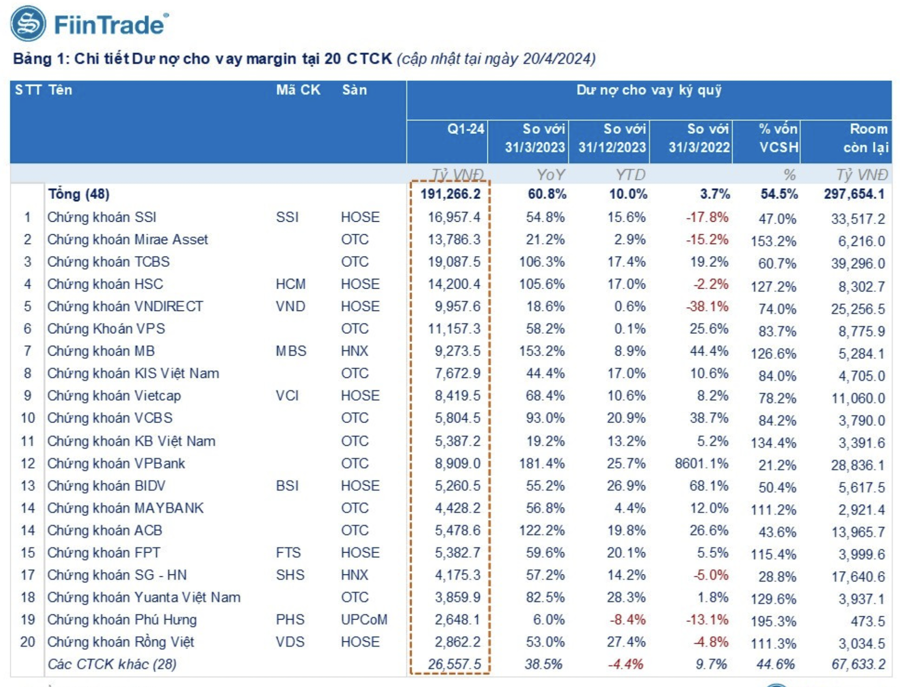

The latest statistics from FiinTrade show that margin lending balance at 48 out of 85 brokerage companies reached nearly VND 191.3 trillion as of the end of March 2024, up 60.8% year-on-year but only 10% compared to the end of 2023.

Some companies with high margin ratios include TCBS Securities with margin reaching VND 19,000 billion at the end of the third quarter, a record lending level for the brokerage. However, compared to equity, the lending ratio was only around 60.7%.

ACB Securities’ lending increased by 122% year-on-year; VPBS’s lending increased by 181%; MBS’s lending increased by 153%… Most brokerage companies recorded strong lending growth averaging around 50-60% compared to last year.

Some brokerage companies have high margin/equity ratios such as Mirae Asset 153%; HSC 127%; MB 126.6%; KB 134%; PHS individually 195%.

Compared to the prescribed threshold of 2.0 times, the margin/equity ratio is still low, indicating room for lending is large.

In particular, the margin balance on equity at the end of March 2024 was at a record low of 54.5% compared to 80% at the end of 2023 or 120% in early 2022.

The remaining margin lending room is a huge close to VND 300,000 billion, which is also a record high in terms of excess margin lending. While the actual outstanding margin lending balance is currently much lower due to the rapid and strong adjustment in April. Vn-Index has dropped 120 points, down 9% from its peak on March 28.

The excess lending source is mainly thanks to the recent capital increase by brokerage companies. Prior to that, in 2023, TCBS received an additional VND 10,242 billion from the offering of shares to existing shareholders at VND 97,542 per share. ACBS also completed the capital increase on November 13, 2023, increasing the charter capital from VND 3,000 billion to VND 4,000 billion, corresponding to an increase of VND 1,000 billion… along with many other brokerage companies.

Commenting on the margin figure, Mr. Nguyen The Minh, Director of Yuanta Vietnam Securities’ Retail Research and Development Division, said that margin is not a concern. The story of margin is coming back, but the old peak of 2021-2022 was a time when brokerage capital had not increased much, their capital is now skyrocketing after the recent wave of massive capital increases, so margin is not a concern, as long as the excess source is still comfortable.

Besides brokerage companies, margin now also includes banks, investors put assets into bank loans at interest rates of 6-8% which is still cheaper than margin, low interest rates are also a driving force to borrow margin from banks.

In the context of abundant resources, since the beginning of this year, a series of brokerage companies have continued their plans to increase capital. According to VisRating’s statistics, the total expected new capital increase for the 30 largest brokerages by assets as of March 2024 is about VND 15,000 billion.

In which, Vietcap plans to increase capital from VND 4,375 billion to nearly VND 7,200 billion; SSI Securities will issue more than 453.3 million new shares to increase charter capital by 30%, to VND 19,645 billion; HSC will also issue shares to increase capital from VND 4,581 billion to over VND 7,552 billion. ACBS has received the approval of the State Securities Commission to increase capital from VND 3,000 billion to VND 7,000 billion. LPBS plans to increase capital from VND 250 billion to VND 3,880 billion. VFS also submits to shareholders to increase capital from VND 1,200 billion to VND 2,400 billion…

The purpose of brokerage companies’ massive capital increase is mainly to lend margin ahead of the opportunity after the KRX system goes live.

In particular, in order to meet the solution, brokerage companies will provide payment support to foreign institutional investors (Non-Prefunding Solution – NPS), brokerage companies need to add capital sources.

In the CCP model or NPS service, the responsibility of paying for transactions for investors belongs to the brokerage company, so it is inevitable that brokerage companies must prepare large capital resources to limit payment risks. In Vietnam, the majority of brokerage companies have plans to increase capital in 2024 and 2025, in preparation for this major game.