubon ETF started pouring capital into Vietnam while the fund is still “far from the shore”. Looking at the fund’s portfolio, it is easy to see that the majority of the high-weighted stocks are pillar stocks with large capitalization and high “beta” factor, sensitive to market changes.

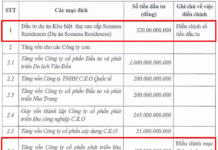

Portfolio of Fubon ETF as of March 19, 2024

Meanwhile, the condition of only investing in stocks with foreign room prevents Fubon ETF from executing its investments in the attractive foreign capital magnets such as FPT, PNJ, GMD, REE, or previously MWG. These are stocks of leading companies in “hot” sectors such as retail, energy, logistics, which have stable growth potential and less cyclicality. This may be part of the reason why the fund’s portfolio has been “unsuccessful” in recent times.

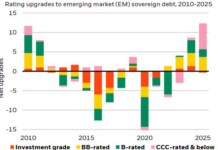

In general, it is not easy for Fubon ETF to improve its short-term performance with a portfolio structure that is almost “locked-in”. However, with positive long-term prospects of the Vietnamese stock market, especially when the story of market upgrade is becoming clearer day by day, this ETF still has a chance to “reverse the tide”.

According to BSC Research’s estimate, in the case of MSCI and FTSE upgrading Vietnam to emerging market status, there will be about $3.5-4 billion USD of new investment in Vietnamese stocks. At that time, large capitalized stocks with foreign room will naturally have an advantage in attracting this capital flow in the future.