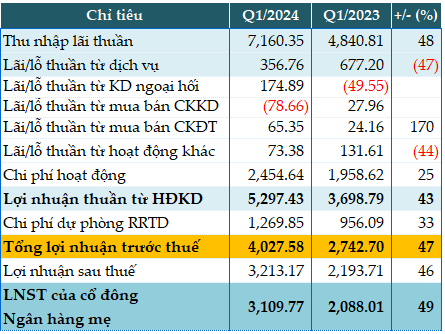

In the first quarter, credit revenue remained the major contributor to HDBank’s income, surging 48% year-on-year to VND7,610 billion (US$328.7 million) in net interest income.

However, non-interest revenue did not witness uniform growth. Service fee revenue declined by 47% year-on-year to merely VND357 billion ($15.5 million), while trading securities business recorded a loss of nearly VND79 billion ($3.4 million), compared to a gain of nearly VND28 billion ($1.2 million) in the same period last year.

On the flip side, foreign exchange trading activities reaped a profit of nearly VND175 billion ($7.6 million), while the same period last year incurred a loss. Profit from investment securities trading also grew 2.7 times to VND65 billion ($2.8 million).

During the quarter, HDBank increased its operating expenses by 25% to VND2,455 billion ($106.3 million) due to higher personnel and administrative expenses.

Provisions for credit risk also increased by 33% as HDBank set aside VND1,270 billion ($55 million). Nevertheless, the bank still reported pre-tax profit of nearly VND4,028 billion ($174.6 million), up 47% year-on-year.

As such, HDBank has fulfilled 25% of its pre-tax profit target of VND15,852 billion ($688.4 million) for the whole of 2024 after the first quarter.

|

HDB’s Q1/2024 Business Results. Unit: VND billion

Source: VietstockFinance

|

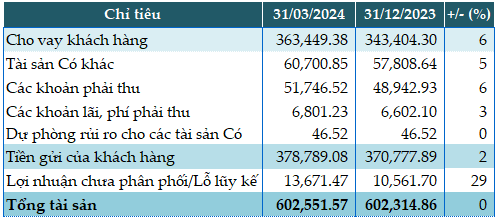

As of the end of the first quarter, HDBank’s total assets remained flat compared to the beginning of the year at VND602,552 billion ($26,143.4 million). Of which, deposits at the State Bank of Vietnam saw a sharp 46% decrease (to VND22,525 billion, or $975.5 million), while deposits at other commercial banks also fell by 10% (to VND79,329 billion, or $3,435.8 million). Loans to customers increased by 6% to VND363,449 billion ($15,763.4 million), mainly to individual customers and household businesses.

On the liabilities side, deposits from other commercial banks decreased by 11% (to VND55,849 billion, or $2,419.3 million), while borrowings from other commercial banks increased by 3% (to VND51,159 billion, or $2,221.8 million). Customer deposits grew by only 2% to VND378,789 billion ($16,418.4 million). Issuance of valuable papers declined by 10% to VND46,301 billion ($2,004.2 million).

|

Some of HDB’s Financial Indicators as of March 31, 2024. Unit: VND billion

Source: VietstockFinance

|

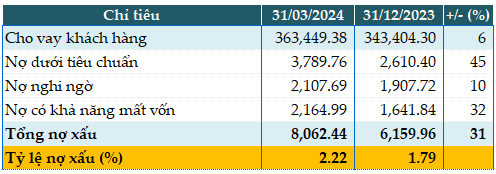

HDBank’s total bad debt as of March 31, 2024, was recorded at VND8,062 billion ($350.6 million), up 31% compared to the beginning of the year. The bad debt ratio to outstanding loans increased from 1.79% at the beginning of the year to 2.22%.

|

HDB’s Loan Quality as of March 31, 2024. Unit: VND billion

Source: VietstockFinance

|