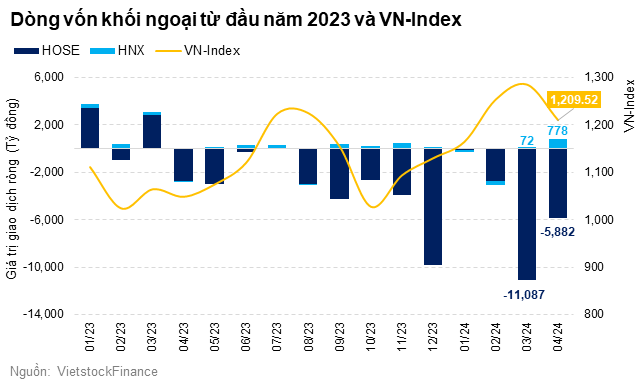

Foreign Investors Sold Nearly VND 5.9 Trillion on HOSE in April

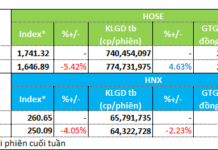

According to statistics from VietstockFinance, foreign investors sold nearly VND 5.9 trillion net on HOSE in April. Since the beginning of 2024, this figure has exceeded VND 19.8 trillion. The cumulative net selling value has been around VND 49.6 trillion over the past 12 consecutive months of net selling since April 2023.

In the Vietstock LIVE program titled “Reading Q1/2024 Business Results and Vietnam’s Economic Outlook”, Ms. Do Minh Trang, Director of the Analysis Center at ACB Securities (ACBS), said that there are two reasons for the recent net selling by foreign investors. Firstly, from an investor perspective, foreign investors buy when they find stock prices cheap and attractive and sell when they achieve their profit target.

“Both domestic and foreign investors always make decisions to make a profit, buying low and selling high. Foreign investors sell in areas where valuations are already high or reasonable, and we need to observe and accept that. Investors cannot buy forever,” noted Ms. Do Minh Trang.

The second reason, according to ACBS experts, could be related to exchange rate pressure. The increase in exchange rate pressure could cause a 3-5% loss in value within 3 weeks to 1 month. If stocks are held, it is not certain that the exchange rate compensation will be obtained, so investors may sell their stocks.

Another factor is the shift in capital flows between markets by investors. There are markets that will be more attractive, such as the Chinese market, which is currently showing signs of allure. If investors base their decisions on the valuation of the entire stock market of a country, they may shift their capital flows.

However, ACBS experts affirmed that there are still many investment funds that are committed to Vietnam’s economy. The selling of stocks is simply the entry and exit of investors, and we monitor it to have trading warning points. It does not mean that this is a story that will change market activity or corporate profits.

“Foreign investors selling stocks does not mean they are leaving the market,” Ms. Do Minh Trang emphasized.

In contrast, foreign investors bought a net VND 778 billion on HNX in April, nearly 11 times more than the previous month. This figure also reversed the cumulative status in the first 3 months of the year from a net sale of VND 480 billion to a net purchase of VND 295 billion in the first 4 months of 2024.

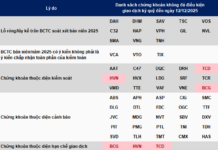

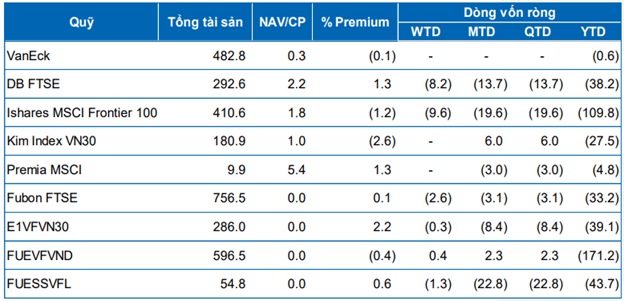

On the ETF side, most of them also recorded net selling values last month. According to a report by Yuanta Securities, from the beginning of the month to the end of April 19 (MTD), SSIAM VNFIN LEAD ETF (FUESSVFL) withdrew a net value of 22.8 million USD, Ishares MSCI Frontier 100 and DB FTSE withdrew a net value of 19.6 million USD and 13.7 million USD respectively.

