The VN-Index Rebounds, but Concerns Linger

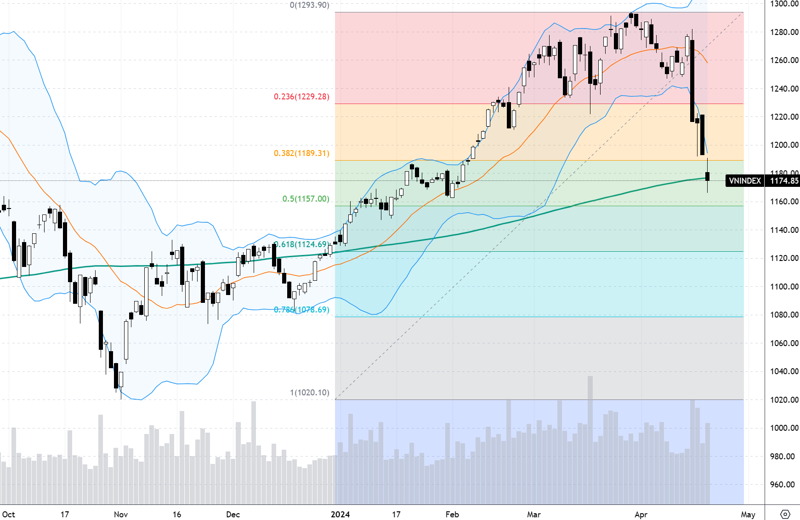

The VN-Index closed the last week of April with three out of five trading sessions in the green, and the lowest closing point of the week was higher than the previous week’s low. This is seen as a positive technical signal, especially considering that the market had just endured a “bloodbath” of a week with a decline of over 100 points.

Experts believe that the market is showing some positive signs, the most important of which is that the sharp declines or down sessions are no longer accompanied by large, sudden increases in trading volume. This implies that the selling pressure is weakening and that the margin pressure—which experts had expressed concern about in earlier assessments—has not materialized.

Despite this, the view that the market is experiencing a “momentum-driven breakout” is not highly regarded by experts; in fact, some are even cautious about it. Trading volume has not increased significantly enough to support the idea of a “momentum-driven breakout.” Experts believe that the market has only recently given a signal that it could be bottoming out in this correction. The market needs a few more corrective sessions to test the liquidity. If the market continues to correct with low volume and then recovers with a sharp increase in volume, the “momentum-driven breakout” factor will be more significant.

Because a cautious outlook still prevails, experts believe that there is not much support left from first-quarter 2024 business results. Information from the annual general meeting season is also unlikely to create any major shifts. Therefore, the market may find it difficult to decline further, but it is still not strong enough to break out. It is more likely that the market will experience divergence between individual stocks and create specific trading opportunities.

Nguyễn Hoàng – VnEconomy

Has the Market Found a Bottom?

_The market experienced a surprise surge on April 24, but the market stalled and corrected over the last two sessions of the week, although the range was not significant. Many investors believe that the April 24 session was a “momentum-driven breakout” and confirms that the market has bottomed out. What do you think?_

There’s nothing definitive at this point to say that the market has bottomed out and that we can expect positive developments in the near term. When expectations are uncertain and price levels are not yet truly safe, investors may want to find a “quiet corner” to continue monitoring and evaluating businesses and the overall market, rather than rushing into action at a time like this.

Nguyễn Thị Thảo Như

Nguyễn Thị Mỹ Liên – Head of Analysis, Phu Hung Securities JSC

The April 24 session was indeed a breakout session in terms of points, with a sharp increase of nearly 30 points; however, the trading volume was low, although it was higher than the previous session. I also did not see many stocks with breakouts or reversal patterns on that day. Therefore, I am somewhat skeptical about this breakout and need to monitor further signals.

I would like to see a positive corrective move with weak selling pressure when the index hits resistance, followed by a strong surge in trading volume. If this scenario plays out, that would be a better quality “momentum-driven breakout.”

Nghiêm Sỹ Tiến – Investment Strategy Analyst, KBSV Securities

I believe that the VN-Index has temporarily bottomed out after a “pullback” of about 4% from around the 1,170 point level. This could be considered a significant support level for the index in the short term, as demand has responded well when the index approached this level.

The positive aspect of this recovery is that market sentiment is gradually improving, while the negative backdrop of macro factors and peripheral information still prevails. The surge on April 24, although not a fully satisfactory “momentum-driven breakout” in terms of trading volume criteria, shows that the selling pressure is no longer excessive and indicates an initial consensus among buyers. The following sessions all experienced early declines, “testing” supply, but trading volume remained low, reflecting that the need to sell off is not urgent and that the current market sentiment is still in favor of holding stocks.

Nguyễn Việt Quang – Director of Yuanta Hanoi’s Business Center 3

From my perspective, although the April 24 session had many factors that satisfied the signs of a “momentum-driven breakout,” such as a strong increase, money flowing into all stocks and industry groups, and many stocks increasing by 5-7%, there was one very important sign that was not satisfied: the trading volume on April 24 was only slightly higher than the previous session and significantly lower than the 20-day average. A “momentum-driven breakout” that meets the criteria can still fail, so in the early stages, when there is a “momentum-driven breakout” that meets the criteria, we should participate with a moderate weighting and avoid using margin.

Money Flow Trend: The Burden of Margin

The State Securities Commission has not yet approved the operation of the KRX system on May 2

Lê Đức Khánh – Director of Analysis, VPS Securities

I believe that the market has confirmed a bottom around the 1,170-point level and has rebounded towards the 1,210 +/- level. I believe this is the bottom of the market, and the recovery will be followed by a period of accumulation before entering a clearer recovery phase. Of course, it is still too early to call the April 24 session a momentum-driven breakout; it should only be seen as a confirmation of the bottom of the correction.

Nguyễn Thị Thảo Như – Head of Retail Clients, Rong Viet Securities

The VN-Index has increased again after a “stormy” week, from a low of 1,164 points to 1,209 points at the close on April 26. The trading sessions with large trading volumes were down days, while the trading sessions with price increases had rather low and relatively small volumes. This could indicate that a large number of investors are genuinely concerned about the overall market and have therefore realized their profits and are now on the sidelines, monitoring further developments.

Thus, there is nothing definitive at this point to say that we have overcome the difficult period or that the market has bottomed out and that we can expect positive developments in the near term. The same cautious outlook as mentioned earlier still applies: when expectations are uncertain and price levels are not yet truly safe