Latest FiinTrade update reveals that as of April 28, 2024, 787/1641 listed companies representing 83.8% of the capitalization on the three exchanges have announced their financial reports for the first quarter of 2024, including many leading companies in the industry.

Accordingly, the profit picture for the first quarter of 2024 has become clearer, specifically:

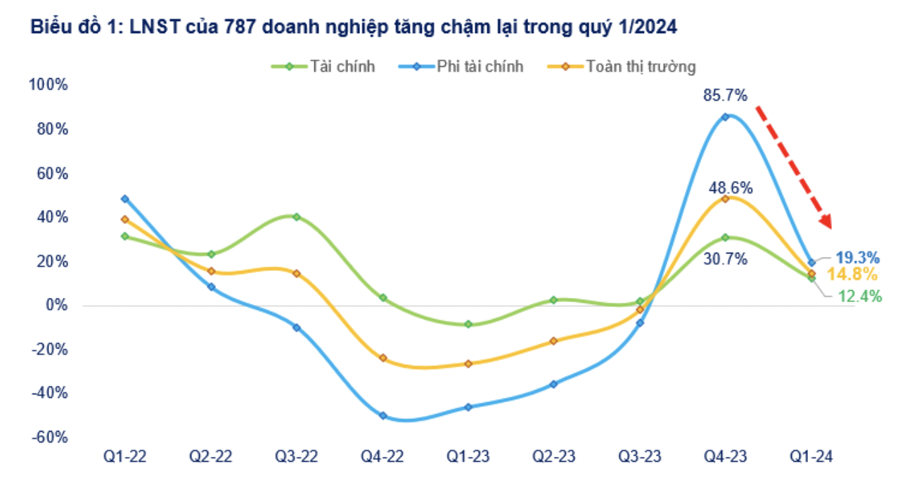

After-tax profit growth slowed down in Q1/2024: The total after-tax profit of the 787 listed companies increased by 14.8% year-on-year, mainly contributed by the non-financial group which increased by 19.3% while the financial group achieved a lower growth rate of 12.4%. The overall profit growth has slowed down considerably compared to the growth rate of Q4/2023 (+48.6%).

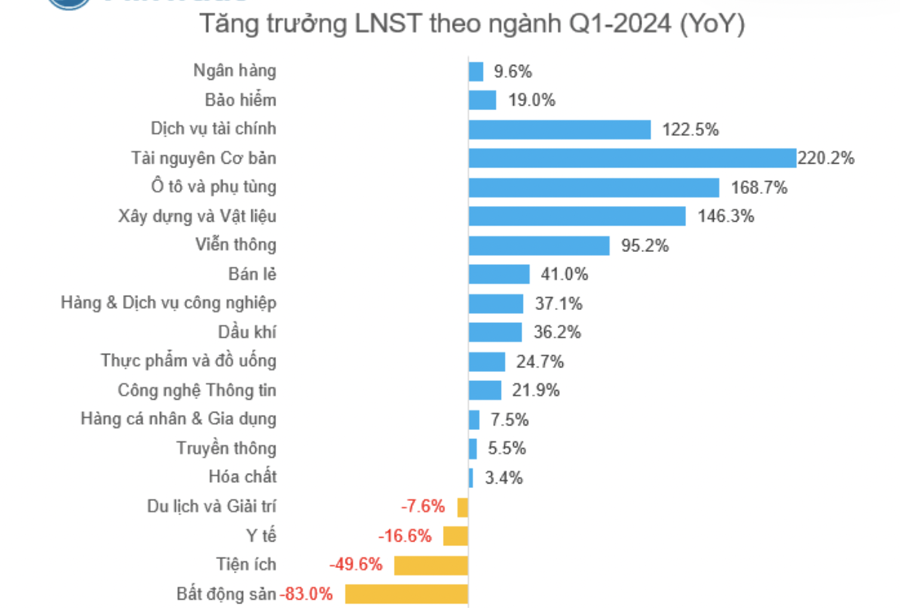

Growth was led by financial services (securities), basic resources (steel), construction, industrial goods and services (airports, seaports), telecommunications, and information technology. However, Securities and Steel have an unfavorable outlook for the second quarter.

For Securities, the advantage of a low comparison base will no longer exist as this is one of the industries with the strongest growth in Q2/2023. For Steel, there is a risk of narrowing profit margins as companies are facing competition from Chinese imports while domestic construction activities have not yet fully recovered.

The two “pillar” industries of the Banking and Real Estate markets both had poor business results: For Banking, the after-tax profit of 27/27 banks increased by 9.6%, far below the projected growth rate for the whole of 2024 (+19%) and the expectations of analysts for Q1 of 12-15%.

For Real Estate, after-tax profit of 60/130 enterprises representing 74.4% of the industry’s total capitalization) decreased sharply by 82% as Vinhomes (VHM) no longer recorded revenue from project wholesales as in the same period last year. Excluding VHM, the profit of the remaining 59 real estate companies decreased by 15.1% due to the impact of the residential real estate group (NVL, KDH, DIG, NLG). Meanwhile, industrial real estate maintained a growth of 26.5% year-on-year thanks to BCM, SZC, and SZB.

The export group is highly differentiated: Profits of the Rubber, Plastics, and Fertilizer groups increased sharply; Aquaculture and Textile recovered slowly; and Chemicals continued to hit bottom.