Hoang Anh Gia Lai Addresses Stock Warning Status with Positive Business Performance and Future Plans

Hoang Anh Gia Lai Corporation (Stock Code: HAG) has submitted a report to the Ho Chi Minh City Stock Exchange (HoSE) outlining measures to address its stock’s warning status.

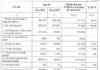

Specifically, for the first quarter of 2024, Hoang Anh Gia Lai reported a positive business performance, with a total post-tax profit of 226 billion VND and a post-tax profit for the parent company of 214 billion VND.

Regarding project investments, Hoang Anh Gia Lai continues to focus its resources on its core businesses of livestock farming and agriculture, with key products being bananas, durians, and pigs.

In 2024, the company plans to plant an additional 2,000 hectares of bananas, increasing its total area to 9,000 hectares, and an additional 500 hectares of durians, bringing its total area to 2,000 hectares.

In terms of financial status, the company will continue to implement financial restructuring measures to significantly reduce its outstanding bank debt, lower interest expenses, and maintain a stable cash flow for its production and business operations.

HAG stock fluctuations over the past 3 months. Source: Fireant

For 2024 specifically and the period of 2024-2030 in general, Hoang Anh Gia Lai plans to operate under a “Circular Agriculture” model. The company emphasizes the application of scientific advancements and technological solutions to recycle by-products and waste from farming and livestock activities to be reused in agricultural production, thereby creating a closed-loop production chain…

Based on the positive business results achieved in the first three months of 2024 and the outlined operational model, Hoang Anh Gia Lai believes that its business activities will continue to yield positive outcomes, paving the way to gradually reduce and eliminate accumulated losses, addressing the reasons for its stocks being placed on warning status.

Earlier, in late March 2024, HoSE announced its decision to maintain the warning status for HAG stocks, as stipulated in Decision 740/QD-SGDHCM dated October 7, 2022.

The reason was that Hoang Anh Gia Lai’s retained earnings after tax amounted to a negative 1,669 billion VND at the end of 2023, according to the 2023 Audited Consolidated Financial Statements, which did not meet the regulations of the listing and trading rules for listed securities.

Since then, the price of HAG stocks has decreased by over 5%. Notably, before the holiday break, the stock experienced four consecutive trading days with gains (from April 22nd to April 25th) of nearly 6%.

The uptrend occurred after Hoang Anh Gia Lai successfully sold 130 million private placement shares (at an offering price of 10,000 VND per share) to three investors: Thaigroup Corporation, LPBank Securities Company, and individual investor Le Minh Tam, raising a total of 1,300 billion VND.

However, on April 26th, HAG stocks broke the upward trend, decreasing by 0.8%, and continued to decline today by 1.2%, to a price of 12,250 VND per share. Compared to the beginning of the year, HAG stocks have dropped by 7%.