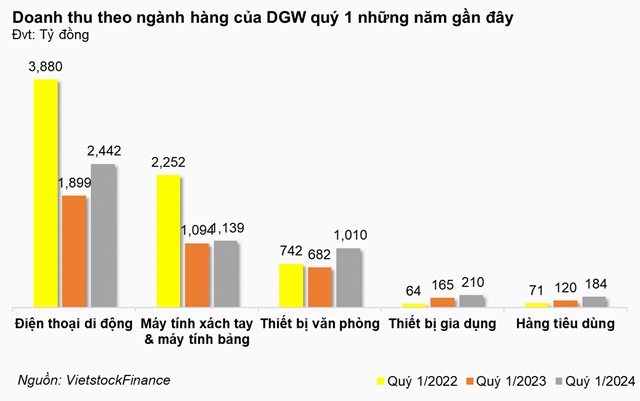

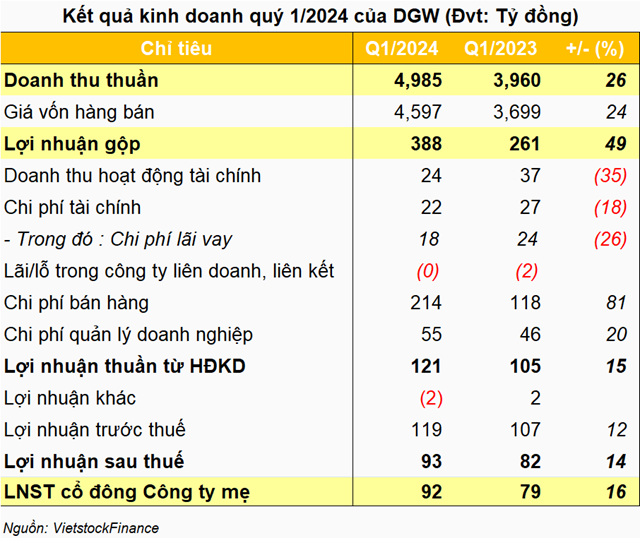

In Q1/2024, DGW reported net revenue of VND 4,985 billion, representing a 26% growth year-over-year and accomplishing 22% of the annual plan. Remarkably, all business lines experienced substantial growth, including a 53% rise in consumer goods, 48% in office equipment, 29% in mobile phones, 27% in home appliances, and a 4% increase in laptops and tablets.

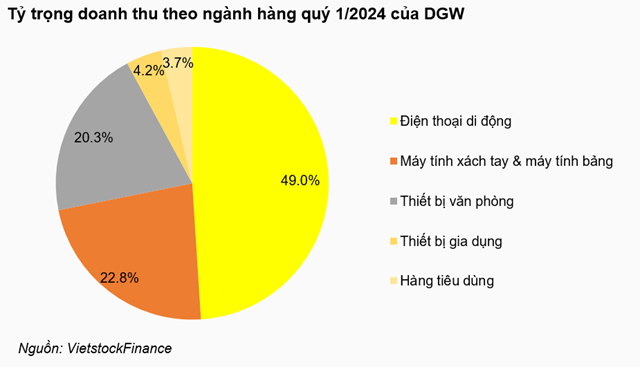

In terms of proportion, mobile phones and laptops & tablets continued to dominate, contributing 49% and 23%, respectively, accounting for 72% of total revenue. However, management of DGW predicts that this ratio may decline in the future.

Specifically, in a recent statement at the annual general meeting of shareholders in 2024, Mr. Đoàn Hồng Việt – Chairman of DGW‘s Board of Directors stated, “By 2025, the contribution ratio of the mobile phone, laptop, and tablet sector may decrease to around 65%, although it is still experiencing growth.”

Gross profit margin improved by 1.2 percentage points to 7.8%, resulting in a gross profit of over VND 388 billion for DGW, marking a 49% increase.

The company faced significant pressure from an 81% increase in selling expenses to VND 214 billion, while administrative expenses also rose by 20% to VND 55 billion, leading to a 1.3 percentage point increase in SG&A expenses to revenue ratio, reaching 5.4%.

Ultimately, DGW reported a net income of over VND 92 billion, a 16% growth, and fulfilled 19% of the annual plan.

At the end of Q1/2024, DGW‘s total assets were recorded at over VND 6,902 billion, reflecting an 8% decrease from the beginning of the year, primarily due to a nearly 60% reduction in cash and cash equivalents to approximately VND 518 billion.

On the liabilities side, the amount owed to short-term creditors decreased significantly by 28% to just over VND 1,117 billion. According to DGW‘s explanatory notes, there were declines in accounts payable to suppliers such as Asus Global Pte Ltd and Xiaomi H.K Limited.

Source: DGW‘s Q1/2024 financial statements

|

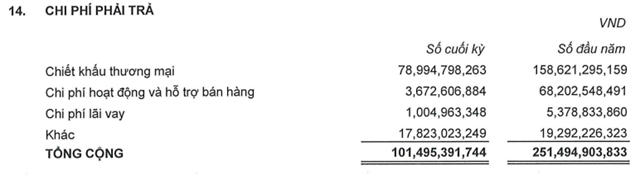

Another item that witnessed a substantial reduction was short-term payables, which dropped by 60% to approximately VND 102 billion, mainly due to a decline in trade discounts, operating expenses, and sales support.

Source: DGW‘s Q1/2024 financial statements

|