2023 marks the year when real estate started showing signs of recovery in certain countries post-COVID-19. Nevertheless, businesses in this sector are still facing numerous challenges, including major corporations and funds from abroad. Keppel Corporation is a case in point, with the Singaporean real estate giant failing to sell any homes in Vietnam throughout 2023.

2 MAJOR DEALS IN VIETNAM

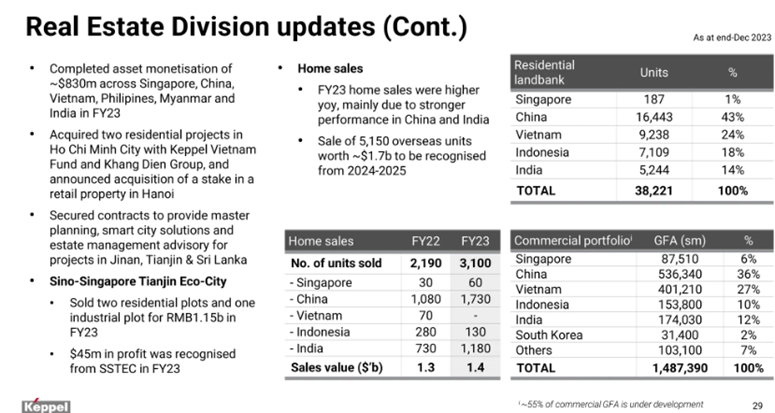

According to Keppel’s 2023 financial report, the group sold over 3,100 homes in countries where it has investments, with China (1,730 units, up 60% year-on-year) and India (1,180 units, up 61%) being the two most impressive performers.

In Vietnam specifically, the group failed to sell any homes in 2023 (compared to 70 units the previous year). Despite this, the group continues to invest in two residential projects in Ho Chi Minh City and has acquired an additional stake in a commercial property in Hanoi. Moreover, Vietnam remains one of the strategic markets that Keppel will focus on in its plan up to 2030.

Specifically, in mid-2023, Keppel Land announced a VND3,180 billion ($135 million) deal to purchase a 49% stake in two projects developed by Khang Dien. Under the agreement, the two parties will jointly develop more than 200 landed houses and over 600 high-rise apartments across the two projects. The total development cost of these projects is estimated at VND10,200 billion ($435 million).

Joseph Low, Keppel’s Chairman in Vietnam, said that the acquisition of stakes in Khang Dien’s two projects is in line with Keppel’s business model, which allows the company to tap into third-party land banks for growth. Khang Dien expects to start selling the two projects in Ho Chi Minh City developed together with Keppel Land Group by the end of this year.

In July 2023, the Singaporean group announced that, through its subsidiary VN Prime Vietnam (VNPV), it is acquiring a 65% stake in a company owning a retail property in Hanoi. The remaining 35% stake will be held by the project’s developer, Binh Minh Commercial and Investment Development Joint Stock Company.

This project is part of an under-construction real estate complex scheduled for completion in 2025. VNPV will invest approximately VND1,230 billion ($52 million) in this transaction.

Keppel Corporation is one of the most active foreign real estate developers in Vietnam. Among the projects Keppel Corp has invested in, the most famous is the five-phase Saigon Centre complex located in the center of District 1, Ho Chi Minh City.

Other projects include: Estella JV (98% owned), Riviera Point (100% owned), Saigon Sports City (100% owned), Empire City (40% owned), and the Vietcombank Tower at 198 Tran Quang Khai Street, Hanoi (30% owned).

In addition to these projects, the Singaporean company has also invested in the shares of Vietnamese real estate development companies, including: 8% of Nam Long, 60% of Nha Be Real Estate Company, and 42% of Nam Rach Chiec Company (Palm City project).

A RECORD PROFIT YEAR FOR KEPPEL

2023 was a tremendously successful year for Keppel, with revenue reaching approximately SGD7 billion ($5.1 billion) and profit after tax reaching SGD4 billion ($2.9 billion, up 339% year-on-year). This record-breaking profit after tax was primarily driven by the divestment of its offshore and marine (O&M) business. Furthermore, the value of the funds managed by the group reached $55 billion, a 10% increase year-on-year after the completion of the Aerrmont acquisition’s first phase.

Keppel is a diversified group established in 1968 and headquartered in the island nation of Singapore. Starting as a shipyard in Singapore, the company gradually expanded into ship repair, real estate, and finance, becoming a large and reputable corporation worldwide. Currently, the company focuses on several key business segments: fund management, infrastructure, telecommunications, and energy, operating in over 20 countries and territories, including Vietnam.

