Hence, what is cashflow? All the funds that flow in and out of your account in a specific time frame – that’s your cashflow. Cashflow gives you an idea of your ability to meet your financial obligations, how much you can spend, and your capacity to save and accumulate wealth. Cashflow is a crucial component in assessing your financial health.

Understanding cashflow helps you manage it. When it’s managed effectively, you can allocate funds efficiently, invest, and get returns on your idle money. On the other hand, if you don’t know how to optimize your cashflow, you may miss out on potential earnings, spend more time achieving future financial goals, and even struggle to cover basic living expenses.

Time deposits: A stable and regular source of interest

Placing a time deposit is a common and safe way to increase your cashflow. This involves depositing your savings for a fixed amount of time and receiving interest at a fixed rate.

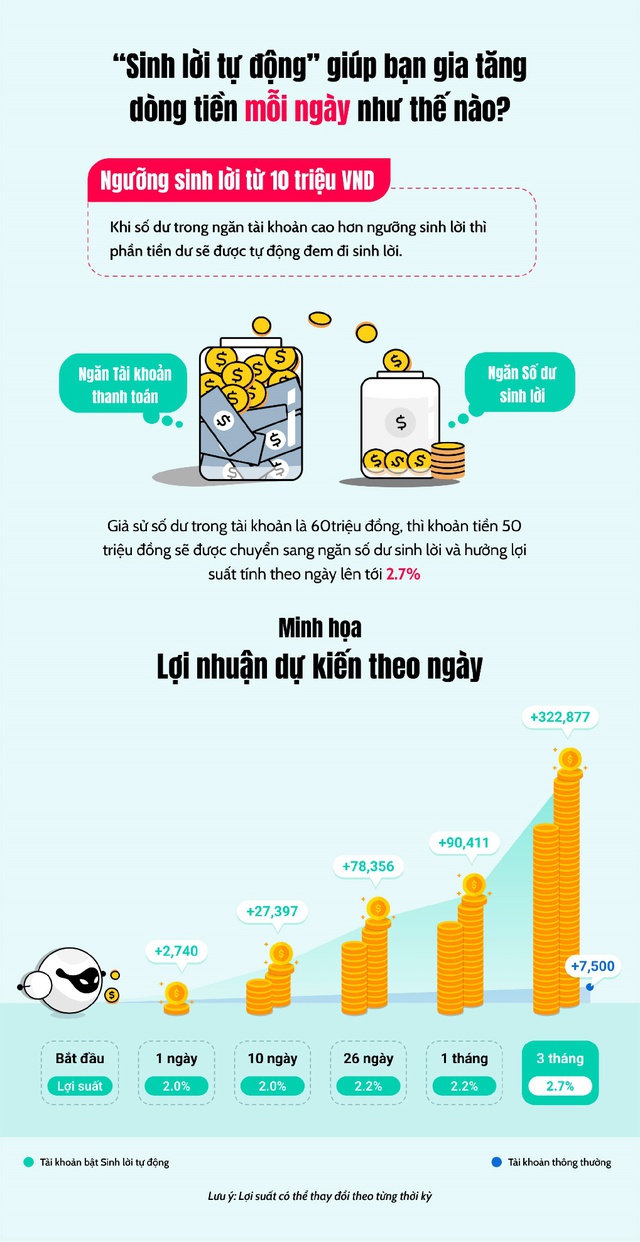

Many individual investors, shop owners and even family financial managers often need to maintain cashflows of several tens of millions or even hundreds of millions of VND, and often for durations of a few days to a month. In these situations, time deposits may be inconvenient as they don’t provide enough flexibility to access funds when needed. Techcombank’s “Auto Profit” feature is ideal for these cashflow needs.

For short-term cashflow needs, the “Auto Profit” feature on the Techcombank app is an excellent choice. It combines daily cashflow growth with the flexibility to withdraw the entire amount whenever necessary.

Explore the “Auto Profit” feature here.