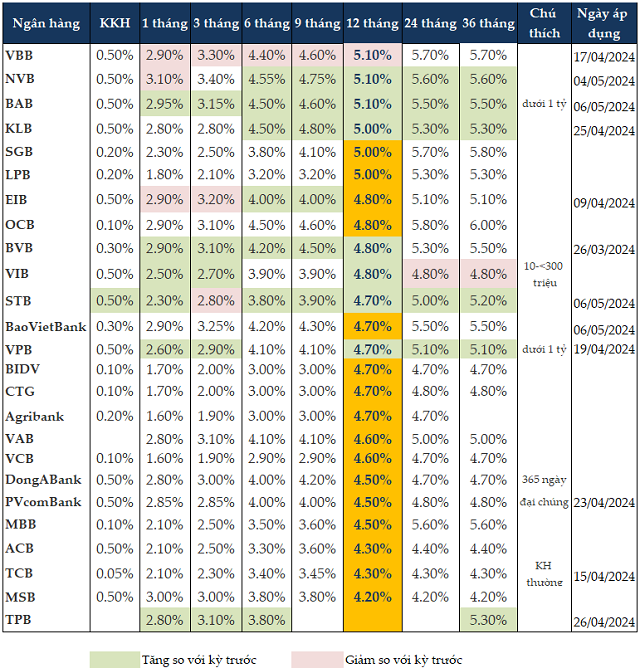

Drawing on aggregated data from relevant local construction departments, the Ministry of Construction (MoC) has reported that real estate transactions in the first quarter totaled 133,512. Of these, 35,853 were successful transactions involving apartment units and detached houses, while 97,659 involved land plots.

The aggregated figures suggest that transaction volumes across the three segments of land plots, apartment units, and detached houses all increased in the first quarter compared to the fourth quarter of 2023 (in Q4/2023, there were 27,590 detached house and apartment transactions and 81,476 land plot transactions). Accordingly, transactions involving apartments and detached houses rose by 129.95% compared to Q4/2023 and by 81.51% year-on-year, while land plot transactions increased by 119.86% compared to Q4/2023 and by 145.18% year-on-year.

According to the MoC, real estate inventory in projects in the first quarter of 2024 stood at around 23,029 units (including apartments, detached houses, and land plots), of which apartments accounted for 3,706 units, detached houses for 8,468 units, and land plots for 10,855 plots. This suggests that inventory is predominantly concentrated in the detached house and land plot segments of project developments.

Inventory of detached houses and land plots in the first quarter of 2024 stood at 19,323 units/plots (detached houses: 8,468 units; land plots: 10,855 plots), representing a 143.25% increase compared to the fourth quarter of 2023 (detached house and land plot inventory in Q4/2023 amounted to 13,489 units/plots, of which detached houses accounted for 5,173 units and land plots for 8,316 plots).

According to the MoC, the condominium apartment market continues to attract interest from both end-users and medium- to long-term investors. According to surveys conducted by several research organizations, average selling prices for selected projects in Hanoi and Ho Chi Minh City range from 50 to 70 million VND per square meter.

Surveys conducted by several research organizations indicate that some condominium projects that have been in operation for 5 to 10 years, and even some older high-rise collective housing units, have seen significant price increases. Prices for condominium apartments in Hanoi in early 2024 were up by 38% compared to 2019.

In Ho Chi Minh City, in the first quarter of 2024, condominium apartment selling prices on the secondary market showed an increase compared to the previous quarter, with particularly significant increases in certain districts such as District 7, Tan Phu, Tan Binh, and Phu Nhuan. Some projects saw average price increases of above during the first quarter of 2024.

In the detached house and land plot segment, demand for these properties increased in the first quarter of 2024 compared to the previous quarter and the same period last year. Selling prices in Hanoi increased by around 5% to 15% compared to the end of 2023 (prices ranged from 80 to 220 million VND per square meter), while in Ho Chi Minh City prices ranged from 90 to 250 million VND per square meter.

The MoC predicts that between now and the end of 2024, Hanoi will see an influx of 2,977 new villas and townhouses from 13 projects (Dong Anh will account for the largest share of future supply at 34%, followed by Ha Dong at 19% and Hoai Duc at 16%).

Market reports from several research organizations indicate that in the first quarter, new supply of villas and townhouses increased by 7% quarter-on-quarter and by 221% year-on-year, with primary supply of villas and townhouses reaching 665 units from 16 projects, a decrease of 6% quarter-on-quarter and 12% year-on-year. However, villas were the dominant property type, accounting for 41% of primary supply;…

Meanwhile, the market for villas and townhouses in Ho Chi Minh City in the first quarter of 2024 did not see many positive changes in terms of performance. Market absorption remained at just 20-30%, showing no significant change compared to the previous quarter.