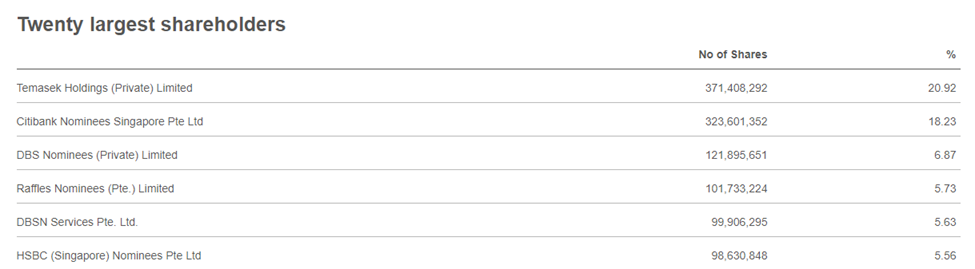

Keppel’s two largest shareholders are Temasek Holdings (holding 20.92% of shares) and Citibank Singapore (18.23% of shares). The group’s Chairman is Mr. Danny Teoh, who worked for 27 years at the auditing firm KPMG Singapore.

Keppel’s Largest Shareholders (Source: Keppel)

Infrastructure has been one of Keppel’s key focus areas in recent times. The company invests in renewable energy sources such as wind and solar power, with a target of achieving a “clean” electricity output of 7 GW by 2030. Additionally, the company is developing the Keppel Sakra Cogen power plant with a capacity of 600 MW, utilizing high-efficiency gas turbines with hydrogen fuel, a first for Singapore. The company is also developing wastewater treatment technologies, with the Keppel Marina East Desalination Plant project said to be capable of treating both seawater and freshwater in Singapore.

Real estate is also considered a strength of the Keppel group, as they own a land bank of approximately 38,000 homes and 1.5 million square meters of total commercial floor area, spanning from Singapore, China, India, Vietnam, and various other countries. Some of Keppel’s notable projects include the Marina Bay Financial Centre in Singapore, Empire City and Saigon Centre in Vietnam, among others. In the future, the company plans to continue developing more residential estates on its vast land bank.

Keppel’s Empire City Project in Vietnam (Source: Huttons VN)

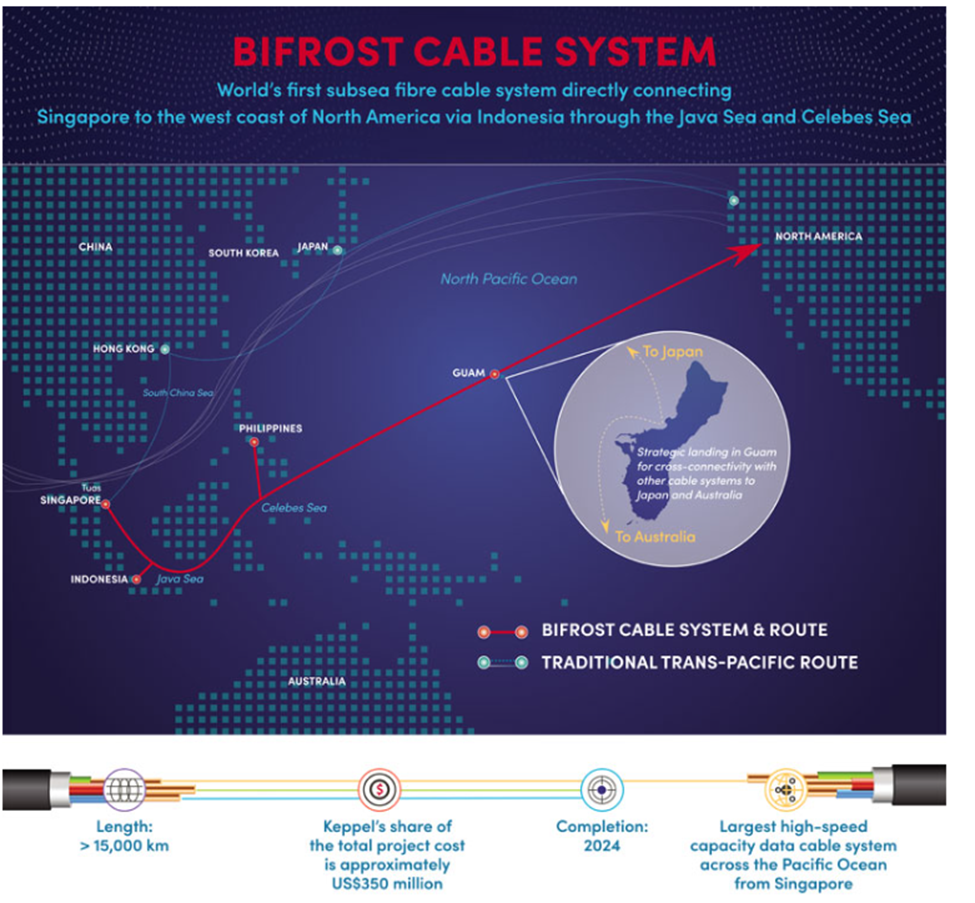

Keppel is also a major player in the telecommunications sector, owning 30 data center facilities across the Asia Pacific and Europe regions. Additionally, through its subsidiary M1, they also have over two million subscribers and are a leading telecommunications provider in Singapore. The company is also partnering with Facebook and Telin to develop the Bifrost submarine cable system, which will have the largest capacity in the Asia Pacific region upon completion.

Keppel’s Ambitious Bifrost Submarine Cable System (Source: Keppel)