PGV’s Business Indicators in Q1

|

PGV’s business indicators in Q1

Source: VietstockFinance

|

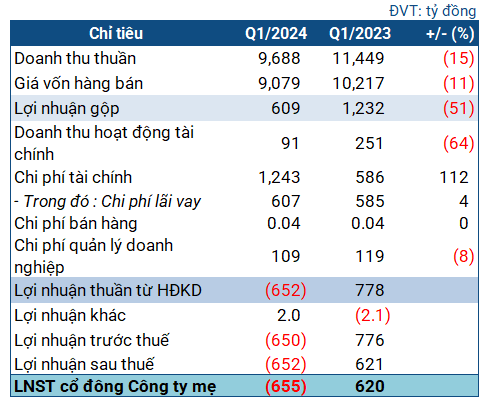

In Q1, PGV witnessed a 15% decrease in revenue to nearly VND 9.7 trillion. After deduction, the company’s gross profit was VND 608 billion, half of the same period last year.

Financial revenue plunged by 64% to only VND 91 billion. On the other hand, operating expenses doubled to over VND 1.2 trillion, half of which was interest expense. Consequently, PGV incurred a net loss of VND 655 billion (compared to a profit of VND 620 billion in the same period last year).

The company reported that lower average electricity selling prices led to a significant decline in electricity sales revenue. However, the “thorn in the flesh” for PGV was the foreign exchange loss (VND 617 billion loss in Q1, while it gained VND 172 billion in the same period last year).

| VND/USD central exchange rate from the beginning of 2024 |

Despite these challenges, PGV’s financial health remains stable. At the end of Q1, PGV’s total assets remained almost unchanged from the beginning of the year at over VND 58 trillion. Of which, more than VND 17 trillion was current assets, slightly higher than at the beginning of the year. Cash and cash equivalents decreased slightly to over VND 3.4 trillion.

The company still has over VND 10.3 trillion in short-term receivables, a slight increase compared to the beginning of the year, mostly from EVN’s Electricity Trading Company.

On the other side of the balance sheet, short-term debt is close to VND 13 trillion, 13% higher than at the beginning of the year. The current and quick ratios are 1.3 times and nearly 1.1 times, respectively, indicating that PGV’s ability to repay its debts is not at risk.