Steady Revenue Growth, Top-tier Profitability

At the end of Q1/2024, VIB reported pre-tax profit of over VND 2,500 billion, with total operating income reaching VND 5,320 billion, an 8% increase year-on-year. Non-interest income accounted for nearly 25% of revenue, driven by strong contributions from credit cards, foreign exchange, and recovered debt.

The bank maintained an efficient net interest margin (NIM) of 4.5% amid significant reductions in both deposit and lending rates. Well-controlled operating expenses kept the cost-to-income ratio (CIR) around 30%, among the lowest in the retail banking sector. As a result, the bank’s profit before provision reached VND 3,440 billion, a 2% increase year-on-year.

In the context of the overall market conditions and seasonality in Q1, VIB’s non-performing loan (NPL) ratio temporarily rose from 2.2% to around 2.4%. However, the bank has proactively increased its risk provision buffer, with provisions for risk reaching nearly VND 950 billion in Q1, a 40% increase year-on-year. For the whole of Q1, VIB reported a pre-tax profit of over VND 2,500 billion, enabling the bank to maintain its ROE at 24%, continuing its position among the top performers in the industry.

Robust Balance Sheet, Lowest Credit Concentration Risk in the Industry

VIB’s total assets reached VND 414,000 billion by the end of March 2024, a 1% increase compared to the beginning of the year. In terms of credit growth, despite interest rates being at their lowest levels in years and a recovery in real estate, consumer spending, and investment, VIB’s credit grew by 1% year-on-year.

VIB remains one of the banks with the lowest credit concentration risk in the market, with retail loans accounting for 85% of its total loan portfolio. Of this, over 90% of loans are secured by assets, primarily residential properties and land with clear legal documentation and good liquidity.

VIB also has one of the lowest corporate bond investment balances in the industry, representing only 0.2% of its total credit balance. All bonds are from manufacturing, trade, and consumer sectors. For over 4 years, the bank has had zero lending to activities and sectors such as BOT, renewable energy, corporate bond underwriting, and real estate bond investment.

As of the end of March 2024, VIB’s mobilized capital exceeded VND 360,000 billion, including customer deposits, marketable securities, and funds raised from international institutions such as IFC and ADB. With the successful disbursement of a USD 100 million loan from IFC and the largest syndicated loan in the banking industry in 2023, amounting to USD 280 million from UOB and 12 leading financial institutions worldwide, VIB’s total international funding now stands at over USD 1.1 billion, with credit lines from these institutions totaling over USD 2.5 billion.

Through effective capital management and optimization, VIB reduced its funding costs by over 2% year-on-year, creating room for further lending rate reductions to support customers and stimulate credit demand.

Top-tier Rating from the State Bank of Vietnam

At the end of 2023, VIB received the highest industry rating from the State Bank of Vietnam due to its strong business performance and financial soundness. As a result, VIB is among the banks granted a credit growth limit of 16% for 2024, the highest in the industry.

Prudent Ratios at Optimal Levels, Including a Loan-to-Deposit Ratio (LDR) of 71.89% (Below the Regulatory Cap of 85%), a Short-term Capital Adequacy Ratio of 25.31% (Below 30%), a Capital Adequacy Ratio (CAR Basel II) of 11.8% (Above 8%), and a Net Stable Funding Ratio (NSFR) of Around 116% (Above the Basel III Minimum Requirement of 100%).

VIB’s brand reputation is also tied to its pioneering role in implementing international standards in Vietnam, such as Basel II, Basel II Enhanced, and Basel III. Additionally, VIB has completed and published its financial statements in accordance with International Financial Reporting Standards (IFRS) since 2019, six years ahead of the Ministry of Finance’s timeline.

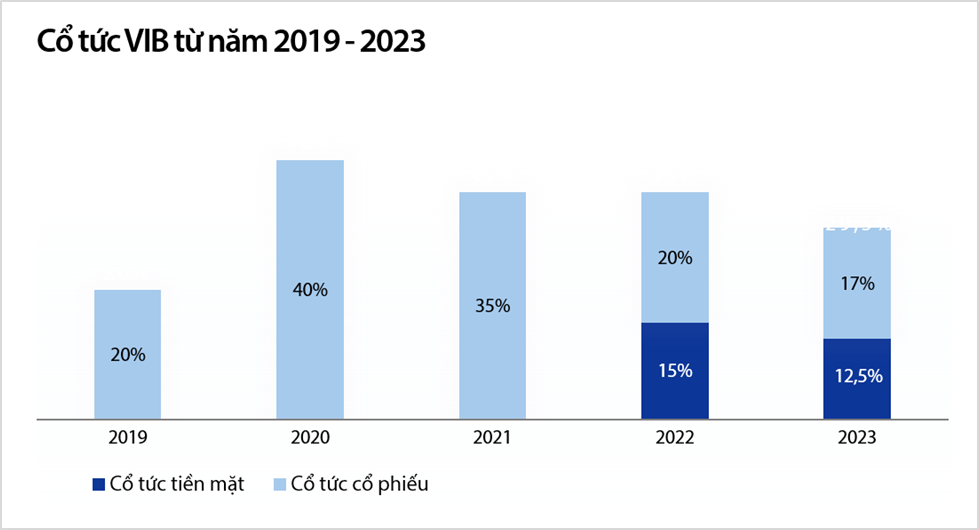

29.5% Dividend Distribution

In April 2024, VIB’s Annual General Meeting of Shareholders approved a dividend payment plan of 29.5%, consisting of 12.5% cash dividends and 17% in shares. In early January 2024, the bank completed the distribution of 6% cash dividends. VIB is currently in the process of distributing 6.5% cash dividends, 17% bonus shares to shareholders, and 11 million bonus shares to employees (ESOP).

Following the 6% cash dividend payment in January, the bank’s capital adequacy ratio (CAR Basel II) remained high at around 11.8% as of March 31, 2024. It is expected to be maintained between 11% and 12% throughout 2024, well above the State Bank of Vietnam’s minimum requirement of 8%.

In February 2024, VIB and its partner Temenos officially announced the implementation of VIB’s Core Banking Modernization Project on Amazon Web Services’ (AWS) cloud computing platform. This marks the first time in Vietnam that a bank has implemented Temenos Core Banking on a cloud computing platform.

Signing Ceremony Between Representatives of VIB, Temenos, and Partners for Core Banking Deployment on AWS

|

According to VIB’s management, amidst ongoing market volatility driven by macroeconomic and political factors globally, VIB continues to affirm its position as a leading retail bank in Vietnam in terms of both quality and scale and a preferred banking partner for corporates and financial institutions. The bank will continue to prioritize maintaining a prudent risk appetite and pioneering the adoption of international standards. Moreover, VIB is focused on building a modern, advanced, and highly secure digital banking platform to meet the evolving needs and provide the best possible experience for each customer.

![[Infographic] A Mid-Year Review: Banking Sector Performance in 2025](https://xe.today/wp-content/uploads/2025/09/info-ngan-hang-quy-2-218x150.jpg)