Kinh Bac City Development Corporation (stock code: KBC) announced its Q1 2024 financial statements, reporting a 93% year-on-year revenue decline to VND 2,213 billion. Notably, the company recorded no revenue from land and infrastructure leasing, which had contributed VND 2,068 billion in the same period last year.

After deducting cost of goods sold, Kinh Bac’s gross profit reached nearly VND 74 billion, a 95% decrease compared to the previous year. Financial revenue decreased by 56.3% to VND 67.8 billion due to the absence of gains from share transfers. Bond issuance expenses also declined by almost 60% to VND 54 billion, as there were no bond issuance costs and a reduction in interest expenses. Sales expenses decreased significantly, while administrative expenses increased.

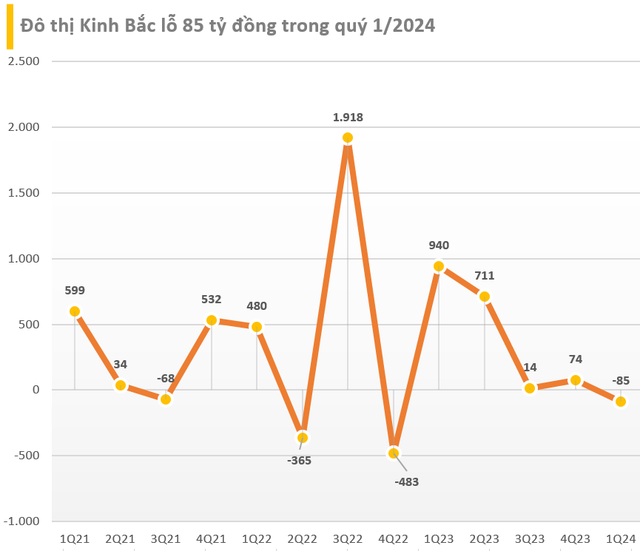

As a result, Kinh Bac incurred a net loss of nearly VND 86 billion in Q1 2024, compared to a profit of VND 940 billion in the same period last year. This marks the company’s fifth consecutive quarterly loss.

For the full year of 2024, Kinh Bac City has set a revenue target of VND 9,000 billion and a post-tax profit target of VND 4,000 billion, representing increases of 53% and 80%, respectively, compared to 2023. The company is currently far from achieving these targets.

As of March 31, Kinh Bac’s total assets reached VND 39,337 billion, an increase of nearly VND 6,000 billion compared to the beginning of the year. Of this, the company’s inventory accounted for the largest proportion within the asset structure, reaching VND 12,684 billion, an increase of VND 500 billion. Cash and cash equivalents surged from VND 841 billion to VND 6,238 billion. Short-term receivables amounted to VND 9,573 billion.

Kinh Bac City’s total financial debt as of the end of Q1 2024 stood at over VND 4,000 billion. The company’s equity reached VND 20,144 billion, including VND 7,668 billion of undistributed post-tax profits.