SSI Securities Corporation has just released its first-quarter 2024 individual financial statements, reporting total revenue of VND 1,945 billion and pre-tax profit (PBT) of VND 900 billion, up 33% and 53% respectively year-on-year (YoY). SSI estimates its consolidated revenue to reach VND 2,022 billion and PBT of VND 945 billion, representing a 36% and 53% growth compared to Q1/2023.

In the first quarter, the Securities Services (SS) segment recorded revenue of nearly VND 911 billion, accounting for the largest proportion of total revenue at 47%.

Brokerage, custody, investment advisory and other services reached VND 464 billion, a 66% increase YoY. SSI’s market share in brokerage of stocks, fund certificates and covered warrants on the Hochiminh Stock Exchange (HoSE) in Q1 continued to rank among the top 2 market with 9.32%.

Margin lending and pre-sale advances generated revenue of nearly VND 447 billion, up 32% YoY. SSI’s margin lending outstanding balance reached VND 16,957 billion, an increase of 16% compared to the end of 2023, thanks to positive market movements.

Investment revenue reached approximately VND 902 billion, up 33% YoY, contributing 46% to total operating revenue. The investment segment performed well due to the growth trend of the stock market and significant contributions from investments in valuable papers, with SSI’s invested bond portfolio ensuring high liquidity and always paying principal and interest on time.

Revenue from Capital Sources & Financial Trading recorded nearly VND 132 billion, accounting for 7% of total revenue. This is a traditional business segment based on total asset size, relationships with financial institutions and the interest rate environment at each point in time.

As of March 31, 2024, SSI’s parent company’s total assets reached VND 64,712 billion and equity reached nearly VND 23,311 billion. For the last four consecutive quarters, the return on equity (ROE) and return on total assets (ROA) in Q1/2024 were 11% and 4.1%, respectively.

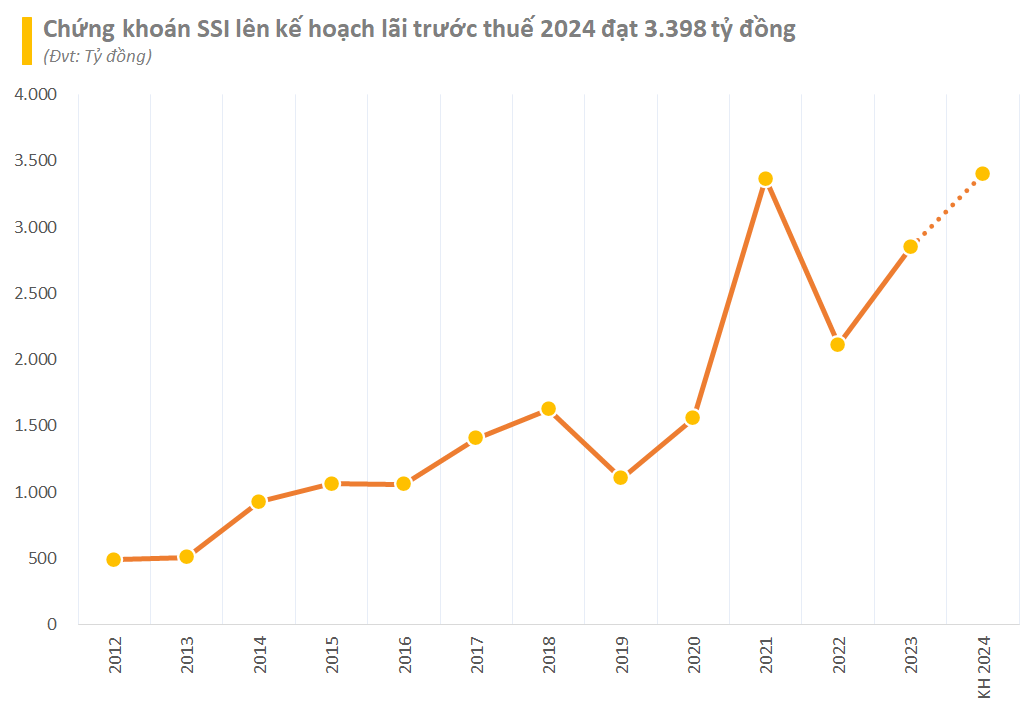

In related news, SSI is expected to hold its 2024 Annual General Meeting of Shareholders (AGM) on April 25th. At the AGM, SSI will submit to its shareholders for approval its 2024 business plan with a consolidated revenue target of VND 8,112 billion. Consolidated pre-tax profit is expected to reach VND 3,398 billion, an increase of 19% compared to the previous year.

In addition to the business plan, SSI is expected to submit to the AGM for approval a number of important matters, such as the issuance of shares under the 2024 Employee Stock Ownership Plan (ESOP), continuing with the share offering and issuance plan approved by the AGM in 2023; election of 2 members of the Board of Directors and other matters.

Earlier, at the end of December 2023, SSI shareholders had approved two capital increase plans, including the issuance of over 302.2 million bonus shares for a capital increase of 20% and a rights offering of over 151 million shares to existing shareholders at a price of VND 15,000 per share on a 10% basis. In total, SSI will issue over 453.3 million new shares. SSI’s charter capital is expected to increase from VND 15,111 billion to nearly VND 19,645 billion, thus consolidating its position as the number 1 in terms of charter capital among securities companies.