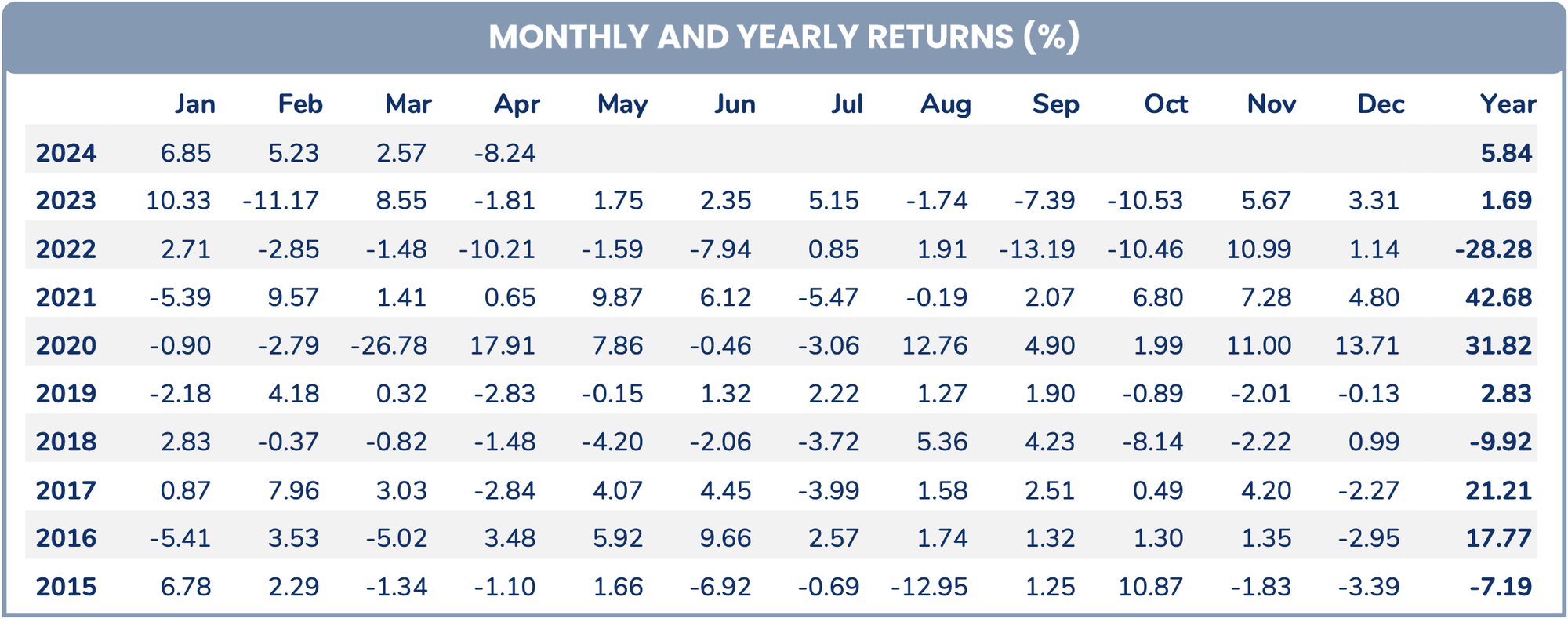

Pyn Elite Fund, one of the largest foreign investment funds in Vietnam, has released its April performance report, revealing a negative investment return of 8.2% due to the impact of banking stocks and the weakening of the VND.

This performance break comes after five consecutive months of positive returns. In April, the VN-Index also experienced a dip of 8.5% but recovered to close the month with a 5.8% loss.

According to Pyn Elite Fund, the VND depreciated by 2.1% against the USD in April, raising concerns about interest rate hikes. However, the fund believes that the depreciation is in line with regional currencies and reflects the recent strength of the USD. Towards the end of the month, deposit rates at some banks increased by 10-50 basis points from historical lows, but overall, interest rates remain favorable, according to the fund.

Vietnam’s manufacturing PMI rebounded to 50.3 in April, indicating expansion and driven by a solid increase in new orders. Retail sales also showed positive growth, up 9% year-on-year, with tourism revenue surging by 58% due to the return of Chinese tourists.

International tourist arrivals for the first four months of the year increased by 58.2% compared to the same period before the pandemic, a promising sign for the industry.

