Gold Demand Surges to Seven-Year High, Driven by Central Banks and Asian Investors

Data: WGC

On April 30, the World Gold Council officially released its “Gold Demand Trends” report, which shows that total gold demand in Q1 2024 increased by 3% year-over-year to 1,238 tons, the highest level in the past seven years since 2016.

Key contributors to this record gold demand were central banks across regions and Asian investors.

Central banks added 290 tons of gold to their reserves during Q1. This represented a 1% increase compared to the same period last year and was 69% higher than the five-year quarterly average. It was the strongest start to a year from the central bank sector since 2020, when WGC began tracking the data. Central banks in China and India led the buying spree in the quarter.

WGC assessed that central bank demand is a key driver of the recent rally in gold prices, despite macroeconomic headwinds including higher US Treasury yields and a strong US dollar.

China remained the leading driver of global gold demand, accumulating over 300 tons in Q1, a 13% increase year-over-year. India and the Middle East followed.

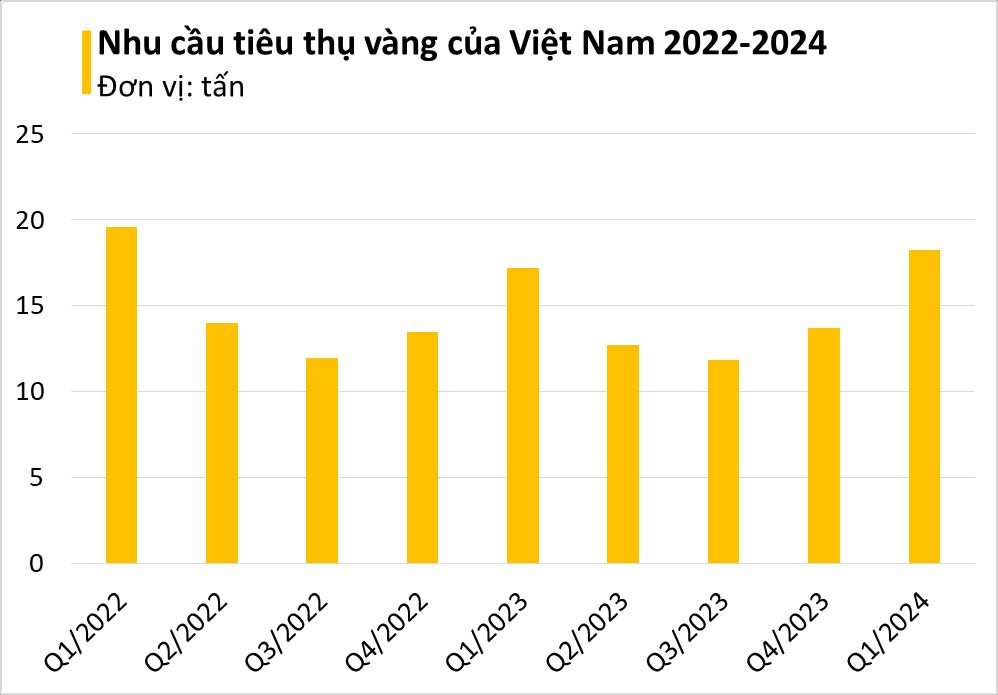

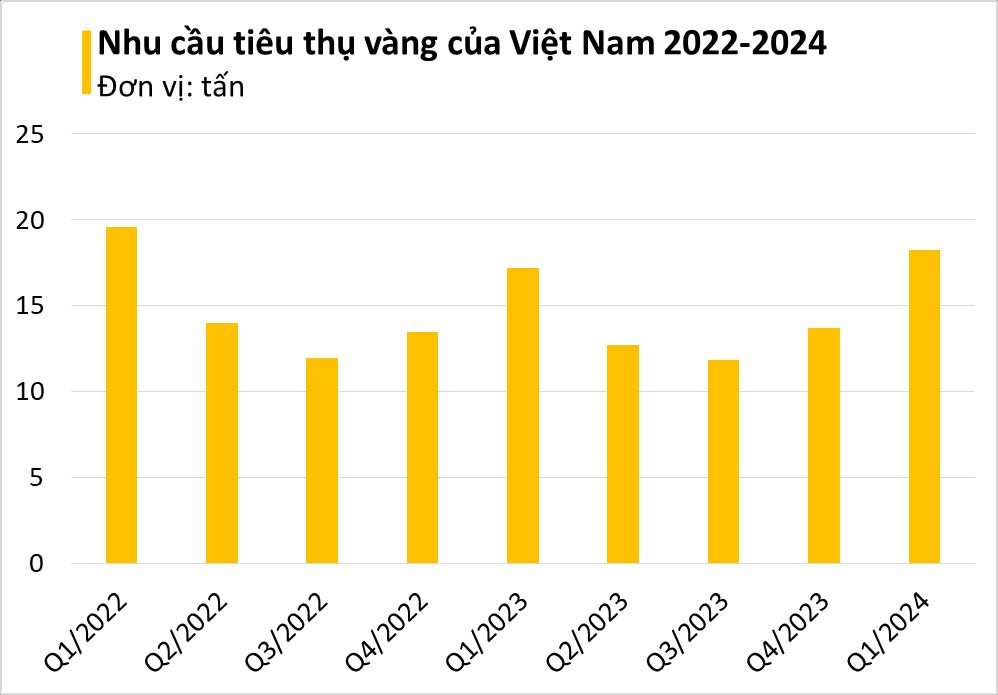

Within Vietnam, according to the report, general gold consumption reached **18.3 tons, up 6.13% year-over-year, ranking among the world’s top 10 gold-consuming countries**. Demand for gold bars witnessed a 12% increase year-over-year, reaching 14.1 tons.

Data: WGC

However, there was a significant decline in the demand for gold jewelry in Vietnam, dropping by 10% to 4.1 tons, a trend also observed in many markets worldwide.

Domestic gold prices have risen steadily since the beginning of the year, with SJC gold bars exceeding 85 million VND/tael and gold rings reaching over 78 million VND/tael. Despite the price increase, many Vietnamese people continue to buy gold. Gold bars were previously more popular, but now gold rings are in higher demand. Some gold shops have even faced a shortage of gold rings.

Vietnamese have a long history of accumulating gold as a form of investment, speculation, and risk mitigation, especially during periods of global uncertainty.

WGC anticipates that the sharp rally in gold prices in April may lead to increased recycling and reduce global demand for gold jewelry. However, elevated geopolitical risks and investment demand for gold jewelry in some key markets will likely cushion the decline.

For the rest of the year, WGC expects demand from central banks in emerging markets and retail investors to support the gold market.