Throughout his presidency, President Biden has maintained the Trump administration’s tariffs on China. However, on April 17th, 2024, while in Pittsburgh, Pennsylvania – the heart of the American steel industry – on the campaign trail for re-election, Biden for the first time called for tripling tariffs on Chinese steel and aluminum from 7.5% to 22.5% in order to court the local workers.

CONTINUED TRADE TENSIONS ON THE RISE?

Also on that day, the U.S. Trade Representative (USTR) launched an investigation into China’s maritime, logistics and shipbuilding industries. The USTR alleged that Bejing has used “unfair, non-market policies and practices” to dominate these sectors.

Shortly thereafter, on April 20th 2024, China imposed an anti-dumping duty of 43% on imports of propionic acid compounds from the United States.

BSC Securities commented that the recent tit-for-tat actions between the United States and China can be summarized in one word – “Overcapacity”.

The United States has accused China of aiming to dominate global markets by subsidizing the overproduction of certain sectors—making the price of exported goods from China excessively cheap. For example, the average price of an electric vehicle in Europe is $70,462 (€65,000), in the US it is $71,683 (€66,000), while in China it is only $32,842 (€30,300), according to data from JATO Dynamics.

Similarly, China has been selling steel on the international market at half the price of US-made steel. The current low price of Chinese steel is due to a real-estate crisis leading to a supply glut.

As of 2023, the value of steel and aluminum imports from China only account for about 0.13% and 0.6% of total US imports from China, respectively.

In contrast, the value of US exports of propionic acid to China is less than 0.02% of total US exports to China. Thus, it is evident that these actions have yet to have a significant economic impact and are more symbolic, signaling that trade tensions between the two nations may continue to rise in the near future.

Moreover, major global polls show that Biden and Trump are neck-and-neck in the lead for the 47th US Presidential Election in 2024, suggesting that regardless of the election results, there is little indication that US-China trade tensions will subside.

HOW WILL VIETNAM BE AFFECTED?

Since the outbreak of the US-China trade war, US-China imports have been declining rapidly (2019). The trend of moving production out of China and into countries with lower tariffs imposed by the US has begun. Vietnam has benefited from this trend, thanks to its proximity, competitive labor costs, and the US not imposing anti-dumping tariffs.

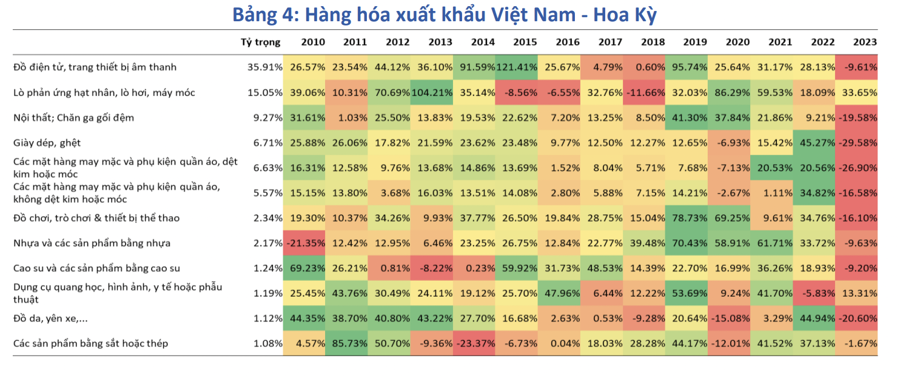

In 2019, when the value of US-China imports fell sharply, the value of US-Vietnam imports rose sharply. Vietnam’s top exports to the US also increased significantly in 2019, such as electrical and audio equipment, nuclear reactors, boilers, machinery, furniture, footwear, textiles, rubber, plastics, iron, and steel.

Meanwhile, the value of these same goods exported from China to the US has fallen sharply.

The increasing tensions between the US and China will benefit Vietnam’s exports to the US, which currently account for nearly 30% of Vietnam’s total exports. This factor, along with the recent elevation of US-Vietnam relations to a Comprehensive Strategic Partnership in 2023, will drive Vietnam’s exports in the near future.

In addition, with Vietnam’s exports primarily coming from FDI-owned enterprises, the positive outlook for the export sector will continue to attract FDI inflows to Vietnam.

Since 2019, when the trend of moving production out of China began, the inflow of FDI into Vietnam’s manufacturing sector (which accounts for ~78% of total FDI registered in Vietnam as of 2023) has grown at a higher annual rate than in previous years, except for 2020 when the world was hit by the Covid-19 shock. These two factors have also contributed to increasing the country’s foreign exchange reserves, which provide additional room to manage the exchange rate.

Not only has it increased, but FDI inflows into Vietnam have recently begun to focus on high-tech industries, in line with global trends. Hana Micron Vina (South Korea) inaugurated the semiconductor plant in Van Trung Industrial Park, Bac Giang, in September 2023. By 2025, the company plans to increase its total investment to over $1 billion and create 4,000 jobs for Vietnamese workers.

Amkor (South Korea – US) has invested $1.6 billion to build a factory in Bac Ninh that produces, assembles, and tests semiconductor materials and equipment. The factory officially began operations in October 2023.

Luxshare-ICT Vietnam has invested an additional $330 million (November 2023) to expand its factory in Bac Giang, bringing the company’s total capital in Bac Giang province to $504 million.

Luxshare-ICT manufactures AirPods and other devices for Apple. It has also invested $290 million in the VSIP Nghe An Industrial Park to produce electronic components.

Most recently, in April 2024, NVIDIA – the world’s leading manufacturer of artificial intelligence (AI) chips – announced during a business trip to Vietnam that it may consider moving some of its equipment manufacturing to Vietnam and enhancing cooperation in AI development.