According to the government, to promptly respond to the socio-economic situation, consider and calculate in accordance with actual conditions, it is necessary to drastically and effectively implement tax, fee, and land rent support solutions issued in 2023. At the same time, it is necessary to study and propose a number of solutions on taxes, fees, and land rents in 2024.

Reducing VAT is one of the solutions to stimulate consumer spending in the context of low purchasing power. Photo: PHUONG AN

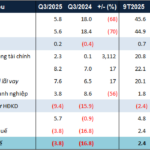

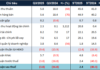

On the basis of assessing the results achieved when reducing VAT by 2%, the government proposed that the National Assembly consider continuing to reduce VAT by 2% for a number of groups of goods and services subject to the 10% tax rate. The implementation period is from July 1 to December 31, which is an extension of 6 months compared to the National Assembly’s decision at the end of last year.

The government estimates that the continued reduction of VAT in the last 6 months of 2024 will result in a budget deficit of approximately VND 24,000 billion. According to the government’s report, in the first 6 months, the tax reduction resulted in a budget deficit of VND 23,488 billion. Thus, the total revenue reduction for the whole year of 2024 is estimated at VND 47,488 billion.

The government said that in the period of 2020 – 2023, financial solutions to remove difficulties for production and business have been issued with a total value of exemption, reduction, and extension of taxes, fees, and land rents of up to VND 700,000 billion. Of which, the solutions issued and implemented since the beginning of 2024 amounted to VND 68,000 billion.