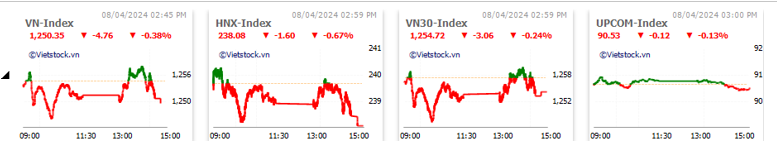

At the close, VN-Index dropped 4.76 points (0.38%), reaching 1,250.35 points; HNX-Index declined 1.6 points (0.67%), reaching 238.08 points. The overall market breadth favored sellers with 532 decliners and 253 advancers. Red dominated the VN30-Index basket, with 17 decliners, 9 advancers, and 4 flat.

Market liquidity decreased compared to the previous trading session, with the matching volume of VN-Index reaching over 790 million shares, equivalent to a value of over VND 18.4 trillion; HNX-Index reached nearly 80 million shares, equivalent to a value of nearly VND 1.7 trillion.

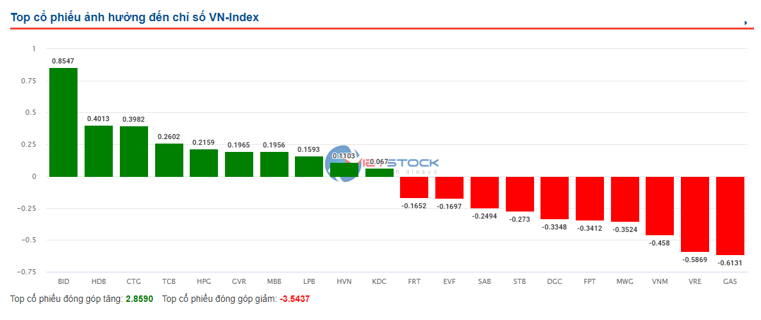

VN-Index opened the afternoon session positively as buying pressure emerged from the start of the session, helping the index recover and regain green until near the end of the session. After that, selling pressure suddenly appeared, dragging the index down into the red and closing near the lowest level of the day. In terms of impact, GAS, VRE, VNM, and MWG were the stocks with the most negative impact, taking away more than 2 points from the index. On the other hand, BID, HDB, CTG, and TCB were the stocks with the most positive impact on VN-Index, contributing over 1.9 points gain.

Source: Vietstock Finance

|

HNX-Index also had a similar trend, in which the index was negatively affected by stocks such as DDG (-9.3%), LAS (-7.31%), BVS (-5.68%), NDN (-4.31%), etc.

Source: Vietstock Finance

|

At the close, the market declined 0.38%. The advisory and support services sector declined the most significantly, with -5.39%, primarily due to TV2 (-7%), TV4 (-1.44%), and KPF (-6.99%). The rubber products and retail sectors followed, with declines of 2.31% and 1.88%, respectively. Conversely, the other financial sector rebounded the most, with a gain of 1.05%, primarily due to OGC (+0.31%) and TVC (+5.88%).

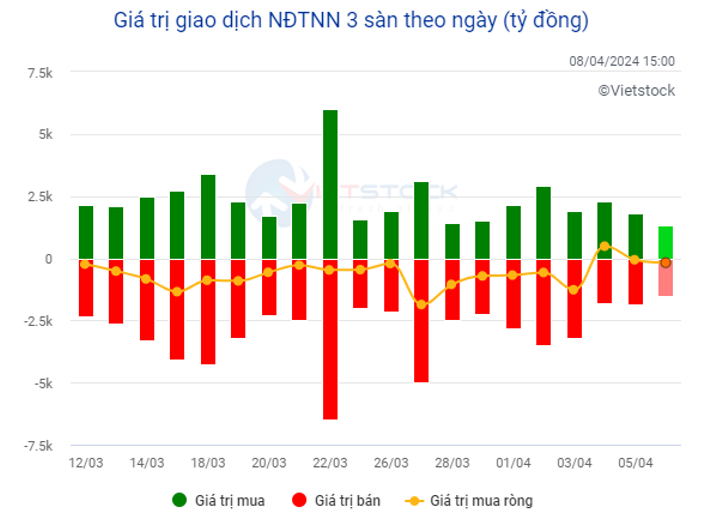

In terms of foreign trading, foreign investors continued to net sell nearly VND 253 billion on the HOSE exchange, mainly in VHM (VND 254.2 billion), VRE (VND 123.83 billion), FRT (VND 36.46 billion), and DIG (VND 27.87 billion). On the HNX exchange, foreign investors net bought nearly VND 74 billion, mainly in PVS (VND 64.47 billion), IDC (VND 13.22 billion), and MBS (VND 7.62 billion).

Dinh Vu Petroleum Services and Port JSC (UPCoM: PSP) – a subsidiary of PVS – announced its 2024 Annual General Meeting documents, with a slightly increased business plan after becoming one of the leaders in net profit growth in the port and logistics sector in 2023. PSP also plans to distribute VND 16 billion in dividends in 2024.

12 p.m.: Market narrows decline as liquidity dries up

By the end of the morning session, VN-Index had declined 3.03 points (-0.24%), reaching 1,152.08 points; HNX-Index declined 0.76 points (-0.32%), reaching 238.92 points. The overall market breadth favored sellers with 441 decliners and 225 advancers. Meanwhile, the VN30 basket tilted towards red, with 17 decliners, 8 advancers, and 5 flat.

Market liquidity witnessed a sharp decline during the morning session. Specifically, the trading volume of VN-Index reached only 406 million shares, equivalent to VND 9.2 trillion. The trading volume of HNX-Index also reached only nearly 43 million units, equivalent to a value of nearly VND 900 billion.

After the lunch break, the market’s performance significantly improved compared to the morning session, as VN-Index narrowed its decline from -8 points to -3.03 points. However, the market lost its momentum as demand remained extremely cautious. At the close, GVR (+1.6%) and BID (+0.6%) contributed the most positively to VN-Index, with contributions of 0.49 and 0.42 points gain, respectively. In contrast, VCB (-0.3%) and VPB (-1%) were the stocks with the most negative impact on the index, causing it to lose 0.41 and 0.38 points, respectively.

In terms of industry groups, the number of sectors in red outnumbered those in green. Specifically, only 5 sectors advanced by the end of the morning session, while the number of declining sectors reached 20. Among them, the mining stock group led the gainers with an industry index increase of 1.06%, supported by positive performances from oil stocks such as PVS (+1.42%), PVD (+1.37%), PVC (+1.82%), and PVB (+0.38%). They were followed by other financial, construction materials, agriculture, forestry, and fishery, and chemical plastics production.

On the decline, selling pressure weighed on the retail stock group, with the industry index falling 1.59%. MWG declined 1.76%, PNJ declined 1.03%, and FRT declined 2.97%, etc. In contrast, the CTF stock maintained a green color until the end of the morning session.

By the end of the morning session, red dominated most of the industry groups. Major industry groups such as retail, rubber products, advisory and support services, and information technology fell deeper into the red. In contrast, industry groups such as mining, construction materials, and other financials maintained a positive green, indicating that investors are focusing on these industry groups.

10:40 a.m.: Sellers dominate the market

Selling pressure continued to prevail, pushing the major indices below the reference level. The trio of real estate, banking, and securities industries remained a “burden” on the overall index. As of 10:40 a.m., the VN-Index had declined by more than 1 point, trading around 1,253 points. HNX-Index had declined by 0.23 points, trading around 239 points.

Most