The market witnessed a relatively positive trading week after the May Day holidays. The surge of VN-Index was in line with the trend of global markets, as the US Federal Reserve (Fed) left interest rates unchanged and dismissed the possibility of a rate hike in the June meeting. VN-Index ended the week at 1,221 points, up 0.95% from the previous week.

However, liquidity remained weak, only reaching over VND 14,000 billion on all three exchanges. Cash flow was focused on FPT (+3.3%), SAB (+4%), and electricity stocks as power consumption increased in the first quarter.

Foreign investors sold net VND 378 billion. Most of the transactions came from the sell-off of over 12 million shares of BWE, worth VND 515 billion. On the buying side, foreign investors bought MWG with a value of VND 243 billion, BID VND 54.5 billion and VNM VND 35.8 billion.

Analyst Pham Binh Phuong of Mirae Asset Securities, said that the recovery of the VN-Index is being supported by stocks with positive first-quarter business results. This is a positive sign for the market.

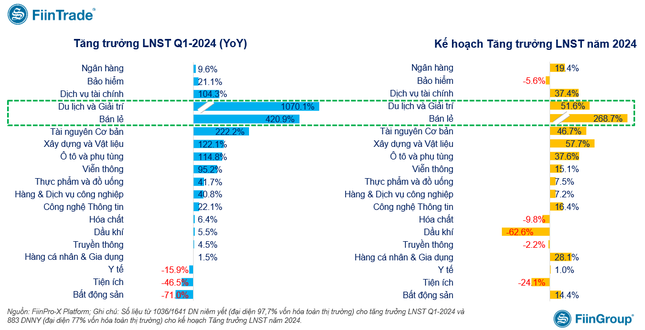

Statistics from FiinTrade reveal that more than 1,000 companies have announced their Q1 business results, with the retail sector showing strong growth.

In terms of the short-term trend, from the 1,170-point level, the current recovery has gained more than 50 points, about half of the points lost since April 15. Therefore, stocks that have technically recovered may face selling pressure after the recent rally. The 1,230-point level is a notable resistance for the index in the short term.

Besides the first-quarter business results, Dinh Quang Hinh, an expert from VNDirect Securities, believes that the market has also received positive supporting information from domestic macroeconomic data in April, and the recovery trend has been maintained. Some aspects of the economy have shown positive changes, such as industrial production, consumption and public investment. These developments reinforce expectations for the growth of the Vietnamese economy to continue improving in the coming quarters.

With these recent developments, Hinh believes that the risk of a “deeper double-bottom correction” has been somewhat alleviated. Therefore, the new bottom established around 1,150-1,170 points may be the market bottom in the medium term. Conversely, the market is approaching the 1,230-point resistance level. Selling pressure may emerge at this level.

Investors should maintain a moderate proportion of stocks and avoid investing immediately. Instead, they should wait for the market’s upcoming fluctuations and corrections.

“Consider dividing the investment into two portions and investing cautiously if the market corrects to the 1,190-point level. Invest aggressively if the market reaches the previous bottom of 1,150-1,170 points. Investors should prioritize investing in stocks in sectors with positive growth prospects this year, including the export sector (wood products, steel), banks , securities and consumer goods,” Hinh analyzed.

Analysts from VPBank Securities (VPBankS) believe that VN-Index, despite the increase, has low liquidity, which makes it difficult to determine the market trend in the short term. Caution continues to prevail, as evidenced by the persistently low liquidity.

Technically, the market is still in a short-term recovery phase and has not yet broken out of the correction trend . With the 20-day MA line sloping down and crossing the 50-day MA, VN-Index is likely to face a renewed correction soon.