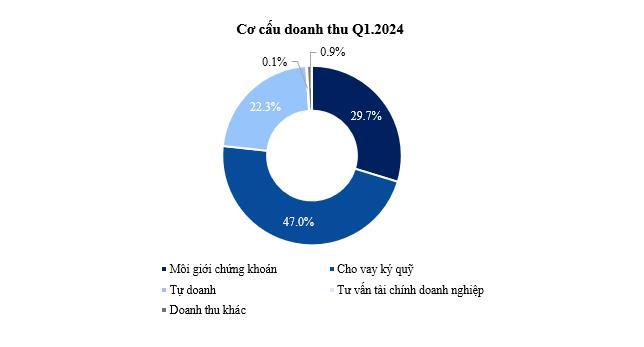

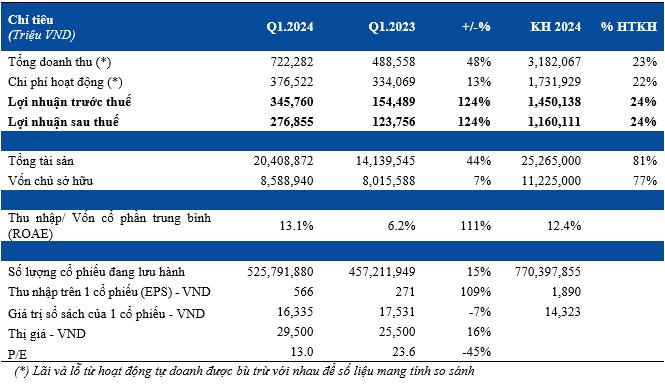

The abovementioned results were recorded given the context of the average trading value in the whole market in the first quarter of 2024, which reached nearly 24,000 billion VND/day. Taking advantage of favorable market factors, HSC grew in most business segments. Revenue in the first quarter of 2024 reached 722 billion VND, up 48% over the same period in 2023, in which:

Revenue from securities brokering activities reached 215 billion VND, up 62% compared to the same period in 2023. The first quarter of 2024 was the third consecutive quarter in which HSC increased its market share to 5.9%, thus maintaining its position among the top 5 largest brokerages on the HOSE floor.

Revenue from margin lending activities reached 339 billion VND, up 52% compared to the first quarter of 2023. The implementation of the new margin lending management model from the beginning of 2024 is expected to provide the best possible support for customers’ trading needs, as well as increase the flexibility in HSC‘s loan management.

Revenue from proprietary trading activities reached 161 billion VND, up 28% compared to the same period in 2023 and contributing 22% to HSC‘s total revenue. HSC‘s proprietary trading is mostly for market making of ETFs and covered warrants.

The corporate financial advisory segment recorded a revenue of 1 billion VND. In the first quarter of 2024, HSC‘s Corporate Finance worked actively. However, the revenue reported in the accounting period does not fully reflect the business results of this activity since the implementation period of advisory deals is often prolonged. Based on the current deals portfolio, the corporate financial advisory activities are expected to lead to a positive outcome in 2024.

As of March 31, 2024, HSC‘s total assets reached 20,409 billion VND, and shareholders’ equity reached 8,589 billion VND. Earnings per share (EPS) in the first quarter of 2024 reached 566 VND/share.

On April 25, 2024, HSC will hold the Annual General Meeting of Shareholders for the fiscal year 2023. According to the published documents, HSC sets a target of a 72% increase in pre-tax profit in 2024 to 1,450 billion VND. Revenue for the whole year is expected to reach 3,182 billion VND, up 41% compared to 2023. The business plan is based on the forecast that the average market trading value in 2024 will reach 20,000 billion VND/day, up 18% compared to 2023. In addition, HSC expects the 2,400 billion VND increase in capital from the private placement will be used from mid-2024 to increase the scale of its margin lending and proprietary trading activities, mainly for market making, provision and trading support for customers.