The stock market continued to struggle in the session of April 17 before the holiday break. However, correction pressure emerged at the end of the session, causing the VN-Index to decline sharply and close below the 1,200 level. At the close, the VN-Index dropped 22.67 points to 1,193.01 points. Foreign trading became a negative factor when it abruptly sold net 991 billion VND in the entire market.

In that context, corporate bond traders turned to net sales of 27 billion VND on all three floors.

On the HoSE floor, corporate bond traders sold net nearly 9 billion VND, of which 156 billion VND was sold net on the order-matching channel, but 147 billion VND was bought net on the negotiation channel.

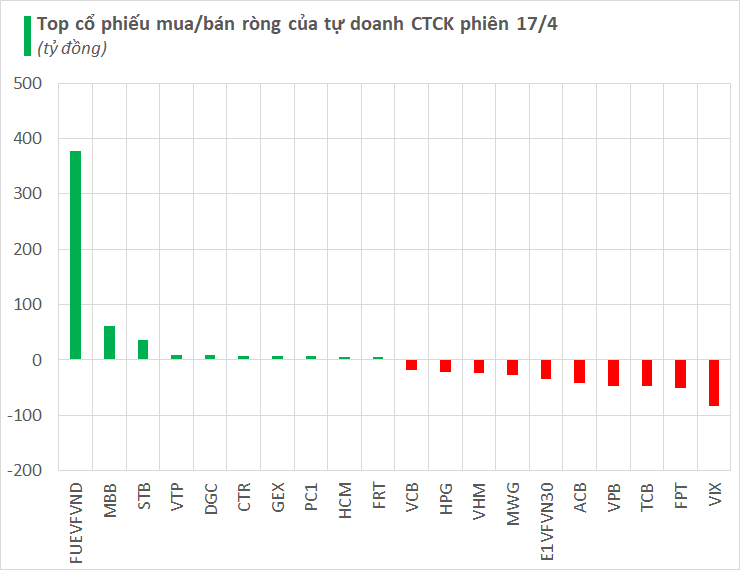

Specifically, the transactions of the strongest net selling brokerages were in the VIX stock with 83 billion, FPT and TCB were also sold net with 51 billion and 48 billion VND in each code, followed by VPB and ACB which were also sold net with 47 billion and 42 billion, respectively. Other stocks that were net sold during the session today include E1VFVN30, MWG, VHM, HPG, etc.

In contrast, the group of brokers that bought the most were in the FUEVFVND fund certificate with 378 billion, and MBB was also bought with 62 billion. STB and VTP were bought by approximately 35 billion VND and 9 billion, respectively. Besides, stocks like DGC, CTR, GEX, PC1, etc. were also bought slightly net in the session of April 17.

On the HNX, corporate bond traders bought net nearly 5 billion VND, of which more than 7 billion was bought net on IDC. In contrast, PVS was sold net for nearly 2 billion.

On the UPCoM, corporate bond traders sold net 23 billion, of which the focus was on QNS when it was sold net 27 billion VND. and BCR was sold net 4 billion. On the contrary, MCH was bought for more than 4 billion.