Yesterday’s positive trend could not be sustained, and the VN-Index gained only a few minutes at the beginning of the session before quickly plummeting. The strong selling force caused the index to lose nearly 20 points at one point before narrowing the decline towards the end of the session. The VN-Index closed the session on 23/4 with a decrease of 12.82 points (1.08%) to 1,177 points. Liquidity matching orders on HOSE remained sluggish, reaching only approximately VND 15,600 billion.

Foreign block trading was negative as they net sold VND 283 billion throughout the market.

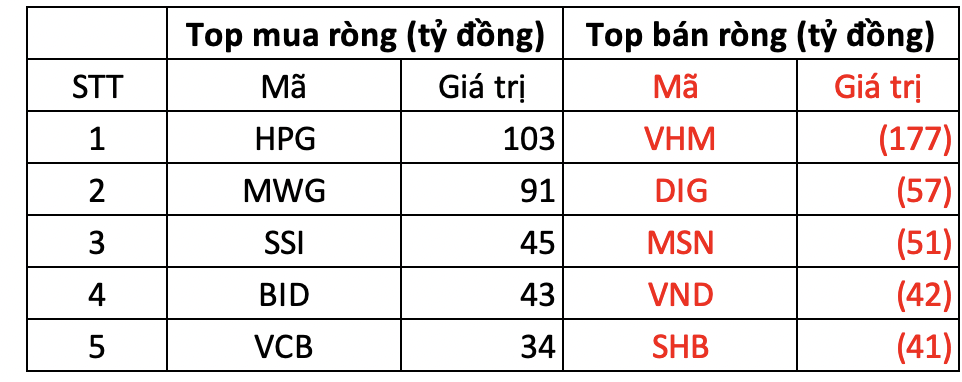

On HOSE, foreign investors were net sellers with a value of approximately VND 292 billion.

On the buy side, HPG and MWG stocks were the most strongly net bought by foreign investors, with values of VND 103 billion and VND 91 billion, respectively. SSI and BID were the next two stocks net bought at VND 45 billion and VND 43 billion, respectively, on HOSE.

In contrast, VHM was under strong selling pressure from foreign investors with a value of VND 177 billion, followed by DIG, MSN, which were also sold VND 57 billion and VND 51 billion, respectively.

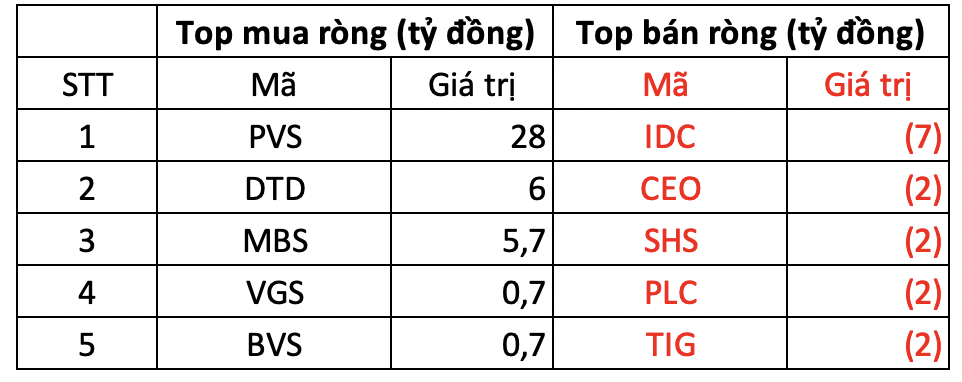

On HNX, foreign investors net bought VND 22 billion

On the buy side, PVS was the most strongly net bought with a value of VND 28 billion. DTD followed in the strong net buying list on HNX with VND 6 billion. In addition, foreign investors also spent several billion VND to net buy MBS, VGS, and BVS.

On the other hand, IDC was the code that suffered net selling pressure from foreign investors with a value of nearly VND 7 billion; CEO was sold about VND 2 billion.

On UPCOM, foreign investors were net sellers with VND 13 billion

On the buy side, LTG was bought by foreign investors for nearly VND 3 billion. BSR and AAS were also net bought, each with a few billion VND.

In the opposite direction, VEA was net sold by foreign investors by about VND 17 billion today; they also net sold at NTC, ACV,…