As of April 28, 2024, out of 1641 listed companies representing 83.8% of the capitalization on the three stock exchanges, 787 have published their financial reports for Q1 2024, including many industry leaders, according to FiinTrade.

The two “pillar” industries of the market, Banking and Real Estate, both reported lackluster business results. In Real Estate, the profit after tax of 60 out of 130 companies representing 74.4% of the industry’s total capitalization fell sharply by 82% due to Vinhomes (VHM) no longer recording income from project wholesale as in the same period last year.

Excluding VHM, the profit of the remaining 59 real estate companies decreased by 15.1% due to the impact of the housing real estate group (NVL, KDH, DIG, NLG).

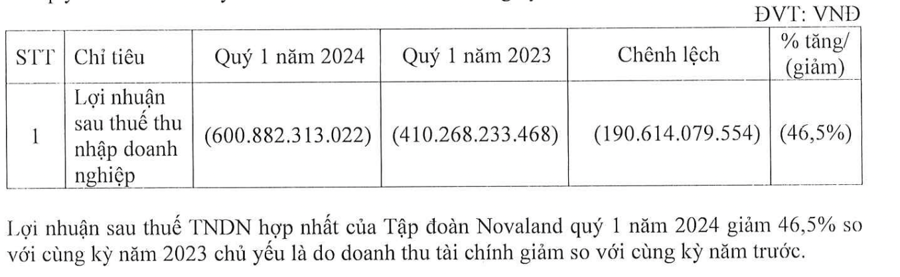

Notably, No Va Real Estate Investment Group Corporation (NVL) reported a record net loss in Q1 2024. In Q1, NVL recorded a net revenue of over VND 697 billion, an increase of 15% compared to the same period last year. In which, both real estate transfer revenue, consulting management revenue, and asset leasing revenue all increased. However, NVL’s financial revenue decreased sharply by 30% to VND 640 billion due to a decrease in profit from investment cooperation contracts to only over VND 456 billion.

On the other hand, although interest expenses decreased by 52%, financial expenses only decreased by 6% due to an increase in exchange rate difference losses. Business management expenses increased. After deducting the incurred expenses, NVL lost VND 600 billion in the first quarter of the year, which is the largest quarterly loss of the Company while in the same period last year it lost VND 410 billion.

As of the end of Q1, Novaland’s total assets decreased to VND 236,480 billion, of which inventories increased to VND 140,881 billion, and cash and cash equivalents decreased. Current liabilities are VND 191,778 billion, 4 times the equity, of which financial debt is VND 58,000 billion.

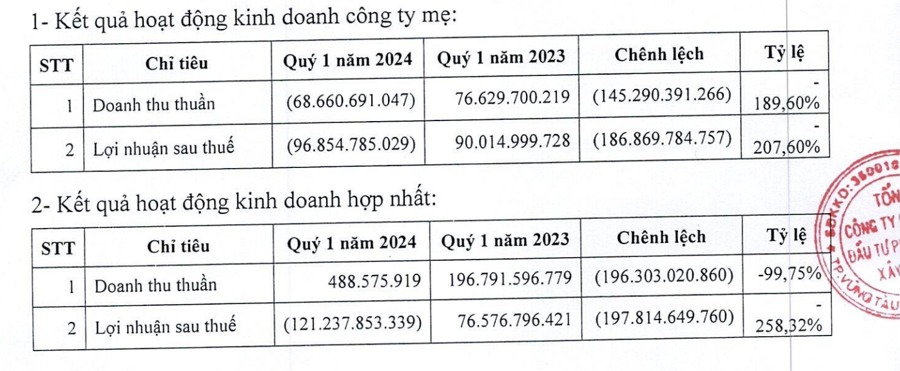

Similarly, in Q1 2024, DIC Corp recorded a revenue of VND 186.4 billion, a decrease of 5.7% compared to the same period last year. In which, real estate business revenue reached VND 111.8 billion, accounting for 60% of total revenue; service provision revenue reached VND 37 billion, accounting for 19.8%; semi-finished product sales revenue of VND 20.2 billion, accounting for 10.8%; and investment real estate revenue of VND 843.5 million.

It is worth noting that in this quarter, DIG recorded a returned sales turnover of up to nearly VND 185.7 billion. Therefore, this company’s net revenue was only VND 489 million, a decrease of 99.8% compared to the same period in 2023. Due to operating below the cost of goods sold, DIG reported a gross loss of VND 50.8 billion compared to a gross profit of VND 42.3 billion in the same period.

Financial revenue decreased by more than VND 158 billion to VND 12 billion; selling and business management expenses increased by 38% and 72.2%, respectively, to VND 13.8 billion and VND 53 billion. As a result, DIC Corp reported a loss of VND 121.23 billion in Q1 2024, which is also a record loss for DIG.

