According to the plan, the General Meeting will vote on many items including the business plan for 2024 and options for increasing the charter capital.

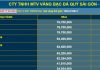

Specifically, based on the economic context with potential risks, MSB sets conservative targets with total assets reaching 280,000 billion VND, a 5% increase compared to 2023; capital raised in Market I and bonds raised to reach 178,900 billion VND, an increase of 27% compared to the previous year. Credit growth is expected to be 18%. Pre-tax profit is expected to increase by 17% compared to 2023, reaching 6,800 billion VND. Alongside the growth targets, MSB also closely follows controlling the non-performing loan ratio below 3% as prescribed.

In addition, to enhance competitiveness and charter capital position and ensure capital safety standards at a good level, MSB will submit to the General Meeting of Shareholders the plan to increase the charter capital to 26,000 billion VND by issuing a 30% stock dividend from the retained earnings.

According to information from the meeting documents announced by the Bank, the maximum number of additional shares issued will be 600 million. The specific implementation plan and schedule will seek shareholder approval for MSB to carry out, depending on market developments and MSB’s business situation. MSB representatives further shared: “In addition to increasing the risk buffer, the capital increase will also create more resources that will strongly promote the digitalization process as well as projects serving sustainable development strategies in the journey to green the bank”.

Regarding the direction for 2024, the bank focuses on capital management and diversification, especially low-cost capital sources through attracting non-term deposits and green financial sources from the international market.

Regarding CASA in particular, in the past 5 years, the ratio of CASA/total deposits has always been a highlight of MSB in the market as it has always been among the top 5 banks with the best CASA ratio, despite fluctuating interest rates over a long period of time. To achieve this result, the bank relies on three main factors.

First is the “convenient” product and service “tailored” to real customer needs and segmented, aimed at providing comprehensive service and resolving the shortcomings in daily financial transactions of individuals and businesses. Second, MSB offers added value when customers use a product, providing attractive incentive packages, increasing profitability on customers’ own cash flow, and expanding access to pre-approved credit limits. Third, the bank enhances customer experience through digital platform, bringing faster and more convenient access to products and services. Notably, in 2023, MSB’s corporate clients can register for online loans with a limit of up to 15 billion and fast approval within 03 working days. The customer satisfaction score with this product is over 80/100 points.

Regarding sustainable development (ESG), MSB aims to pioneer the development of diverse products and customer portfolios, green finance projects, and sustainable finance for both asset and liability components, in accordance with international best practices, principles, and conventions. The Bank is in the process of researching and developing a sustainable loan framework to provide green, social, and sustainable linked loan products for domestic corporate clients, focusing on financing for renewable energy, agriculture, businesses with export products, and low-carbon manufacturing and consumption industries. This is a crucial foundation for MSB to attract green finance from the international market.

In addition, the bank is also diversifying revenue sources, continuing to increase fee income through cross-selling solutions and leveraging the ecosystem of financial partners, while optimizing the leading position of MSB in foreign exchange business activities.

The plans and orientations approved by MSB’s General Meeting of Shareholders are expected to create a foundation for MSB to continue striving for sustainable growth, towards the goal of becoming a customer-centric bank with high profitability in Vietnam.