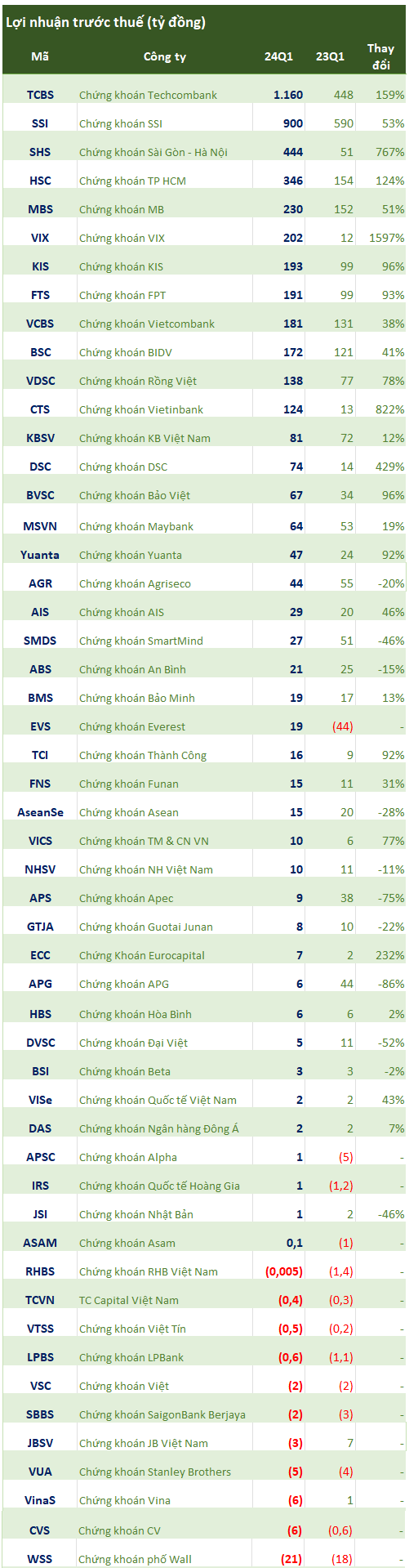

According to the statistics released on April 19, 2024, a total of 52 brokerage companies have disclosed their Q1 2024 financial statements.

SHS Securities recorded an operating revenue decrease of 17% year-over-year, down to VND 565 billion in Q1 2024. This is mainly attributed to a 26% decline in gains from FVTPL assets, which amounted to VND 369 billion. Conversely, interest income from loans and receivables increased by 6% to VND 120 billion, and brokerage revenue doubled to VND 68 billion.

Operating expenses saw a significant reduction of 87% to only VND 74 billion, primarily due to the reversal of a VND 525 billion loss from FVTPL assets in Q1 2023, resulting in a gain of over VND 26 billion in the current period.

As a result, SHS Securities reported a pre-tax profit of VND 444 billion, nearly nine times higher than its Q1 2023 profit.

KB Securities Vietnam (KBSV) saw its operating revenue increase by 17% year-over-year to VND 303 billion in Q1. Interest income from loans and receivables contributed over half of this, reaching VND 124 billion, a decrease of approximately 7% compared to Q1 2023. Brokerage revenue surged by 95% to nearly VND 80 billion, while gains from FVTPL assets slightly declined to VND 46 billion.

Operating expenses increased by 70% to VND 85 billion during the period. After deducting related expenses, KBSV reported a pre-tax profit of VND 81 billion in Q1 2024, an increase of 12% year-over-year.

BIDV Securities (BSC, stock code: BSI) generated VND 352 billion in operating revenue during the first quarter of 2024, a 23% increase from the same period last year. Notably, interest income from loans and receivables increased by 30% to VND 120 billion. BSC’s margin and UTTB balance increased by over VND 1,200 billion in the first three months of the year, reaching VND 5,500 billion.

BSC’s brokerage revenue reached VND 82 billion in Q1, an increase of 55%. Gains from FVTPL assets remained stable at VND 128 billion. As a result, BSC reported a pre-tax profit of nearly VND 172 billion, a 41% growth compared to Q1 2023. Net income after tax reached VND 137 billion.

At HSC Securities (stock code: HCM), operating revenue grew by 37% year-over-year to VND 863 billion in Q1. Specifically, gains from FVTPL assets increased by 13% to VND 303 billion; interest income from loans and receivables increased by 52% to VND 339 billion; and brokerage revenue rose by 63% to VND 215 billion.

Meanwhile, operating expenses rose by only 6%. Consequently, HSC recorded a pre-tax profit of close to VND 346 billion in Q1 2024, a 124% increase compared to the same period in the previous year.

