Oil Prices Rise

Oil prices increased by more than $1 per barrel as the U.S. dollar index declined to a more than one-week low, and investors shifted focus from Middle East tensions to the global economic outlook.

Brent crude futures closed up $1.42, or 1.6%, to $88.42 a barrel, and West Texas Intermediate (WTI) crude futures rose $1.46, or 1.8%, ending at $83.36 a barrel.

The U.S. dollar weakened after data from S&P Global showed that U.S. business activity in April 2024 fell to a four-month low, dragged down by weak demand. A weaker greenback typically boosts demand for oil, which is priced in dollars, from investors holding other currencies.

Additionally, oil prices were supported by data from the eurozone, which showed that business activity in April 2024 grew at its fastest pace in almost a year.

U.S. Natural Gas Prices Fall

U.S. natural gas prices declined, pressured by forecasts for mild weather, which reduces demand for heating.

Natural gas futures for May 2024 delivery on the New York Mercantile Exchange fell 2.1 cents, or 1.2%, to $1.81 per million British Thermal Units (mmBtu).

Gold’s Ascent Stalls

Gold prices steadied after hitting a more than two-week low, as concerns over the escalating tensions in the Middle East eased, with investors awaiting key economic data to gauge the path of U.S. interest rate hikes.

Spot gold at LBMA was little changed at $2,325.8 per ounce, after touching its weakest level since April 5, 2024. Bullion has risen nearly $400 per ounce since the end of March 2024, reaching a record high of $2,431.29 on April 12, 2024. June 2024 gold futures on the New York Mercantile Exchange fell 0.2% to $2,342.1 per ounce.

Copper Retreats from Two-Year Highs, Tin Plunges

Copper prices dipped, pulling back from two-year highs on profit-taking after the metal rallied.

Three-month copper on the London Metal Exchange (LME) fell 2% to $9,627 a tonne. However, copper has still gained 9% so far this month.

Tin on the LME plunged 8.9% to $31,400 per tonne, its biggest one-day drop since June 2022. Tin had hit a 22-month high in the previous session on April 22, 2024.

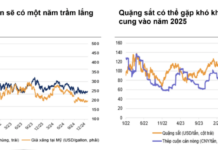

Iron Ore Touches One-Week Low, Steel Declines

Iron ore prices on China’s Dalian Commodity Exchange fell for a second session to a near one-week low, as signs of a slowdown in the steel market weighed on demand in top consumer China.

Dalian iron ore futures for September 2024 delivery declined 1.91% to 849 yuan ($117.17) a tonne, their lowest since April 17, 2024.

Meanwhile, Singapore iron ore futures due in May 2024 fell 2.88% to $112.85 per tonne, also the lowest since April 17, 2024.

Steel consumption in the world’s second-largest economy has slowed at the start of April 2024, after major southern Chinese regions were hit by earlier-than-expected rainfall.

On the Shanghai Futures Exchange, rebar futures fell 0.84%, hot-rolled coil and wire rod dipped 0.68%, and stainless steel lost 2.28%.

Japanese Rubber Prices Slide

Japanese rubber prices fell after two consecutive days of gains, as a price war in automobiles and excess auto parts supply pressured the market.

Tokyo Commodity Exchange (TOCOM) futures for September 2024 delivery closed down 5.6 yen, or 1.77%, at 311.4 yen ($2.01) per kilogram.

Shanghai rubber futures for September 2024 delivery fell 275 yuan to 14,280 yuan ($1,970.85) per tonne.

Singapore futures for May 2024 delivery edged down 0.06% to 160.6 US cents per kg.

Coffee Prices Drop

London robusta coffee futures for July 2024 delivery declined 0.4% to $4,117 per tonne.

Analysts said that Brazil’s 2024 robusta coffee crop is coming in smaller than initially expected.

Meanwhile, ICE arabica coffee futures for July 2024 delivery fell 5.8 cents, or 2.5%, to $2,2185 per pound.

Sugar Prices Continue to Rise

Raw sugar futures for May 2024 delivery on ICE rose 0.11 cents, or 0.6%, to 19.91 cents per lb.

London white sugar futures for August 2024 delivery climbed 0.5% to $573.2 per tonne.

Wheat, Corn, and Soybeans Gain

U.S. wheat prices rose to a two-month high as adverse weather threatened to curb yields of the U.S. winter wheat crop. Corn and soybean prices also advanced.

Chicago Board of Trade wheat futures for July 2024 delivery climbed 15-1/4 cents to $6.02-3/4 per bushel, the highest since Feb. 12, 2024. Corn futures for July 2024 gained 2-3/4 cents to $4.52-1/2 per bushel, and soybeans for the same delivery month rose 5-1/2 cents to $11.82 per bushel.

Palm Oil Prices Edge Up

Malaysian palm oil futures extended gains as the impact of hot weather on production in top grower Malaysia, coupled with higher export data and firmness in other vegetable oil prices, provided support.

The benchmark palm oil contract for July 2024 delivery on the Bursa Malaysia Derivatives Exchange rose 25 ringgit, or 0.63%, to 3,960 ringgit ($830.68) per tonne.

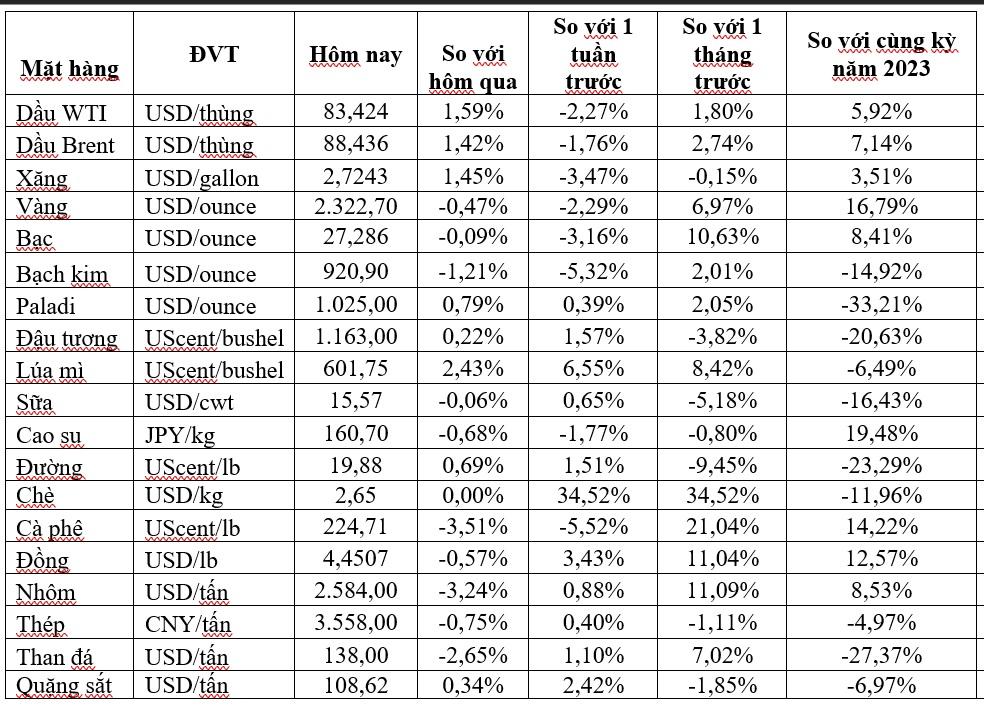

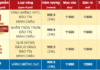

Key Commodities Prices on April 24 Morning