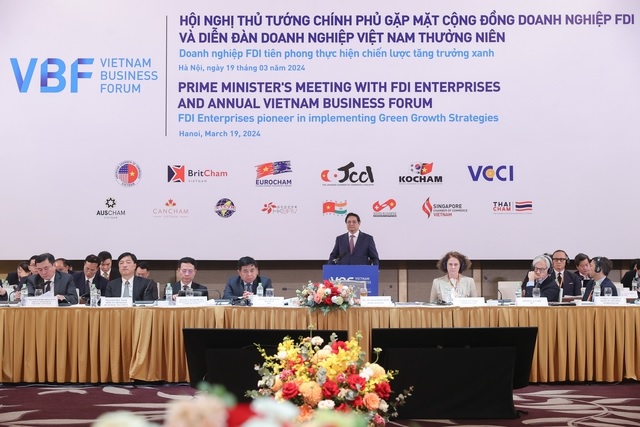

On March 19, the Vietnam Business Forum 2024 (VBF 2024), organized by the Ministry of Planning and Investment, the World Bank (WB), the International Finance Corporation (IFC), and the Vietnam Business Forum Alliance, took place in Hanoi with the theme “Vietnam Ready for the ESG Journey, High-Tech and Digitalization” (ESG: E-Environment, S-Social, and G-Corporate Governance). Prime Minister Pham Minh Chinh attended and delivered a speech at the forum.

The Vietnam Business Forum 2024 (VBF 2024), organized by the Ministry of Planning and Investment, the World Bank (WB), the International Finance Corporation (IFC), and the Vietnam Business Forum Alliance, was held in Hanoi, chaired by Prime Minister Pham Minh Chinh. Photo: VGP/Nhat Bac

|

Promoting Sustainable Infrastructure Development Policies

Speaking at VBF 2024, the Infrastructure Working Group of the Vietnam Business Forum stated that the international investor community greatly welcomes the Government’s approval of the National Power Development Plan VIII on May 15, 2023 (PDP8). The group also expressed the desire for the early approval of the PDP8 implementation plan and new policies to build sustainable infrastructure and new supply chain industries towards Vietnam’s goal of achieving net-zero emissions by 2050.

Regarding access to international finance, the Infrastructure Working Group noted that while wind and solar power capacity has significantly developed in Vietnam in recent years, most of this capacity is financed through a combination of domestic and regional banks or banks evaluating business risks, rather than project risks. The financing structure also often relies on a form of credit risk mitigation, typically guarantees, from domestic banks or project sponsors. There is generally no mechanism for non-recourse project financing, which would provide lower capital costs and longer tenors compared to domestic sources of financing.

“What is important for Vietnam is that it is not feasible to rely on credit risk mitigation support from domestic banks for large-scale project development. In addition, limited liquidity, high interest rates, a lack of long-term funding sources, and sector limitations of domestic banks will increasingly require reliance on external debt to finance infrastructure development in the coming decade,” the Infrastructure Working Group observed.

Therefore, the group suggests that the Government work with leading private sector entities and multilateral financial institutions to mobilize the necessary project financing for Vietnam’s infrastructure projects by 2030. Multilateral financial institutions should be involved to ensure the availability of guarantees to minimize national risks and support large-scale infrastructure, renewable energy, and LNG projects.

The Infrastructure Working Group also recommends the early implementation of the Power Plan VIII. This plan should include realistic timelines for completing transitioning and deferred projects as well as fuel-switching projects.

As Vietnam transitions away from conventional technologies, specific policy requirements are expected for new sectors. To maximize the allocation and flow of capital into these sectors, the Infrastructure Group made recommendations to develop specific policies for each sector.

The group proposes increasing offshore wind power capacity by 2030 and recommending a FIT (Feed-in Tariff) price for this capacity to create price certainty and promote investor confidence and commitment to establishing Vietnam’s offshore wind power market. Additionally, a national offshore spatial plan should be established in conjunction with the development of regional power centers, LNG projects, and offshore wind power to determine the optimal use and allocation of maritime areas.

“Develop supplementary cargo transport capacity at international transportation hubs (aviation and maritime) to expand trade and promote economic recovery. Establish a national regulatory body and training program to support the development of both LNG and offshore wind power sectors, making Vietnam a leading nation in the region and the world in these fields, exporting clean skills and energy globally,” the Infrastructure Working Group recommends.

For the development of new Power Purchase Agreements for the LNG and offshore wind power sectors with risk allocation provisions, the Infrastructure Working Group anticipates that large-scale new electricity projects (LNG, offshore wind, and other renewable sources) will mainly be developed on an IPP (Independent Power Producer) basis rather than a PPP basis. Therefore, the lack of international project finance will pose significant development and financing risks for Vietnam in the near future.

“With an estimated demand of 8-9GW of new electricity generation capacity annually by 2030, and with plans to support the transition to renewable energy through the development of LNG baseload, Vietnam needs a framework for the feasibility of financing large-scale wind and LNG projects,” the Infrastructure Group proposes.

Not Counting Green Finance in “Room” Credit

Summing up the opinions of working groups on environment, banking, and capital markets around the financial and ESG issues, Dominic Scriven, Head of the VBF Capital Market Working Group, emphasized the letter E – the environment.

“The letter E – the environment is an unavoidable factor. Although the environmental working group was established 2-3 years ago, its members have raised 27 issues, focusing mainly on sustainable development, green development, and climate change,” Mr. Dominic Scriven stated.

According to the representative of the working group, Vietnam needs to establish a national classification system (taxonomy). This system needs to provide a framework for concepts, policies, regulations, and laws, as well as incentives to implement balanced and reasonable carbon commitments, circular economy, shared economy… This will serve as a basis for businesses to develop specific action plans and financial flows for these activities. In addition to traditional sources of funding such as ODA, foreign direct investment, indirect investment through the banking system and capital markets…, the market is developing special capital flows for green development.

“The banking working group proposes that green finance and green credit be counted outside the annual credit growth rate,” Mr. Dominic Scriven suggested as a solution to boost financing for this area.

Vietnam needs to make choices to harness and direct the flow of capital. The challenges from these issues are becoming increasingly evident when looking at taxes and other barriers faced by Vietnam’s partners. The most prominent example is the forthcoming Carbon Border Adjustment Mechanism (CBAM) of the European Union (EU), and similar legislation on carbon border adjustment mechanisms in the US is also under development, or stricter regulations related to greenwashing entities – organizations that engage in deceptive or misleading practices to make consumers believe that the company is environmentally responsible.

In terms of information disclosure, the VBF Capital Market Working Group representative also stressed that businesses need to not only pursue IFRS accounting standards as at present, but also move towards International Sustainability Standards (ISSB). The working group also recommended that Vietnam and businesses study financial information related to climate change (TCFD), implement natural capital risk management, stable biodiversity, and research marketable biodiversity credits.