Everest Securities successfully turned a loss of VND 44 billion in Q1 last year into a profit of VND 19 billion in the reporting period.

In contrast, Agribank Securities (Agriseco) reported a 20% year-over-year decline in pre-tax profit for Q1, down to VND 44 billion.

——————————————————————————-

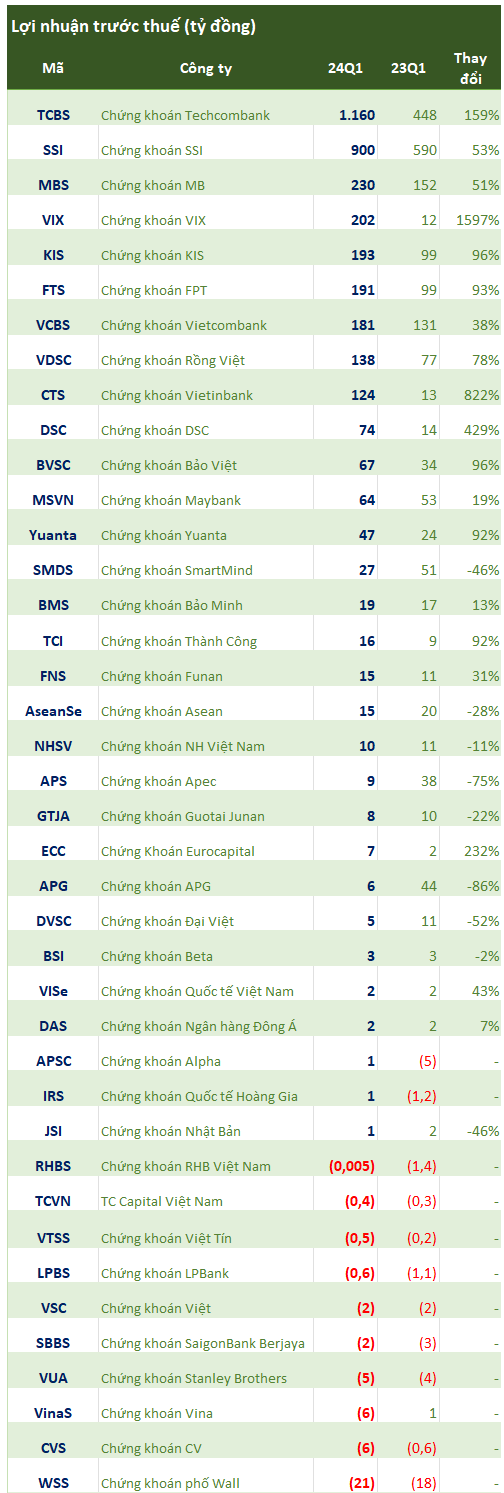

As of April 19, 2024, 40 brokerage companies have released their Q1 2024 financial statements, reporting generally positive results.

Vietcombank Securities (VCBS) recorded a significant 54% increase in operating revenue in Q1 compared to the same period last year. This is largely attributed to interest income from loans and receivables, which exceeded VND 152 billion, an increase of 83% compared to Q1 2023. VCBS’s margin and pre-sale receivables balances increased by over VND 1,000 billion in the first three months of the year.

Moreover, brokerage revenue doubled year-over-year, reaching nearly VND 108 billion. Operating expenses surged by 173% compared to the same period last year. However, net income before tax increased by 38% to VND 181 billion, resulting in a net income after tax of VND 145 billion.

According to VCBS, the improvement in profitability is mainly due to strong growth in market liquidity, leading to higher revenues from proprietary trading, brokerage, and financial support.

Meanwhile, Alpha Securities successfully turned a loss of over VND 5 billion in Q1 2023 into a profit of over VND 1 billion. Operating revenue increased by 3.3 times to approximately VND 10 billion, with most segments such as proprietary trading, lending, and brokerage showing improvements. Operating expenses were close to VND 4 billion, resulting in a profit for Alpha Securities in Q1 2024.

Equally positive, Funan Securities reported a 31% year-over-year growth in pre-tax profit for Q1 2024, up to VND 15 billion. Although operating revenue declined slightly by 13% to VND 34 billion during the period, operating expenses were reduced by half compared to the same period last year, down to just over VND 7 billion, resulting in a significant improvement in Q1 2024 profitability.

Among the small-cap brokerages, SaigonBank Berjaya Securities reported another loss-making quarter with a net income before tax of less than VND 2 billion, compared to a loss of around VND 3 billion in Q1 2023.