FDI disbursement from the beginning of the year rose by 7.4% year-on-year, and April saw strong import and export growth of 10.6% and 19.9%, respectively, contributing to a new record surplus of 8.6 billion USD. Additionally, the government proposed extending the VAT reduction program until December 24, fostering a conducive environment for consumer growth.

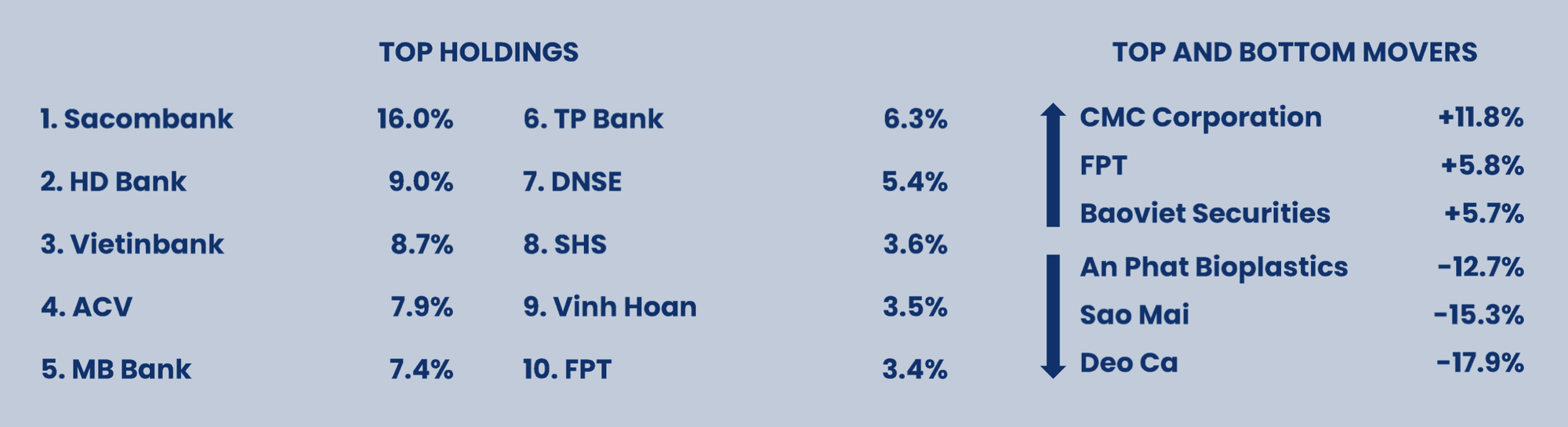

With assets under management totaling 742 million EUR (~20 trillion VND) as of the end of April, Pyn Elite Fund is one of the largest players in Vietnam’s stock market. The fund’s top 10 investments remain dominated by banking stocks, but there have been some notable shifts.

FPT, a Vietnamese technology company, has made a surprise entry into the fund’s top 10 investments as of the end of April, with a weight of 3.4%, equivalent to approximately 25 million EUR (~680 billion VND). This marks the first time FPT has appeared in Pyn Elite Fund’s disclosed portfolio.

This development can be attributed to the strong performance of FPT’s stock price in April, and it is possible that Pyn Elite Fund has been acquiring more shares during this period. If so, the fund would have had to accept a premium of around 7% over the market price due to the stock’s frequent room closure.