As of the end of Q1/2024, DIG’s total debt increased by 36.2% to VND 4,238.7 billion. Of which, DIC’s outstanding bond debt was VND 2,444.4 billion at the end of March 2024.

At the annual general meeting of shareholders held recently, DIG approved the 2024 business plan with consolidated revenue and other income reaching VND 2,300 billion, up 72% compared to 2023; profit before tax is VND 1,010 billion, an increase of 508.9% compared to the results achieved last year. This is the third year DIG has set its profit target at the thousand billion dong level, however in the previous two years the company failed to complete the set target.

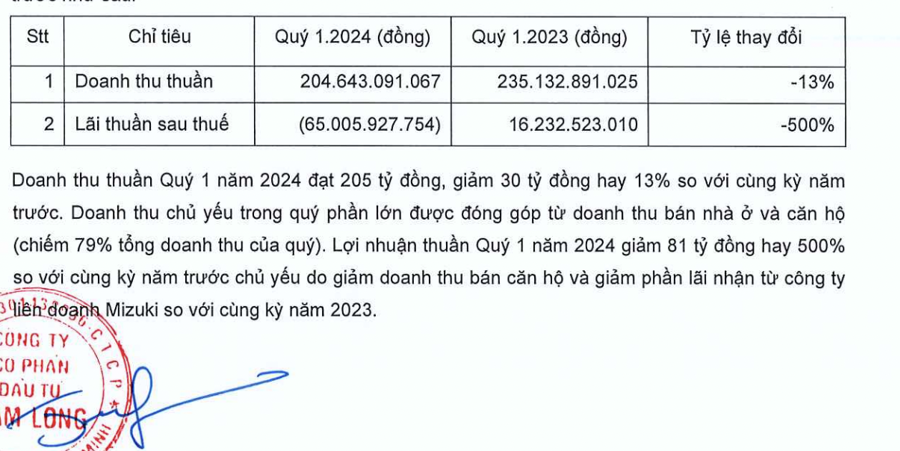

According to the consolidated financial statements for Q1 2024, Nam Long’s revenue reached nearly VND 205 billion, a decrease of 13% compared to the same period last year. The revenue in the period mainly came from the sale of houses and apartments, specifically from the continued handover of Mizuki, Southgate and the Izumi City project. The cost of goods sold increased sharply, leading to a reduction in gross profit to VND 86 billion.

Financial revenue also halved compared to last year, and profit in joint ventures and associates halved. Meanwhile, selling expenses and business management expenses decreased disproportionately, resulting in a loss from operating activities of VND 58 billion. After deducting tax expenses, NLG reported a loss of VND 65 billion, while in the same period last year it had a profit of VND 16 billion. This is also NLG’s record historical loss.

In 2024, NLG sets a target of VND 6,657 billion and VND 506 billion for net revenue and net profit, respectively, double the revenue but only a 5% increase in profit. With a record loss in Q1, NLG’s ability to complete its annual plan remains a question mark and a major challenge for the company’s leadership.

In Q1, KDH’s net revenue reached VND 334 billion, a decrease of 21% compared to the same period. Revenue from real estate transfer still accounted for the highest proportion with over VND 318 billion, also decreasing by 21%. Revenue decreased while cost of goods sold increased by 71%, in which the cost of real estate transfer activities was nearly double that of the same period, with over VND 149 billion. As a result, KDH’s gross profit decreased by 48% to over VND 174 billion.

Interest expenses increased; other income decreased sharply, other expenses increased sharply, resulting in KDH’s profit after tax being VND 63 billion, a decrease of nearly 70% compared to the same period last year. With VND 63 billion in profit after tax in Q1, KDH has only achieved over 8% of the target of VND 790 billion set for 2024.

On the balance sheet, KDH’s total assets as of March 31, 2024 exceeded VND 27,200 billion, an increase of 3% compared to the beginning of the year. Of which, the item with the largest proportion is inventories, increasing by 9% to nearly VND 20,500 billion, mainly due to the increase in the value of construction in progress of the Binh Hung 11A residential area project from VND 610 billion to over VND 1,400 billion. In contrast, the amount of cash on hand decreased by 32% to over VND 2,500 billion. The Company’s liabilities increased by 6% to nearly VND 11,700 billion.

The profits of the group of real estate companies reflect the actual market situation and are contrary to the “excessive” optimistic expectations of the companies.

According to VDSC’s assessment, the fact that businesses lack products for sale in the 2022-2023 period will make it difficult for businesses to record strong profit growth in 2024.

VDSC expects that from 2025, when the revised Law on Real Estate Business and the Law on Housing take effect, along with the issuance of the Decree on