According to additional information published from the shareholder meeting of Masan Consumer Group Joint Stock Company (Masan Cosumer, stock code MCH), the business plans to pay dividends in cash at the rate of 100% (1 share receives VND 10,000). Previously, in July 2023, the company paid an interim dividend of 45%, with the remaining 55% to be paid in 2024.

A recent analysis report by Vietcap Securities noted that MCH’s dividend payment of VND 10,000 per share for 2023 is higher than the annual payment of VND 4,500 per share in the past 5 years (except for 2022 when no dividend was paid). In addition, MCH’s dividend yield (cash dividend/share price) is equivalent to 7.2%, which is relatively higher than that of other listed F&B companies in Vietnam such as Sabeco (6.5%) and Vinamilk (6.0%) for the 2023 fiscal year.

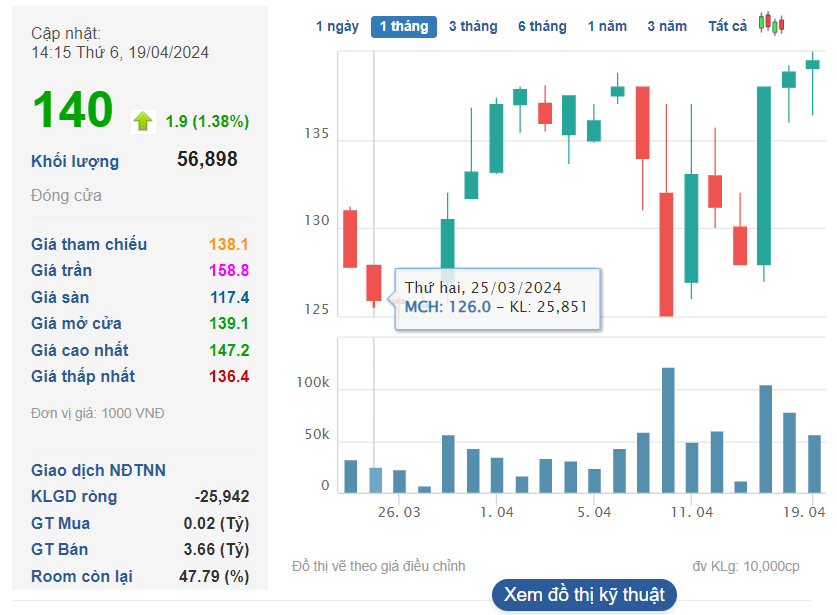

The dividend yield is calculated based on a share price of VND 140,000 as of the closing price on April 19 – an increase of 57% year-to-date. MCH shares have continued to gain for the past three trading sessions, despite the broader market declining for 4 consecutive sessions.

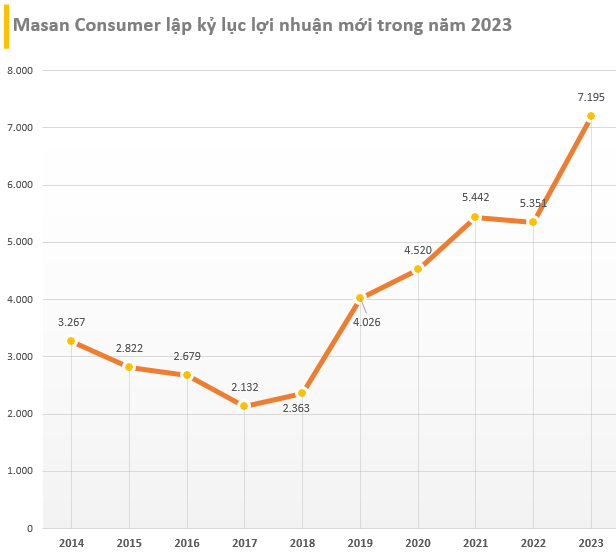

The decision to pay a ‘generous’ dividend follows a positive business year for Masan Consumer. The company has recorded exponential growth since 2018 to date. In 2023 alone, the company set a new record profit mark with after-tax profit reaching VND 7,195 billion, a 30% increase compared to 2022. EPS in 2023 reached VND 9,888 per share, significantly higher than the EPS of VND 7,612 per share in 2022.

Compared to other listed companies in the F&B sector, Vietcap Analytics found that the compound annual growth rate (CAGR) of profit after tax attributable to non-controlling interests in MCH was 16%, outperforming the single-digit growth rates of Sabeco and Vinamilk in the period 2018-2023.

