Over the past decade, the S&P 500 and Nasdaq have seen increases by 231% and 335% respectively. However, another investment has seen an even more explosive increase: Bitcoin.

12,000% GROWTH IN A DECADE

Bitcoin (BTC) is the first and largest cryptocurrency (crypto), created from Blockchain technology. It operates as a medium of online payment and is a decentralized currency, free from any Central Banking or Government control. As the first and original cryptocurrency, its existence has led to the creation of the cryptocurrency marketplace.

Utilizing a peer-to-peer network, Bitcoin allows for transactions to occur directly between the sender and receiver without the need for an intermediary. This removes unnecessary fees, making each transaction significantly less expensive than most international wire services.

“Financial experts believe it would be “ludicrous” to expect the price of Bitcoin to rise another 12,000% in value over the next ten years, which would value a single Bitcoin at nearly $150,000. The entire global GDP was worth just over $100 trillion in 2023, making this scenario seem unlikely.”

In comparison, a $1,000 investment in Bitcoin – the world’s oldest and most valuable cryptocurrency – in April 2013 would be worth roughly $121,000 today, an increase of 12,000%. In Vietnamese currency, an investment of 25 million dong into Bitcoin in 2013 would yield approximately 3.078 billion dong by April 2024.

Bitcoin has grown from a digital currency into a globally-recognized asset with a market capitalization of over $1.2 trillion. This valuation makes BTC the 8th largest company in the world.

The digital currency has been host to some of the most extreme price movements over the past decade. Combined with its parabolic rises, Bitcoin has also endured multiple selloffs that resulted in declines of over 50%. Many critics have proclaimed that Bitcoin’s value will eventually fall to $0, only for it to rally to new heights.

These wild price swings have increasingly attracted investor attention as more people learn about the decentralized and finite supply characteristics of the coin. These are very attractive features for any financial asset to possess.

Bitcoin’s parabolic price increases have led to an entire ecosystem of financial services being built to accommodate easier trading. Earlier this year, the US Securities and Exchange Commission (SEC) approved the first Bitcoin-linked exchange-traded funds (ETFs), which led to a 56% increase in the price of Bitcoin by April 15. This indicated an increased appetite for these regulated financial products.

WILL BITCOIN INCREASE BY AN ADDITIONAL 12,000% OVER THE NEXT DECADE?

Despite the astronomical gains, financial experts believe it would be “ludicrous” to expect the price of Bitcoin to rise another 12,000% in value over the next ten years, which would value a single Bitcoin at nearly $150,000. The entire global GDP was worth just over $100 trillion in 2023, making this scenario seem unlikely.

Bitcoin’s finite supply is perhaps the most attractive feature of the digital currency. There is a fixed global supply of 21,000,000 BTC. This number cannot be changed by anyone, not even the pseudonymous creator, Satoshi Nakamoto. As of April 2024, roughly 19.7 million BTC have been mined, leaving approximately 1 million BTC left to be mined.

“Bitcoin’s price has recently dipped below $64,000. Analysts at JP Morgan said this week that they expect the price to drop further following the upcoming halving event.”

And after the upcoming halving event, Bitcoin’s supply growth rate will be less than gold’s. (Halving refers to the periodic reduction in block subsidies that are given to miners). Halving ensures a stable issuance rate for the crypto-asset until the maximum supply is reached.

When the available supply of a commodity decreases and all else is constant, the price tends to increase as people try to buy more of it. Technical analysts believe that Bitcoin will follow suit.

The supply of Bitcoin that is available to the market also largely depends on cryptocurrency miners, yet data on their inventories and available supply is scarce. If miners sell their holdings, it could put downward pressure on the price.

Bitcoin’s price has recently dipped below $64,000 since reaching an all-time high last month. Analysts at JP Morgan said this week that they expect the price to drop further following the upcoming halving event.

The most common reasons given for the parabolic price increases seen this year were the US Securities and Exchange Commission’s approval of a Bitcoin ETF in January and the expectation that Central Banks would continue to cut interest rates. There is no evidence to suggest that previous halvings were catalysts for Bitcoin’s subsequent bull runs.

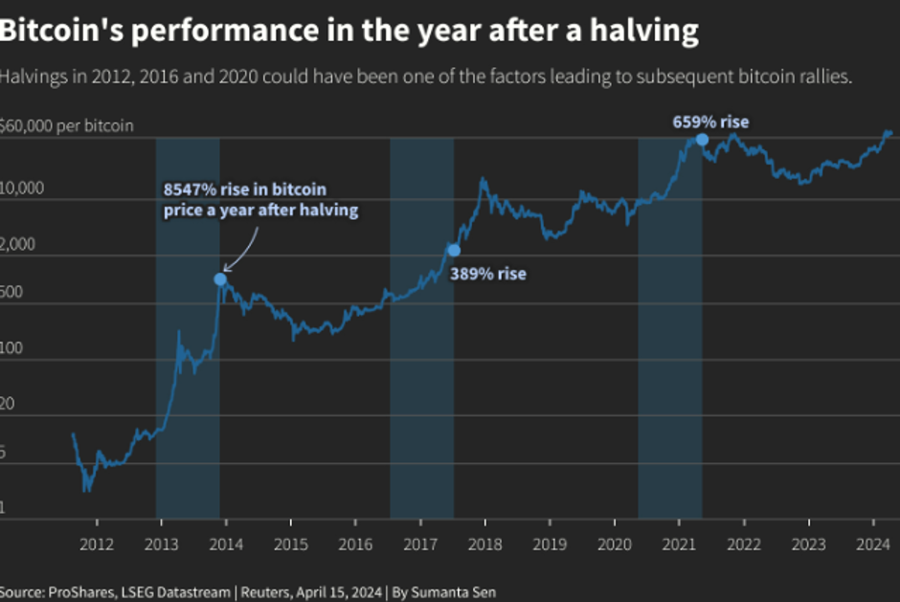

Here is how traders and miners have fared in previous halving events: When the last supply reduction occurred on May 11th, 2020, the price increased by roughly 12% in the following week and 659% over the following 12 months.

However, there are numerous explanations for this recovery – including loose monetary policy and COVID-related lockdowns leaving cashed-up investors looking for places to put their money beyond Bitcoin. There is no concrete evidence to suggest that the halving itself had any impact on the price of BTC.

A previous halving occurred in July 2016. Bitcoin rose by about 1.3% in the following week before declining over the next few weeks and rising again.

It is difficult to assess and determine the impact that these supply reductions have had on the price of Bitcoin in particular and cryptocurrency in general, which is why investors should proceed with caution with this type of digital asset.

In Vietnam and many other countries around the world, Bitcoin (as well as other cryptocurrencies) is not recognized as a legal non-cash payment method. As a result, Bitcoin transactions in Vietnam are illegal and, depending on the severity of the violation, may result in administrative fines or even criminal charges.

Currently, only two countries in the world have deemed Bitcoin to be a legal tender: El Salvador and the Central African Republic. El Salvador’s Congress passed a bill authored by President Nayib Bukele in 2021 that officially declared the cryptocurrency to be a legal form of exchange. The Central African Republic adopted Bitcoin as legal tender in Q2 2022, shortly after El Salvador’s decision.