Online

Vietbank’s 2024 Annual General Meeting of Shareholders was held online on the morning of April 26, 2024.

|

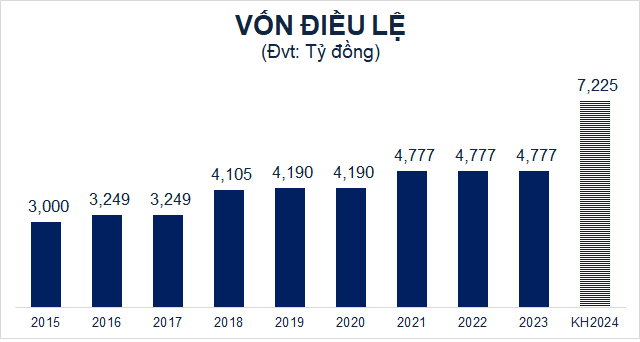

Declare a 25% stock dividend to increase capital

In 2023, Vietbank had nearly 647 billion dong in consolidated profit after tax. After setting aside funds and accumulating undistributed profits from previous years, the bank has over 1,593 billion dong in undistributed profits. The bank plans to use nearly 1,445 billion dong to pay dividends in stock, with the remaining 148 billion dong in retained earnings.

Specifically, Vietbank plans to continue implementing its capital increase plan by offering shares to existing shareholders (which has been approved by the SBV) with a total additional amount of 1,003 billion dong. To date, the bank has completed the offering of more than 100.3 million shares and is carrying out the procedures to request the SBV’s approval to amend the license. The estimated completion time is in the second and third quarters of 2024.

In 2024, Vietbank plans to issue nearly 144.5 million shares to pay dividends to existing shareholders, corresponding to a ratio of 25%. The total nominal value of the issue corresponds to nearly 1,445 billion dong. The source of funds for the implementation is from the accumulated after-tax profit up to December 31, 2023. The expected implementation time is in the third and fourth quarters of 2024.

The additional capital from the issuance of shares to pay dividends in 2024 is planned to be used for asset investment, to supplement the source of capital for development, to expand the operating network, and to ensure compliance with safety ratios in operation.

Vietbank’s current charter capital is 4,777 billion dong. If the procedures for amending the license and the successful issuance of shares to pay dividends are completed, the Bank’s charter capital will increase to nearly 7,225 billion dong.

Source: VietstockFinance

|

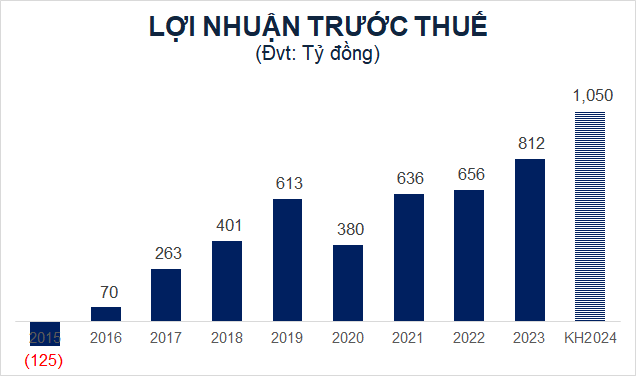

Target of “striving” to achieve 1,050 billion dong in pre-tax profit

Based on the additional capital, Vietbank has set out two business plans for 2024: the basic target and the target to strive for.

With the basic plan, the bank sets a target of pre-tax profit of 950 billion dong, an increase of 17% compared to the 2023 result. The bank sets a target that by the end of 2024, total assets will increase by 5% compared to the beginning of the year to 145,000 billion dong. Mobilization from customers (including marketable securities) will increase by 8% to 110,000 billion dong. Total outstanding loans will increase by 11% to 90,000 billion dong. The bad debt ratio is controlled below 2.5%.

In the striving plan, Vietbank sets a target of pre-tax profit to increase by 29% to 1,050 billion dong. Mobilization from customers and credit balance will increase by 14% and 18%, respectively, to 118,000 billion dong and 95,000 billion dong.

Source: VietstockFinance

|

Continuing to aim for listing on the HOSE exchange

Previously, Vietbank’s 2023 Annual General Meeting of Shareholders approved the listing of VBB shares on the Ho Chi Minh City Stock Exchange (HOSE) when market conditions and timing are favorable.

Based on the business activities in 2021, 2022, and the plan to restructure activities related to bad debt treatment in the period 2021-2025, Vietbank has met the conditions for business results, financial indicators, and corporate governance. However, in 2023, the domestic market environment has been volatile and events such as FLC, SCB, Van Thinh Phat, etc., have created challenges. In such a context, if shares were listed, it would not reflect the true value and ensure the interests of shareholders. Therefore, Vietbank has not yet listed in 2023.

Therefore, the bank continues to submit to the 2024 Annual General Meeting of Shareholders a plan to list on the HOSE exchange when market conditions are favorable.

Heading towards a pre-tax profit of 1,600 billion dong in 2025

Vietbank said it would switch its model from being dependent on credit to providing diversified services.

The bank will accelerate the treatment of bad debts, improve credit quality, and minimize the emergence of new bad debts in order to control the ratio of on-balance sheet bad debts, bad debts sold to VAMC, and bad debts at less than 3% by 2025.

At the same time, the bank also aims to increase the proportion of income from non-credit services in Vietbank’s total income to 12-16% by the end of 2025; and to increase the proportion of bank credit capital to low-carbon manufacturing and consumption industries.

The bank sets a target of achieving 1,600 billion dong in pre-tax profit by 2025. Total assets will increase to 170,000 billion dong. Market 1 capital mobilization will be 135,000 billion dong and credit balance will be 110,000 billion dong. The target is to increase charter capital to 10,000 billion dong. The ROE ratio will be increased to over 11%.

Discussion:

When will the new shares be listed on the HOSE exchange?

Mr. Nguyen Huu Trung – Vice Chairman of the Board of Directors: Due to the negative signs in the financial market in 2023, to ensure the interests of shareholders and optimize the value of the bank, VBB has reviewed and postponed the listing of shares on HOSE.

However, the Board of Directors continues to closely monitor the financial market in order to list VBB shares on HOSE with the goal of optimizing shareholder interests and the value of VBB shares. The Board of Directors will wait for the right time to list on HOSE.

What is the current liquidity of VBB and what are the solutions to ensure liquidity in the context of market volatility?

CEO Tran Tuan Anh: All indicators currently comply with SBV regulations, with a liquidity reserve ratio of 18.83% in 2023. The short-term capital ratio for medium- and long-term lending is 13.37%. In addition, the LDR ratio is 64-65%.

The solution to ensure liquidity is that VBB operates in accordance with regulations, ensures safety ratios, and develops a restructuring plan linked to bad debt treatment.

Currently, mobilization is still growing positively compared to the industry as a whole (negative 0.76%). The Management Board considers all indicators, reviews the KHCN (income) and KHDN (revenue) segments. On that basis, it develops products that are suitable for each customer segment. It promotes sales to all employees. It expands cooperation with other funds and banks to mobilize market 2 capital, ensuring greater efficiency for market 1.

The safety ratios are ensured; the SBV checks very closely. VBB