Industrial Metals Rally on Supply Concerns

As of April 22, industrial metal prices have surged significantly, according to Trading Economics.

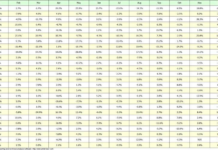

Copper

Up 1.12% to $4.5478 per pound

Highest level in two years

Aluminum

At $2,689 per ton

Up 0.75%

Highest in two years

Used in cans, aircraft, and buildings

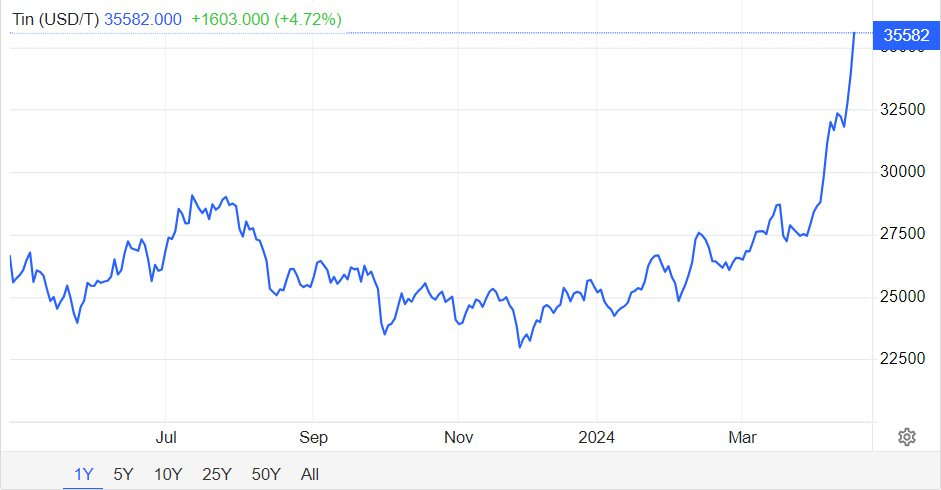

Tin

Spiked to $35,582 per ton

Up 4.72%

Highest since June 2022

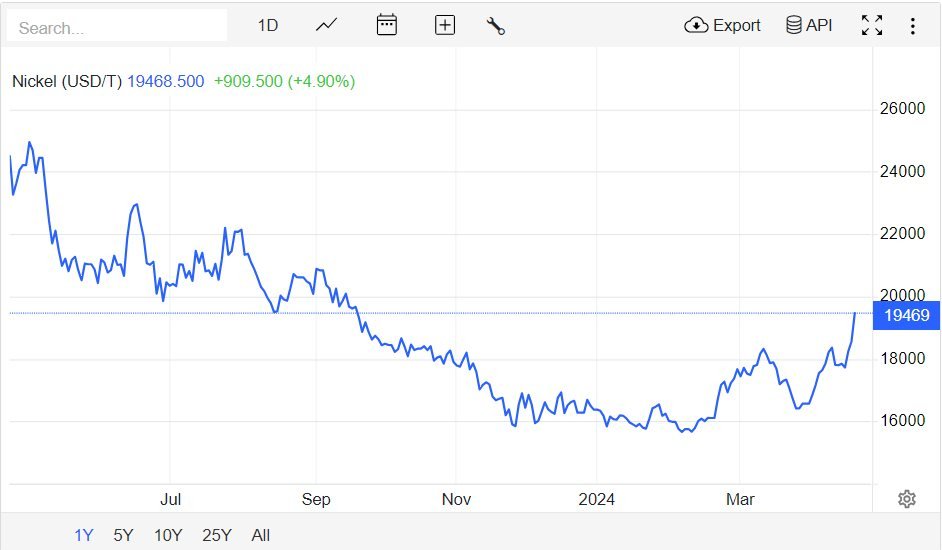

Nickel

Traded at $19,468.5 per ton

Up 4.9%

Highest since September 2023

Causes of the Surge

Market tightness concerns over US and UK bans on Russian metals

Escalating tensions in the Middle East

US and UK Bans

US Treasury Department banned imports of Russian copper, nickel, and aluminum

Bans restrict trading on London and Chicago exchanges

Prohibit direct purchases

Impact of the Bans

Make China the primary buyer of Russian metals

Enhance Shanghai’s role in pricing these materials

Other Factors Influencing Prices

Russia’s significant production of these metals

Increasing Russian metal库存

Indonesia considering export restrictions

China’s planned purchase of nickel pig iron

Market Outlook

Russian companies may shift production to avoid bans

Rusal, a major Russian aluminum producer, remains optimistic about sales

Goldmans Sachs predicts increased imports from China, India, and Turkey into Russia