Source: Yuanta Securities. Unit: Million USD

|

Vietnam’s stock market performed poorly in April with VN-Index closing at 1,209.52 points on the last trading day of the month, down 6% compared to the beginning of the month. Analysts had previously warned of greater caution in April as VN-Index had risen for 5 consecutive months since November 2023 and the market entered an information gap, with a lack of supporting news, mainly revolving around AGMs and Q1 business results. Cash often takes a stand-back approach.

In fact, VN-Index liquidity has declined, with average trading value recorded at nearly VND 21.7 trillion in April, down 19% compared to March’s average. The liquidity decline was most evident after the unexpected collapse on April 15, when VN-Index fell nearly 60 points (the sharpest decline in the past 2 years since May 12, 2022), causing a rout that wiped out over 100 points from the index in a week.

Meanwhile, the heated increase in the USD/VND exchange rate continues to be a topic of lively discussion in the market.

According to Mr. Michael Kokalari, CFA, Head of Macroeconomic and Market Research Analysis at VinaCapital, the reasons for VND’s depreciation in 2024 include factors such as the unexpected sharp increase in the US Dollar (USD) by nearly 5% compared to the beginning of the year (for the DXY index). In addition, the price of gold has climbed by about 16% this year (and 30% since the end of 2022), which is also putting pressure on the USD/VND exchange rate due to increased gold buying by Vietnamese investors, and the purchase of gold by people leading to increased USD buying.

A recent report by Bank of America (BofA) also expressed pessimism about a series of Asian currencies that are being impacted by the US Federal Reserve (Fed) delaying interest rate cuts and the resurgence of the USD, including the Vietnamese currency.

At the recent May meeting, the US Federal Open Market Committee (FOMC), the Fed’s policymaking body, maintained interest rates at 5.25-5.5% as the fight against inflation became more difficult. In addition, FOMC also decided to reduce the pace of balance sheet reduction each month.

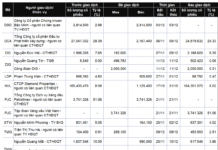

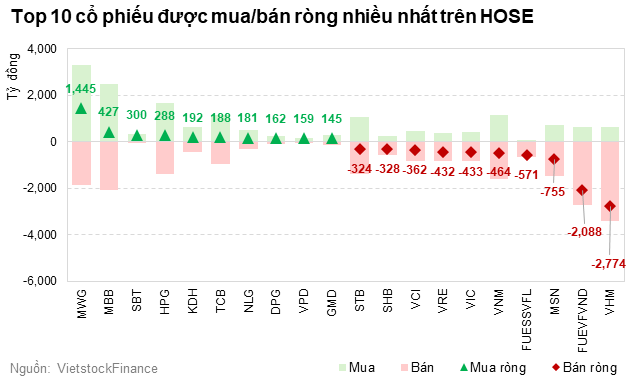

Returning to HOSE, VHM shares were sold the most heavily, with nearly VND 2.8 trillion; followed by the DCVFMVN DIAMOND ETF fund certificate FUEVFVND, which was sold over VND 2 trillion. Another fund certificate, FUESSVFL, was also sold down by more than VND 570 billion, with MSN shares in between.

Conversely, MWG was the most actively bought stock, with over VND 1.4 trillion, a figure larger than the combined value of the following stocks: MBB, SBT, HPG, KDH, TCB.

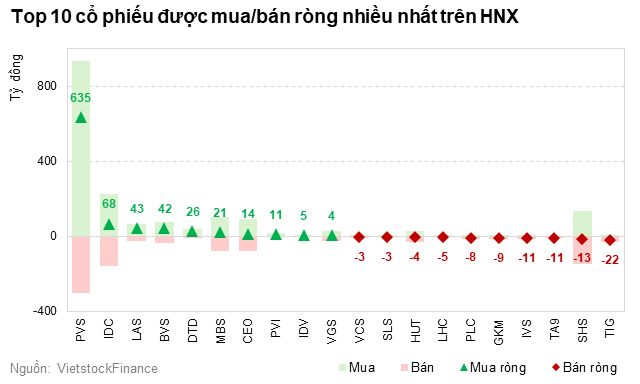

On HNX, PVS became the most actively bought stock, up to VND 635 billion, nearly 3 times the total value of net purchases by the 9 following stocks. On the other hand, the stock with the largest net selling was TIG, at over VND 22 billion.

Duy Khanh