Recently, real estate investment corporation No Va (Novaland, stock code: NVL) has just announced documents for an additional annual general meeting of shareholders in 2024. Accordingly, this business enterprise plans to offer 1.1 billion shares to existing shareholders in the form of rights to buy. The actual rights ratio is 10:6 (shareholders owning 10 shares have the right to buy 6 new shares).

The selling price will be VND 10,000/share, equal to 67.5% compared to the market price of NVL shares. Notably, since the beginning of April, the stock price has decreased by nearly 20%. After the issuance, Novaland’s charter capital is expected to increase by VND 19,501 billion to over VND 31,200 billion. The expected implementation period is from the second quarter of 2024 to the fourth quarter of 2024.

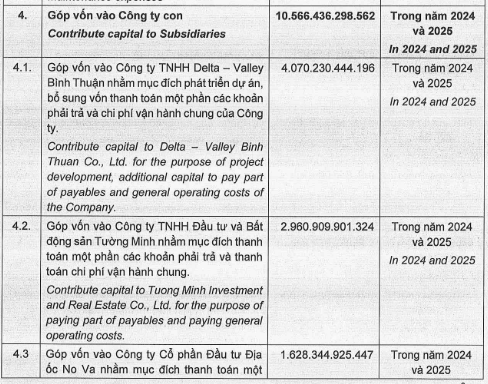

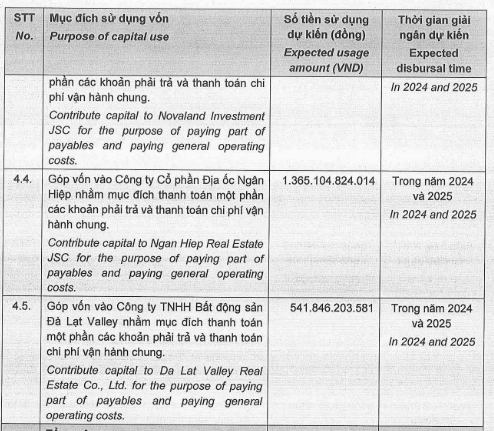

With the expected proceeds from the deal of VND 11,700 billion, Novaland plans to use VND 10,566 billion to contribute capital to subsidiaries. In addition, the company will also use more than VND 855 billion to pay off debts, VND 140.3 billion to pay salaries and VND 138.8 billion to operate the company.

At the upcoming general meeting of shareholders, Novaland plans to submit to shareholders a plan to issue additional shares under the employee stock option plan (ESOP) for 2024. The subjects of the issuance will be members of the Board of Directors as well as key officers. The quantity will not exceed 1.5% of the number of shares in circulation at the time of issuance. The price shall not be less than VND 10,000/share.

Currently, the related group of shareholders as well as the family of Mr. Bui Thanh Nhon – Chairman of the company’s Board of Directors hold the leadership positions of Novaland. Therefore, this will also be an option for this group of shareholders to increase the amount of NVL shares they hold, as this group now only holds less than 40% of the company.

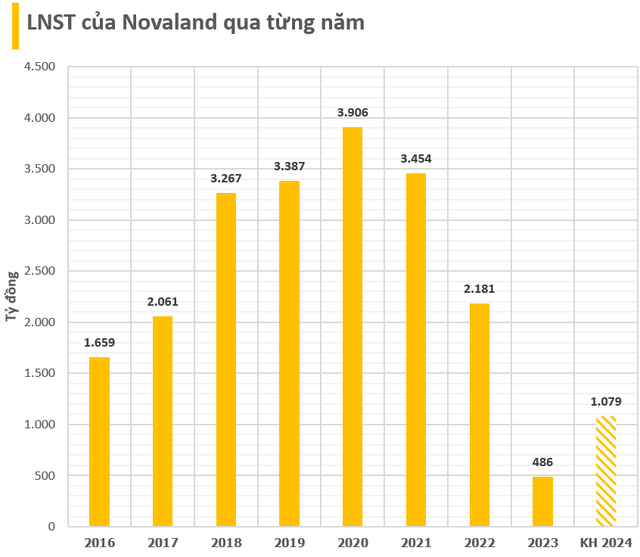

Novaland also aims to bring in VND 32,587 billion (approximately USD 1.3 billion) in revenue next year; VND 1,079 billion in profit after tax, up 585% and 122% respectively compared to the same period last year. The company also has no plans to pay dividends in 2024.

In the coming year of 2023, the company will continue to invest and handover key projects such as The Grand Manhattan in District 1, Aqua City in Dong Nai, Nova World Phan Thiet, NovaWorld Ho Tram in Vung Tau…

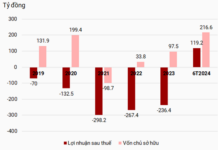

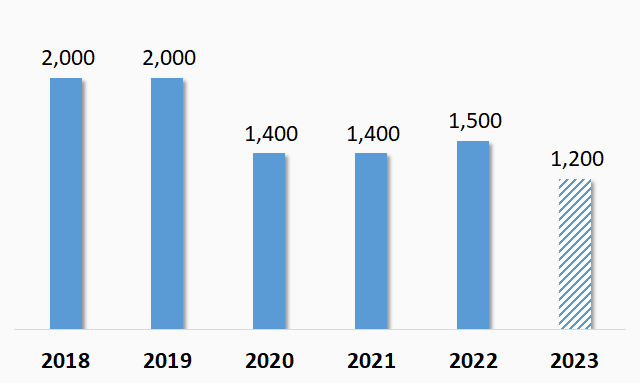

In the consolidated financial statements audited in 2023, Novaland’s net profit was VND 485.9 billion, a decrease of VND 198.9 billion compared to the self-prepared report. According to PwC (the audit unit of Novaland’s financial statements), the difference in profit mainly arose from the provision for inventory price reduction at the associated company. Novaland’s management said that this move was made “with a prudent view” and the provision will be reversed when the project continues to be implemented.