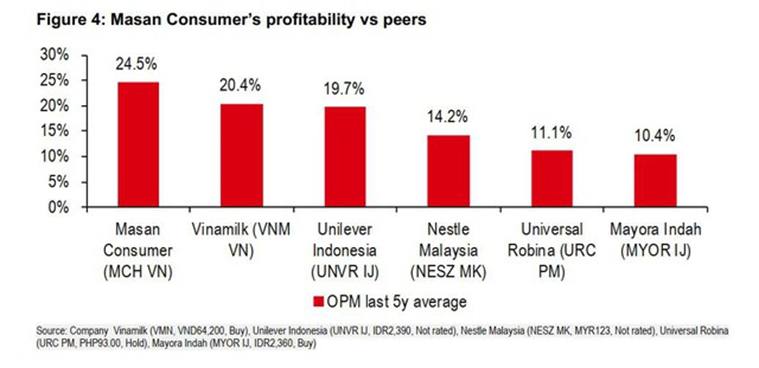

Previously, HSBC’s report also assessed that Masan Consumer has high profit margins, stable revenue growth, and is significantly outperforming other industry peers in the regional FMCG and packaged food sectors. According to HSBC’s calculations, MCH’s profit margins are 4-5% higher than Vinamilk and Unilever Indonesia, outperforming Nestle Malaysia and double that of Universal Robina and Mayora Indah.

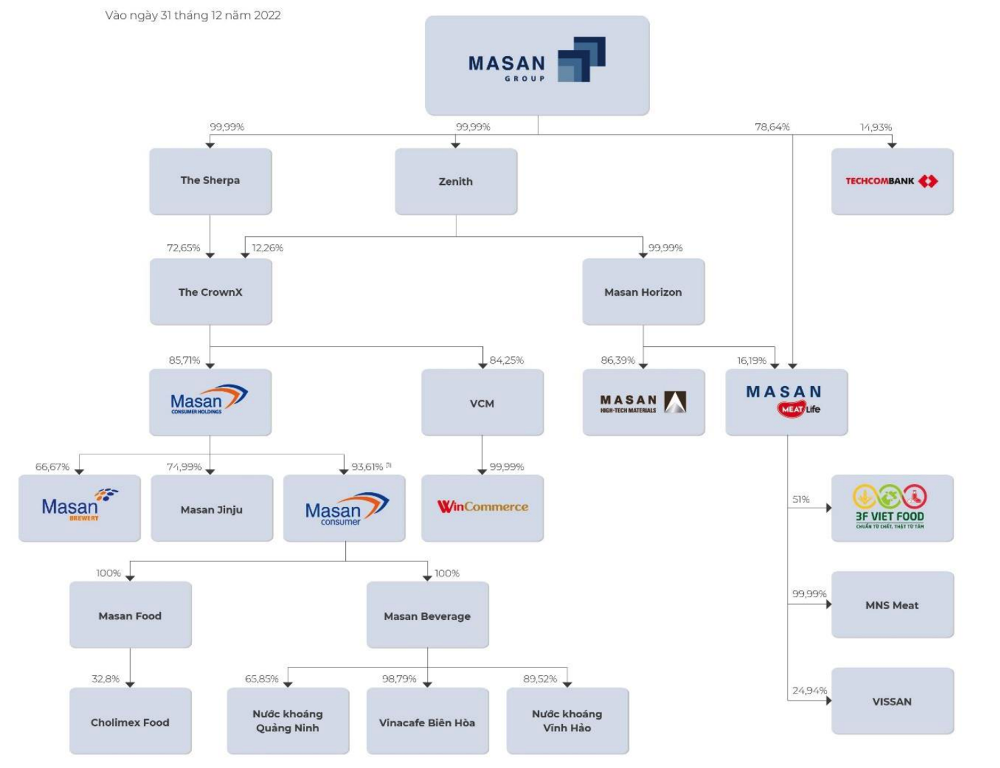

Currently, Masan Consumer Holdings Company Limited (a member of Masan Group) owns 93.6% of MCH’s total outstanding shares, and Masan is the parent company indirectly holding 68.1% of MCH’s shares.

In the AGM documents, the company proposed the approval for The Sherpa Company Limited (a subsidiary of Masan) to acquire up to 5% of MCH’s total voting shares without having to make a public tender offer.

Masan Consumer also proposed to the shareholders at the 2024 AGM to list all outstanding shares on the HOSE. The expected listing date has not been announced by the company. Vietcap believes that this change of listing venue could be a supportive factor for MCH’s share price as in the past, after companies were listed on HOSE, there were often events initiated by the company that led to higher share prices.

Masan Consumer plans to issue ESOPs at a maximum rate of 1% of the total outstanding shares at a price of VND 10,000 per share and a 1-year restriction period on transfer. The expected issuance date is in 2024 or the first 4 months of 2025.