Recently, the Hanoi Stock Exchange (HNX) has posted a document by Phu Khang Dong Sai Gon Co., Ltd. announcing periodic information on the financial situation in the first 6 months of 2023.

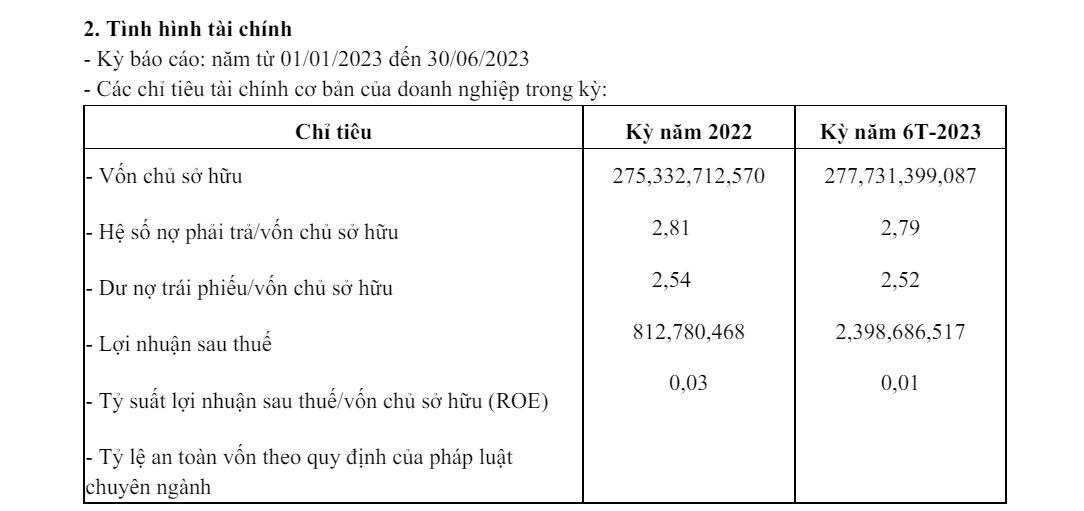

Accordingly, by June 30, 2023, the enterprise’s equity was at 277.7 billion VND, an increase of over 2 billion compared to the same period last year. Net income was only about 2.4 billion VND. However, this number has improved significantly compared to the profit of nearly 813 million VND in the same period last year.

Phu Khang Dong Sai Gon’s financial situation in the first 6 months of 2023. Source: HNX

The ratio of debt to equity improved from 2.81 times to 2.79 times; Phu Khang Dong Sai Gon’s payable debt as of the end of the first half of 2023 is 774.8 billion VND. Of which, the remaining bond debt is nearly 700 billion VND.

It is known that the remaining bond debt comes from the PKDSGH2023001 bond lot, issued on December 31, 2020, and ended on February 24, 2021.

This bond initially had a term of 3 years, later adjusted to 5 years; it is a non-convertible bond without warrants, secured by assets, with interest being a combination of fixed interest and floating interest rates.

The entire amount raised from the above bond lot will be used to increase Phu Khang Dong Sai Gon’s operating capital and to cooperate with partners to develop potential real estate projects.

After researching, Phu Khang Dong Sai Gon was established in December 2013, headquartered at 51 Ngo Thi Nhiem, District 3, Ho Chi Minh City.

The initial charter capital of this enterprise was 50 billion VND, consisting of 2 shareholders: Ms. Luu Thi Thanh Mau (70%) and Ms. Luu Thi Binh Dan (30%). The Chairman of the Board of Directors and the legal representative is Ms. Luu Thi Thanh Mau (born in 1978).

In May 2014, the shareholder structure of Phu Khang Dong Sai Gon changed; at this time, Mr. Luu Van Trung owned 50% of the capital; Mr. Pham Hoang Luong 20%; Ms. Luu Thi Binh Dan’s ownership ratio remained the same. At the same time, the position of Chairman of the Board of Directors was transferred to Mr. Pham Hoang Luong (born in 1964).

In December 2020, the company increased its capital to 250 billion VND, with the following shareholders: Luu Thi Binh Dan (48%), Luu Van Trung (50%), and Pham Hoang Luong (2%).

It is known that Phu Khang Dong Sai Gon is a member of the “ecosystem” of Phu Khang Group of businessman Tran Tam (born in 1974) and Luu Thi Thanh Mau.

Phu Khang Corp was established at the end of April 2009; it is a famous enterprise in the southern real estate market with a series of projects such as: EcoSun (Dong Nai), Eco Village (Long An), Eco Town (Ho Chi Minh City), Diamond Lotus Riverside (Ho Chi Minh City), Diamond Lotus Lakeview (Ho Chi Minh City),…

In addition to Phu Khang Dong Sai Gon, many other members of Phu Khang Group have also mobilized large amounts of capital through bond channels, such as: Phu Khang Investment Management One Member Co., Ltd. (500 billion VND), Happy Home Real Estate Joint Stock Company (200 billion VND, repurchased early on September 30, 2021), Phu Long Van Joint Stock Company (1,350 billion VND, repurchased early on June 30, 2023)

In a related development, on April 25, 2024, the State Securities Commission (SSC) issued Decision No. 180/QD-XPHC on administrative sanctions in the field of securities and the securities market against Phu Long Van Joint Stock Company.

The reason is that Phu Long Van has not disclosed information related to bonds to the Hanoi Stock Exchange (HNX). Specifically, the Company has not disclosed the Semi-annual Bond Interest and Principal Payment Report 2022; Report on the use of capital from bond issuance 2020 and the first half of 2021; Bond Interest and Principal Payment Situation 2020, first half of 2021, 2022; 2021 Semi-annual Financial Statements; Report on the use of the amount from the audited bond issuance in the first half of 2023.

The enterprise also disclosed information not on time to HNX with the following documents: 2020 Financial Statements; Report on the use of capital sources from bond issuance in 2020, 2022; Report on the implementation of the commitments of the bond issuer to the bondholders in 2022 and the first half of 2023; Early Bond Repurchase Results Report.

With the above violations, Phu Long Van was fined 92.5 million VND.