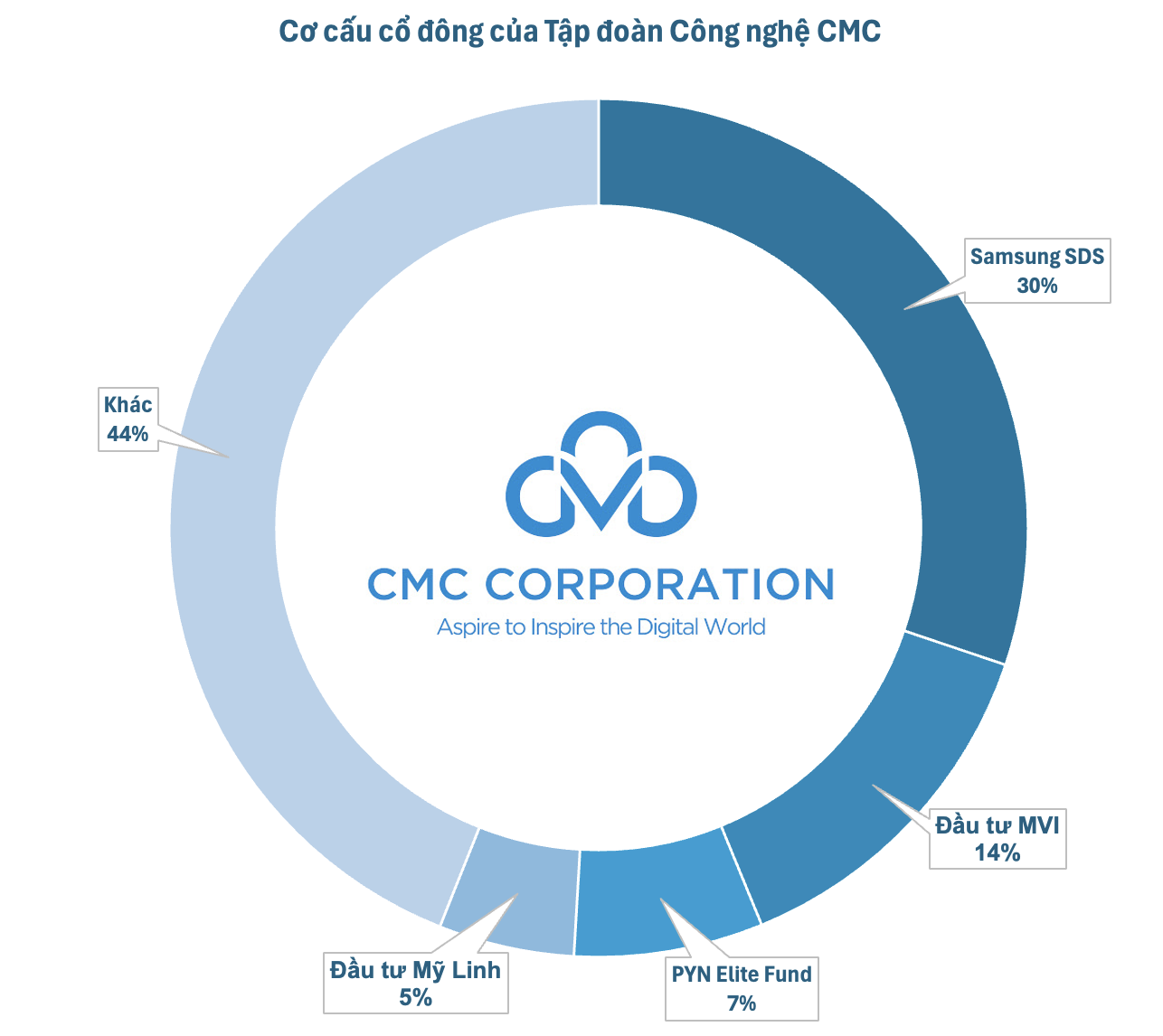

In addition to FPT, Pyn Elite Fund has also invested significantly in another Vietnamese tech stock, CMC Corp (CMG). The fund, originating from Finland, is now the third largest shareholder in the corporation, holding 7% of its capital, after Samsung SDS and MVI Investments. CMG was also the best-performing stock in the fund’s portfolio in April and shows no signs of slowing down.

Notably, Pyn Elite Fund’s portfolio also includes a significant holding in the “giant” ACV, with a weight of 7.9% as of the end of April, equivalent to approximately 57 million EUR (~1.6 trillion VND). It is estimated that the fund held approximately 19 million ACV shares at the end of April. This stock has risen over 20% since the beginning of May and promises to be a key contributor to the fund’s performance this month.

Despite the recent dip in investment performance, Pyn Elite Fund remains confident in its holdings, many of which are showing positive trends. In a recent letter to investors, Petri Deryng, the fund’s founder and manager, expressed his belief that the Vietnamese stock market is still on an upward trajectory since its November 2022 lows.

Deryng also noted that the profit-taking actions of investors in the past time are not commensurate with the market outlook when considering factors such as low-interest rates, good liquidity in the banking system, and the expected income growth of listed companies this year.