Alteration of remaining VND 60 billion usage plan from private placement

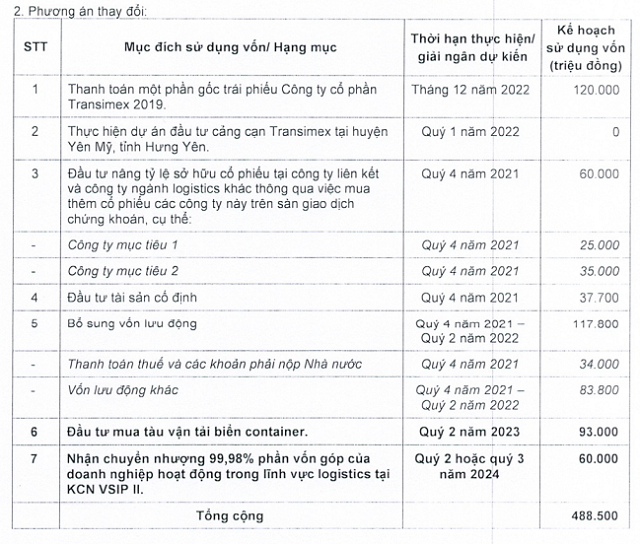

On 31 December 2021, TMS concluded the private placement of over 12.2 million shares, raising over VND 488.5 billion. According to the initial capital usage plan, TMS will divide the capital into 5 portions, including VND 153 billion for the Transimex dry port investment project in Hung Yen province; VND 120 billion to partially pay for the principal of the 2019 bond; VND 117.8 billion to supplement working capital; and VND 60 billion to increase ownership in an associate and another logistics company. The plan was expected to be fully disbursed after the end of 2022.

In April 2023, TMS announced a change in the purpose of using VND 153 billion to invest in purchasing container ships, with the disbursement expected to take place in the second quarter of 2023.

As of December 31 2023, TMS revealed that it had disbursed VND 428.5 billion out of the total VND 488.5 billion raised. The remaining VND 60 billion is yet to be implemented for the aforementioned container ships purchase plan due to the actual ship price being lower than expected.

On April 20 2024, TMS announced the second adjustment to the capital usage plan from the private placement, with the remaining VND 60 billion being used to acquire 99.98% of the capital contribution of a logistics enterprise in the VSIP 2 industrial zone, and the disbursement is expected in the second or third quarter of 2024.

Source: TMS

|

Halt in the plan to offer convertible bonds worth VND 200 billion to the public

In the same resolution, the Board of Directors of TMS added to the documents of the 2024 Annual General Meeting of Shareholders (AGM) the suspension of the plan to offer convertible bonds worth VND 200 billion. This plan had been approved at the 2023 AGM, but according to the TMS management board, the financial market conditions since the second half of 2023 have been unfavorable for the implementation, and TMS‘s capital needs have changed.

Numerous additions and alterations to the plan to offer convertible bonds worth VND 700 billion to the public

The Board of Directors of TMS also proposed to approve adjustments and replacements for several contents in the plan to offer convertible bonds worth a maximum of VND 700 billion to the public.

Accordingly, the total value of the bonds offered (at par value) has been reduced to a maximum of VND 400 billion to align with the capital usage plan in each offering tranche. Additionally, the exercise ratio has been revised to 42.33:1 from the initial 17.4:1 due to adjustments in the offered bond value and the number of outstanding shares.

TMS also added information about a conversion price not lower than the par value; the minimum successful offering ratio as per Decree 155; a compensation payment plan; and a principal payment plan in case bondholders are unable to exercise their conversion right due to the Company’s foreign ownership ratio limit as per the regulations.

TMS plans to offer the bonds after completing the share issuance to pay dividends, in 2024 or 2025, or at a later time determined by the Board of Directors and subject to approval from the State Securities Commission. The bonds will have an interest rate of 7%/year, with a term of 2 years from issuance, and the proceeds will be used to invest in various projects, acquire fixed assets, provide additional capital for financial activities, and repay outstanding debts and loans.

TMS intends to issue VND 700 billion convertible bonds, cancels dividend payment for 2021