Ho Chi Minh City Technical Infrastructure Investment Joint Stock Company (HOSE: CII) announces its Annual General Meeting of Shareholders for fiscal year 2023, rescheduled for May 21st, 2024, at 8:00 am.

As a token of appreciation, the company will be offering gifts to shareholders who attend the meeting. These gifts will be sent directly to their bank accounts as a thank-you for their participation.

The first meeting, held on April 24th, was unable to proceed due to insufficient attendance.

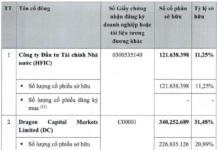

The previous attempt to hold the Annual General Meeting on April 24th was unsuccessful, with only 36.77% of the shares with voting rights being represented. This fell short of the required 51% for the meeting to be valid.

CII has a history of facing challenges in organizing successful shareholder meetings. In 2023, despite offering cash gifts, the company struggled with low attendance, with the first meeting achieving only a 23% participation rate and the second meeting reaching only 31%.

For the upcoming meeting, CII acknowledges the economic challenges faced by businesses globally and will focus on maintaining stable operations for its BOT road and bridge projects, ensuring consistent revenue growth. The company will also work on capital restructuring and optimization of cash flow from these projects, as well as focus on capital recovery and profitability from its investments.

CII’s specific goals for 2024 include a total revenue target of VND 4,194 billion, an 11.3% decrease from the previous year, and a net profit target of VND 430 billion, representing a 9.7% increase compared to 2023.

In terms of business orientation, CII plans to increase toll road revenue by 45% in 2024 compared to the previous year. This increase is mainly due to toll price adjustments for the expanded National Highway 1 in Ninh Thuan province and the Co Chien Bridge project, as well as the consolidation of revenue from the Trung Luong-My Thuan Expressway project from the beginning of the year.

Additionally, CII will continue to actively explore new infrastructure projects, especially in light of Resolution 98, which provides a favorable mechanism for PPP projects in Ho Chi Minh City.

In the real estate sector, the company will focus on leasing office spaces and commercial areas in completed projects, while also working on legal procedures for ongoing investment projects.

Regarding profit distribution, CII plans to maintain a cash dividend of 16% for both 2023 and 2024.

Mr. Binh, sharing CII’s current investment plans, mentioned that the company is in negotiations to acquire 100% of a BOT project worth approximately VND 1,600 billion. These negotiations are expected to conclude in the second half of May 2024.

Additionally, CII is exploring a potential investment in a leading company in the same industry as Tasco. While the name of this company cannot be disclosed yet, the deal is expected to be finalized by the end of May or early June 2024, with CII’s investment potentially reaching the thousands of billions due to the target company’s large market presence and potential to become a Vietnamese unicorn.

CII’s consolidated financial statements for the first quarter of 2024 showed remarkable results. The company’s revenue reached over VND 878 billion, a 17% increase compared to the same period last year.

Financial revenue also increased by nearly 2.5 times compared to the first quarter of 2023, reaching over VND 532 billion. This increase was mainly due to a gain of over VND 430 billion from the revaluation of investments and associates as a result of CII gaining control.

CII’s net profit for the first quarter of 2024 was over VND 259 billion, a significant improvement compared to the VND 7 billion profit in the same period last year. The company has already achieved 60% of its full-year profit plan of VND 430 billion.

This outstanding performance in the first quarter is attributed to increased net profit from the BOT Trung Luong-My Thuan project (from CTCP BOT Trung Luong-My Thuan, a subsidiary of CII since Q4 2023) and consolidated profits from CTCP Investment Nam Bay Bay (HOSE: NBB) after it became a subsidiary of CII in Q1 2024.