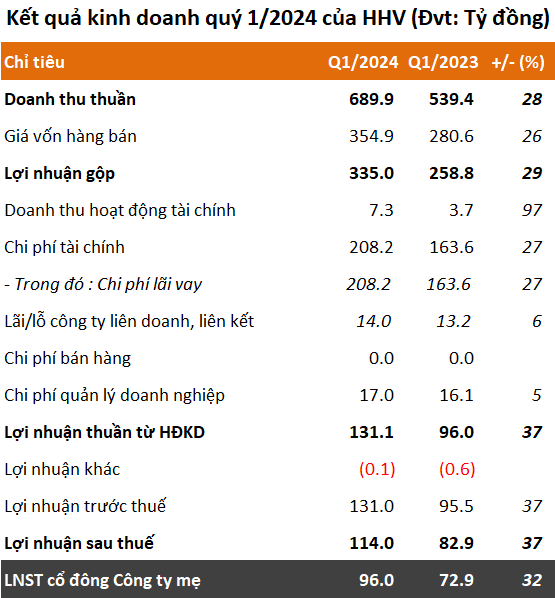

In Q1/2024, HHV recorded a net revenue of nearly VND 690 billion, an increase of 28% compared to the same period last year. Most of the revenue came from BOT toll stations at nearly VND 477 billion and construction and installation revenue of over VND 196 billion, respectively increasing by 23% and 43%.

The company said that the construction and installation revenue in the first quarter mainly came from the Cam Lam – Vinh Hao highway packages and the Quang Ngai – Hoai Nhon highway project.

Total expenses in the period were over VND 225 billion, an increase of 25%; most of which were interest expenses of over VND 208 billion, an increase of 27%. Finally, Deo Ca Traffic recorded a net profit of VND 96 billion, an increase of 32% compared to the same period last year.

In 2024, HHV set a plan for net revenue of over VND 3,146 billion and after-tax profit of over VND 404 billion, respectively increasing by 17% and 11% compared to 2023. Compared to the plan, HHV achieved 22% of the revenue target and 28% of the after-tax profit target after the first quarter.

Source: VietstockFinance

|

As of the end of March, HHV had total assets of over VND 37,660 billion, a slight increase of 2% compared to the beginning of the year. The capital structure focused on long-term assets of over VND 36,156 billion, accounting for up to 96%, and short-term assets of nearly VND 1,504 billion.

HHV is also holding cash and cash equivalents of nearly VND 658 billion, an increase of 122% compared to the beginning of the period, most of which are bank deposits of VND 431 billion. In addition, Deo Ca Traffic has nearly VND 95 billion in 6-month bank deposits; VND 15 billion in term deposits at banks with an interest rate of 5.7%/year. Inventory was at VND 113 billion, an increase of 47%, mainly due to construction costs in progress related to the costs of unfinished construction works.

On the other side of the balance sheet, liabilities were over VND 27,834 billion, a slight decrease of 1% compared to the beginning of the period. Of which, short-term debt was VND 2,866 billion and long-term debt was over VND 24,968 billion.

The largest creditor of HHV is the Joint Stock Commercial Bank for Industry and Trade of Vietnam (Vietinbank, HOSE: CTG) with a short-term loan of over VND 872 billion and a long-term loan of over VND 18,234 billion over 5 years.

Talking about this huge loan, the General Director of HHV once shared: “The large long-term loans are loans for BOT projects with a source of repayment secured from toll revenue, the specific nature of public service works with borrowed capital accounting for a large proportion in the project capital structure, before these projects did not have the participation of capital from the State budget“.

The first Extraordinary General Meeting of Shareholders was unsuccessful

On April 26, 2024, the 2024 Annual General Meeting of Shareholders of the Company did not meet the conditions for holding in accordance with the regulations, because the total number of voting shares of the shareholders attending the meeting represented less than 51% of the total number of voting shares of the Company, according to the list of shareholders on March 21, 2024.

At the same time, HHV announced the invitation to attend the 2nd Annual General Meeting of Shareholders 2024 on May 31, 2024, via the online format.