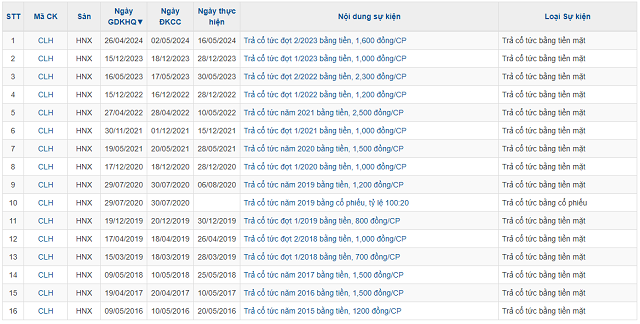

Cement La Hiên to Distribute Cash Dividend of 16%

La Hiên Cement Joint Stock Company (CLH) has announced a cash dividend payment of 16%, equivalent to VND 1,600 per share. With 12 million shares outstanding, the company is expected to disburse over VND 19 billion for this dividend distribution. The ex-dividend date is set for April 26, 2024.

Earlier in late 2023, CLH had distributed an interim cash dividend of 10% for 2023. This brings the total dividend payout ratio for the year to 26%, with an estimated disbursement of over VND 31 billion.

CLH has consistently paid dividends in cash and bonus shares at high rates since its listing on the Hanoi Stock Exchange (HNX) in 2016, ranging from 12% to 40%.

Historical Dividend Payments of CLH since 2016

|

Historical Dividend Payments of CLH since 2016

Source: VietstockFinance

|

At CLH’s 2024 Annual General Meeting of Shareholders, a dividend rate of 15% for the year 2024 was approved. The company also adopted a business plan targeting revenue and other income of nearly VND 681 billion, a 2% increase year-over-year. However, pre-tax profit is projected to decrease by 34% to VND 40 billion. The company aims to produce 650,000 tons of cement and 20,000 tons of commercial clinker.

Regarding the projected decline in profit, Mr. Tran Quang Khai, Member of the Board of Directors and General Director of the company, cited limited waste rock sources from Khanh Hoa Coal Company since late 2023, leading to increased coal consumption per ton of product. Additionally, the government’s hike in electricity prices by approximately 7.5% in 2023 has resulted in higher production costs and reduced profitability.

CLH anticipates a fiercely competitive cement market in 2024, with unstable export markets and fluctuating demand due to oversupply. The company acknowledges the significant challenges and difficulties it faces.

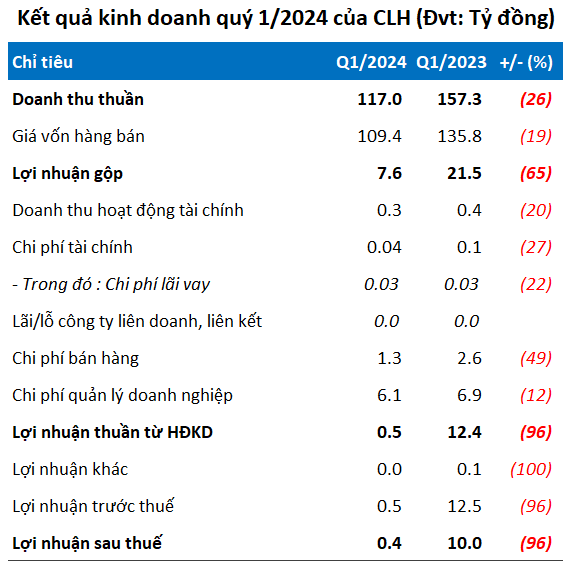

Profit Plummets by 96% in Q1

La Hiên Cement recently released its financial results for the first quarter of 2024, reporting a 26% decrease in net revenue to VND 117 billion compared to the same period last year. Notably, net profit plunged by 96%, dropping to approximately VND 400 million.

The company attributed the decline in profit to the market downturn, sluggish real estate conditions, and reduced demand for cement, particularly during the Tet holiday. Additionally, average product selling prices were lower than in the previous year.

Furthermore, CLH temporarily suspended production to conduct equipment maintenance and repairs, which impacted the company’s operational efficiency during the quarter.

Source: VietstockFinance

|

As of the end of March, CLH’s total assets stood at nearly VND 267 billion, a 12% decrease from the beginning of the year. Short-term assets accounted for the majority of its capital, totaling around VND 163 billion or 61% of total assets. Cash and cash equivalents amounted to VND 64 billion, while inventory reached VND 40 billion, representing decreases of 35% and 10%, respectively.

On the other side of the balance sheet, CLH’s liabilities totaled approximately VND 70 billion, a 35% reduction since the beginning of the year. Notably, the company’s long-term financial debt has been reduced to VND 2.5 billion.